Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

Download - Ferrovial - Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated financial statements at 31 December 2011<br />

<strong>Ferrovial</strong> S.A. and Subsidiaries<br />

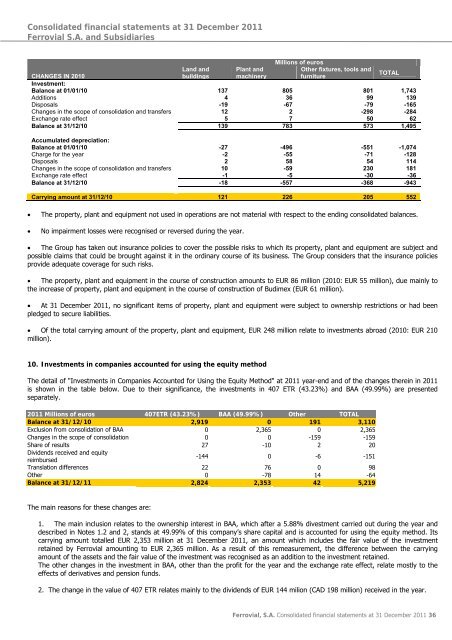

Millions of euros<br />

Land and Plant and<br />

Other fixtures, tools and<br />

CHANGES IN 2010<br />

buildings machinery<br />

furniture<br />

TOTAL<br />

Investment:<br />

Balance at 01/01/10 137 805 801 1,743<br />

Additions 4 36 99 139<br />

Disposals -19 -67 -79 -165<br />

Changes in the scope of consolidation and transfers 12 2 -298 -284<br />

Exchange rate effect 5 7 50 62<br />

Balance at 31/12/10 139 783 573 1,495<br />

Accumulated depreciation:<br />

Balance at 01/01/10 -27 -496 -551 -1,074<br />

Charge for the year -2 -55 -71 -128<br />

Disposals 2 58 54 114<br />

Changes in the scope of consolidation and transfers 10 -59 230 181<br />

Exchange rate effect -1 -5 -30 -36<br />

Balance at 31/12/10 -18 -557 -368 -943<br />

Carrying amount at 31/12/10 121 226 205 552<br />

<br />

<br />

The property, plant and equipment not used in operations are not material with respect to the ending consolidated balances.<br />

No impairment losses were recognised or reversed during the year.<br />

The Group has taken out insurance policies to cover the possible risks to which its property, plant and equipment are subject and<br />

possible claims that could be brought against it in the ordinary course of its business. The Group considers that the insurance policies<br />

provide adequate coverage for such risks.<br />

The property, plant and equipment in the course of construction amounts to EUR 86 million (2010: EUR 55 million), due mainly to<br />

the increase of property, plant and equipment in the course of construction of Budimex (EUR 61 million).<br />

At 31 December 2011, no significant items of property, plant and equipment were subject to ownership restrictions or had been<br />

pledged to secure liabilities.<br />

Of the total carrying amount of the property, plant and equipment, EUR 248 million relate to investments abroad (2010: EUR 210<br />

million).<br />

10. Investments in companies accounted for using the equity method<br />

The detail of "Investments in Companies Accounted for Using the Equity Method" at 2011 year-end and of the changes therein in 2011<br />

is shown in the table below. Due to their significance, the investments in 407 ETR (43.23%) and BAA (49.99%) are presented<br />

separately.<br />

2011 Millions of euros 407ETR (43.23%) BAA (49.99%) Other TOTAL<br />

Balance at 31/12/10 2,919 0 191 3,110<br />

Exclusion from consolidation of BAA 0 2,365 0 2,365<br />

Changes in the scope of consolidation 0 0 -159 -159<br />

Share of results 27 -10 2 20<br />

Dividends received and equity<br />

reimbursed<br />

-144 0 -6 -151<br />

Translation differences 22 76 0 98<br />

Other 0 -78 14 -64<br />

Balance at 31/12/11 2,824 2,353 42 5,219<br />

The main reasons for these changes are:<br />

1. The main inclusion relates to the ownership interest in BAA, which after a 5.88% divestment carried out during the year and<br />

described in Notes 1.2 and 2, stands at 49.99% of this company’s share capital and is accounted for using the equity method. Its<br />

carrying amount totalled EUR 2,353 million at 31 December 2011, an amount which includes the fair value of the investment<br />

retained by <strong>Ferrovial</strong> amounting to EUR 2,365 million. As a result of this remeasurement, the difference between the carrying<br />

amount of the assets and the fair value of the investment was recognised as an addition to the investment retained.<br />

The other changes in the investment in BAA, other than the profit for the year and the exchange rate effect, relate mostly to the<br />

effects of derivatives and pension funds.<br />

2. The change in the value of 407 ETR relates mainly to the dividends of EUR 144 milion (CAD 198 million) received in the year.<br />

<strong>Ferrovial</strong>, S.A. Consolidated financial statements at 31 December 2011 36