Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated financial statements at 31 December 2011<br />

<strong>Ferrovial</strong> S.A. and Subsidiaries<br />

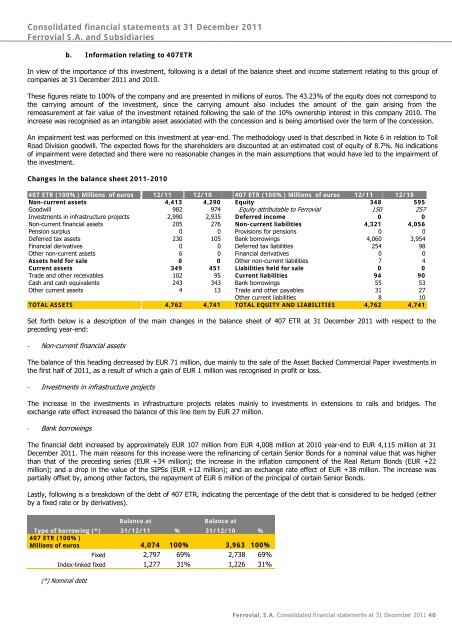

b. Information relating to 407ETR<br />

In view of the importance of this investment, following is a detail of the balance sheet and income statement relating to this group of<br />

companies at 31 December 2011 and 2010.<br />

These figures relate to 100% of the company and are presented in millions of euros. The 43.23% of the equity does not correspond to<br />

the carrying amount of the investment, since the carrying amount also includes the amount of the gain arising from the<br />

remeasurement at fair value of the investment retained following the sale of the 10% ownership interest in this company 2010. The<br />

increase was recognised as an intangible asset associated with the concession and is being amortised over the term of the concession.<br />

An impairment test was performed on this investment at year-end. The methodology used is that described in Note 6 in relation to Toll<br />

Road Division goodwill. The expected flows for the shareholders are discounted at an estimated cost of equity of 8.7%. No indications<br />

of impairment were detected and there were no reasonable changes in the main assumptions that would have led to the impairment of<br />

the investment.<br />

Changes in the balance sheet 2011-2010<br />

407 ETR (100%) Millions of euros 12/11 12/10 407 ETR (100%) Millions of euros 12/11 12/10<br />

Non-current assets 4,413 4,290 Equity 348 595<br />

Goodwill 982 974 Equity attributable to <strong>Ferrovial</strong> 150 257<br />

Investments in infrastructure projects 2,990 2,935 Deferred income 0 0<br />

Non-current financial assets 205 276 Non-current liabilities 4,321 4,056<br />

Pension surplus 0 0 Provisions for pensions 0 0<br />

Deferred tax assets 230 105 Bank borrowings 4,060 3,954<br />

Financial derivatives 0 0 Deferred tax liabilities 254 98<br />

Other non-current assets 6 0 Financial derivatives 0 0<br />

Assets held for sale 0 0 Other non-current liabilities 7 4<br />

Current assets 349 451 Liabilities held for sale 0 0<br />

Trade and other receivables 102 95 Current liabilities 94 90<br />

Cash and cash equivalents 243 343 Bank borrowings 55 53<br />

Other current assets 4 13 Trade and other payables 31 27<br />

Other current liabilities 8 10<br />

TOTAL ASSETS 4,762 4,741 TOTAL EQUITY AND LIABILITIES 4,762 4,741<br />

Set forth below is a description of the main changes in the balance sheet of 407 ETR at 31 December 2011 with respect to the<br />

preceding year-end:<br />

‐ Non-current financial assets<br />

The balance of this heading decreased by EUR 71 million, due mainly to the sale of the Asset Backed Commercial Paper investments in<br />

the first half of 2011, as a result of which a gain of EUR 1 million was recognised in profit or loss.<br />

‐ Investments in infrastructure projects<br />

The increase in the investments in infrastructure projects relates mainly to investments in extensions to rails and bridges. The<br />

exchange rate effect increased the balance of this line item by EUR 27 million.<br />

‐ Bank borrowings<br />

The financial debt increased by approximately EUR 107 million from EUR 4,008 million at 2010 year-end to EUR 4,115 million at 31<br />

December 2011. The main reasons for this increase were the refinancing of certain Senior Bonds for a nominal value that was higher<br />

than that of the preceding series (EUR +34 million); the increase in the inflation component of the Real Return Bonds (EUR +22<br />

million); and a drop in the value of the SIPSs (EUR +12 million); and an exchange rate effect of EUR +38 million. The increase was<br />

partially offset by, among other factors, the repayment of EUR 6 million of the principal of certain Senior Bonds.<br />

Lastly, following is a breakdown of the debt of 407 ETR, indicating the percentage of the debt that is considered to be hedged (either<br />

by a fixed rate or by derivatives).<br />

Type of borrowing (*)<br />

Balance at<br />

31/12/11 %<br />

Balance at<br />

31/12/10 %<br />

407 ETR (100%)<br />

Millions of euros 4,074 100% 3,963 100%<br />

Fixed 2,797 69% 2,738 69%<br />

Index-linked fixed 1,277 31% 1,226 31%<br />

(*) Nominal debt<br />

<strong>Ferrovial</strong>, S.A. Consolidated financial statements at 31 December 2011 40