Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated financial statements at 31 December 2011<br />

<strong>Ferrovial</strong> S.A. and Subsidiaries<br />

As regards these instruments, a linear variation of 100 basis<br />

points in the market interest rate curves at 31 December 2011<br />

would, in the case of the effective hedges, have a net impact of<br />

EUR -462 million on the equity attributable to the Parent (-EUR<br />

177 million at companies accounted for using the equity<br />

method and EUR -285 million at fully consolidated companies).<br />

4.2 Foreign currency risk<br />

Foreign currency risk management is generally centralised<br />

through the Group Finance Department, on the basis of its<br />

global policies that seek to minimise the impact caused by<br />

fluctuations in the exchange rates of the currencies in which<br />

<strong>Ferrovial</strong> operates, by means of hedging mechanisms.<br />

<strong>Ferrovial</strong> has significant investments in developed countries<br />

with a currency other than the euro, including most notably,<br />

pounds sterling, US dollars, Canadian dollars and Polish zlotys.<br />

<strong>Ferrovial</strong> sets up hedging strategies for these long-term<br />

investments by issuing debt in the same currency as that in<br />

which the investment is denominated.<br />

With regard to management of foreseeable cash flow risks, the<br />

following transactions are analysed:<br />

<br />

<br />

<br />

<br />

Investments or divestments in projects.<br />

Income obtained from foreign subsidiaries in the form<br />

of dividends or capital reimbursements expected to be<br />

received from those subsidiaries.<br />

Intra-Group loans to foreign subsidiaries. Cash<br />

surpluses at foreign subsidiaries.<br />

Foreign currency collections from customers and<br />

payments to suppliers.<br />

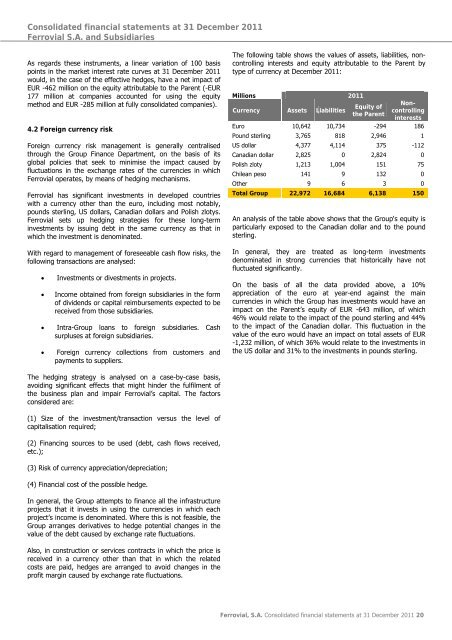

The following table shows the values of assets, liabilities, noncontrolling<br />

interests and equity attributable to the Parent by<br />

type of currency at December 2011:<br />

Millions 2011<br />

Currency Assets Liabilities<br />

Noncontrolling<br />

Equity of<br />

the Parent<br />

interests<br />

Euro 10,642 10,734 -294 186<br />

Pound sterling 3,765 818 2,946 1<br />

US dollar 4,377 4,114 375 -112<br />

Canadian dollar 2,825 0 2,824 0<br />

Polish zloty 1,213 1,004 151 75<br />

Chilean peso 141 9 132 0<br />

Other 9 6 3 0<br />

Total Group 22,972 16,684 6,138 150<br />

An analysis of the table above shows that the Group's equity is<br />

particularly exposed to the Canadian dollar and to the pound<br />

sterling.<br />

In general, they are treated as long-term investments<br />

denominated in strong currencies that historically have not<br />

fluctuated significantly.<br />

On the basis of all the data provided above, a 10%<br />

appreciation of the euro at year-end against the main<br />

currencies in which the Group has investments would have an<br />

impact on the Parent’s equity of EUR -643 million, of which<br />

46% would relate to the impact of the pound sterling and 44%<br />

to the impact of the Canadian dollar. This fluctuation in the<br />

value of the euro would have an impact on total assets of EUR<br />

-1,232 million, of which 36% would relate to the investments in<br />

the US dollar and 31% to the investments in pounds sterling.<br />

The hedging strategy is analysed on a case-by-case basis,<br />

avoiding significant effects that might hinder the fulfilment of<br />

the business plan and impair <strong>Ferrovial</strong>’s capital. The factors<br />

considered are:<br />

(1) Size of the investment/transaction versus the level of<br />

capitalisation required;<br />

(2) Financing sources to be used (debt, cash flows received,<br />

etc.);<br />

(3) Risk of currency appreciation/depreciation;<br />

(4) Financial cost of the possible hedge.<br />

In general, the Group attempts to finance all the infrastructure<br />

projects that it invests in using the currencies in which each<br />

project’s income is denominated. Where this is not feasible, the<br />

Group arranges derivatives to hedge potential changes in the<br />

value of the debt caused by exchange rate fluctuations.<br />

Also, in construction or services contracts in which the price is<br />

received in a currency other than that in which the related<br />

costs are paid, hedges are arranged to avoid changes in the<br />

profit margin caused by exchange rate fluctuations.<br />

<strong>Ferrovial</strong>, S.A. Consolidated financial statements at 31 December 2011 20