Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

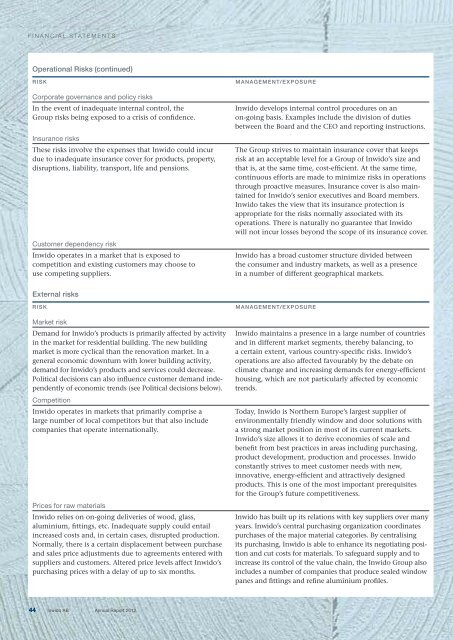

FINANCIAL STATEMENTS<br />

Operational Risks (continued)<br />

RISK<br />

Corporate governance and policy risks<br />

In the event of inadequate internal control, the<br />

Group risks being exposed to a crisis of confidence.<br />

Insurance risks<br />

These risks involve the expenses that <strong>Inwido</strong> could incur<br />

due to inadequate insurance cover for products, property,<br />

disruptions, liability, transport, life and pensions.<br />

Customer dependency risk<br />

<strong>Inwido</strong> operates in a market that is exposed to<br />

competition and existing customers may choose to<br />

use competing suppliers.<br />

MANAGEMENT/EXPOSURE<br />

<strong>Inwido</strong> develops internal control procedures on an<br />

on-going basis. Examples include the division of duties<br />

between the Board and the CEO and reporting instructions.<br />

The Group strives to maintain insurance cover that keeps<br />

risk at an acceptable level for a Group of <strong>Inwido</strong>’s size and<br />

that is, at the same time, cost-efficient. At the same time,<br />

continuous efforts are made to minimize risks in operations<br />

through proactive measures. Insurance cover is also maintained<br />

for <strong>Inwido</strong>’s senior executives and Board members.<br />

<strong>Inwido</strong> takes the view that its insurance protection is<br />

appropriate for the risks normally associated with its<br />

operations. There is naturally no guarantee that <strong>Inwido</strong><br />

will not incur losses beyond the scope of its insurance cover.<br />

<strong>Inwido</strong> has a broad customer structure divided between<br />

the consumer and industry markets, as well as a presence<br />

in a number of different geographical markets.<br />

External risks<br />

RISK<br />

Market risk<br />

Demand for <strong>Inwido</strong>’s products is primarily affected by activity<br />

in the market for residential building. The new building<br />

market is more cyclical than the renovation market. In a<br />

general economic downturn with lower building activity,<br />

demand for <strong>Inwido</strong>’s products and services could decrease.<br />

Political decisions can also influence customer demand independently<br />

of economic trends (see Political decisions below).<br />

Competition<br />

<strong>Inwido</strong> operates in markets that primarily comprise a<br />

large number of local competitors but that also include<br />

companies that operate internationally.<br />

Prices for raw materials<br />

<strong>Inwido</strong> relies on on-going deliveries of wood, glass,<br />

aluminium, fittings, etc. Inadequate supply could entail<br />

increased costs and, in certain cases, disrupted production.<br />

Normally, there is a certain displacement between purchase<br />

and sales price adjustments due to agreements entered with<br />

suppliers and customers. Altered price levels affect <strong>Inwido</strong>’s<br />

purchasing prices with a delay of up to six months.<br />

MANAGEMENT/EXPOSURE<br />

<strong>Inwido</strong> maintains a presence in a large number of countries<br />

and in different market segments, thereby balancing, to<br />

a certain extent, various country-specific risks. <strong>Inwido</strong>’s<br />

operations are also affected favourably by the debate on<br />

climate change and increasing demands for energy-efficient<br />

housing, which are not particularly affected by economic<br />

trends.<br />

Today, <strong>Inwido</strong> is Northern Europe’s largest supplier of<br />

environmentally friendly window and door solutions with<br />

a strong market position in most of its current markets.<br />

<strong>Inwido</strong>’s size allows it to derive economies of scale and<br />

benefit from best practices in areas including purchasing,<br />

product development, production and processes. <strong>Inwido</strong><br />

constantly strives to meet customer needs with new,<br />

innovative, energy-efficient and attractively designed<br />

products. This is one of the most important prerequisites<br />

for the Group’s future competitiveness.<br />

<strong>Inwido</strong> has built up its relations with key suppliers over many<br />

years. <strong>Inwido</strong>’s central purchasing organization coordinates<br />

purchases of the major material categories. By centralising<br />

its purchasing, <strong>Inwido</strong> is able to enhance its negotiating position<br />

and cut costs for materials. To safeguard supply and to<br />

increase its control of the value chain, the <strong>Inwido</strong> Group also<br />

includes a number of companies that produce sealed window<br />

panes and fittings and refine aluminium profiles.<br />

44<br />

<strong>Inwido</strong> AB | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>