Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

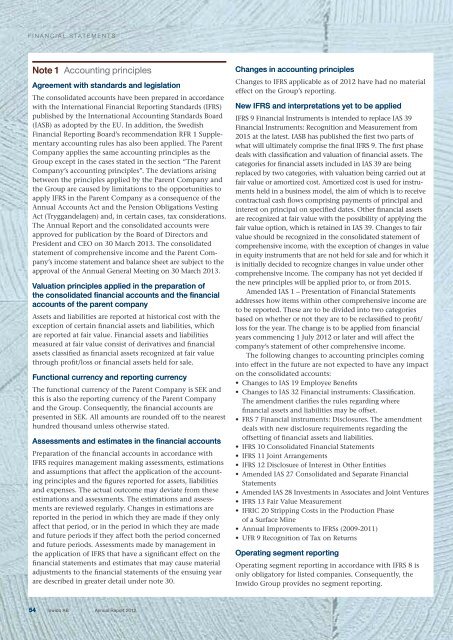

FINANCIAL STATEMENTS<br />

Note 1 Accounting principles<br />

Agreement with standards and legislation<br />

The consolidated accounts have been prepared in accordance<br />

with the International Financial <strong>Report</strong>ing Standards (IFRS)<br />

published by the International Accounting Standards Board<br />

(IASB) as adopted by the EU. In addition, the Swedish<br />

Financial <strong>Report</strong>ing Board’s recommendation RFR 1 Supplementary<br />

accounting rules has also been applied. The Parent<br />

Company applies the same accounting principles as the<br />

Group except in the cases stated in the section “The Parent<br />

Company’s accounting principles”. The deviations arising<br />

between the principles applied by the Parent Company and<br />

the Group are caused by limitations to the opportunities to<br />

apply IFRS in the Parent Company as a consequence of the<br />

<strong>Annual</strong> Accounts Act and the Pension Obligations Vesting<br />

Act (Tryggandelagen) and, in certain cases, tax considerations.<br />

The <strong>Annual</strong> <strong>Report</strong> and the consolidated accounts were<br />

approved for publication by the Board of Directors and<br />

President and CEO on 30 March 2013. The consolidated<br />

statement of comprehensive income and the Parent Company’s<br />

income statement and balance sheet are subject to the<br />

approval of the <strong>Annual</strong> General Meeting on 30 March 2013.<br />

Valuation principles applied in the preparation of<br />

the consolidated financial accounts and the financial<br />

accounts of the parent company<br />

Assets and liabilities are reported at historical cost with the<br />

exception of certain financial assets and liabilities, which<br />

are reported at fair value. Financial assets and liabilities<br />

measured at fair value consist of derivatives and financial<br />

assets classified as financial assets recognized at fair value<br />

through profit/loss or financial assets held for sale.<br />

Functional currency and reporting currency<br />

The functional currency of the Parent Company is SEK and<br />

this is also the reporting currency of the Parent Company<br />

and the Group. Consequently, the financial accounts are<br />

presented in SEK. All amounts are rounded off to the nearest<br />

hundred thousand unless otherwise stated.<br />

Assessments and estimates in the financial accounts<br />

Preparation of the financial accounts in accordance with<br />

IFRS requires management making assessments, estimations<br />

and assumptions that affect the application of the accounting<br />

principles and the figures reported for assets, liabilities<br />

and expenses. The actual outcome may deviate from these<br />

estimations and assessments. The estimations and assessments<br />

are reviewed regularly. Changes in estimations are<br />

reported in the period in which they are made if they only<br />

affect that period, or in the period in which they are made<br />

and future periods if they affect both the period concerned<br />

and future periods. Assessments made by management in<br />

the application of IFRS that have a significant effect on the<br />

financial statements and estimates that may cause material<br />

adjustments to the financial statements of the ensuing year<br />

are described in greater detail under note 30.<br />

Changes in accounting principles<br />

Changes to IFRS applicable as of <strong>2012</strong> have had no material<br />

effect on the Group’s reporting.<br />

New IFRS and interpretations yet to be applied<br />

IFRS 9 Financial Instruments is intended to replace IAS 39<br />

Financial Instruments: Recognition and Measurement from<br />

2015 at the latest. IASB has published the first two parts of<br />

what will ultimately comprise the final IFRS 9. The first phase<br />

deals with classification and valuation of financial assets. The<br />

categories for financial assets included in IAS 39 are being<br />

replaced by two categories, with valuation being carried out at<br />

fair value or amortized cost. Amortized cost is used for instruments<br />

held in a business model, the aim of which is to receive<br />

contractual cash flows comprising payments of princi pal and<br />

interest on principal on specified dates. Other financial assets<br />

are recognized at fair value with the possibility of applying the<br />

fair value option, which is retained in IAS 39. Changes to fair<br />

value should be recognized in the consolidated statement of<br />

comprehensive income, with the exception of changes in value<br />

in equity instruments that are not held for sale and for which it<br />

is initially decided to recognize changes in value under other<br />

comprehensive income. The company has not yet decided if<br />

the new principles will be applied prior to, or from 2015.<br />

Amended IAS 1 – Presentation of Financial Statements<br />

addresses how items within other comprehensive income are<br />

to be reported. These are to be divided into two categories<br />

based on whether or not they are to be reclassified to profit/<br />

loss for the year. The change is to be applied from financial<br />

years commencing 1 July <strong>2012</strong> or later and will affect the<br />

company’s statement of other comprehensive income.<br />

The following changes to accounting principles coming<br />

into effect in the future are not expected to have any impact<br />

on the consolidated accounts:<br />

• Changes to IAS 19 Employee Benefits<br />

• Changes to IAS 32 Financial instruments: Classification.<br />

The amendment clarifies the rules regarding where<br />

financial assets and liabilities may be offset.<br />

• FRS 7 Financial instruments: Disclosures. The amendment<br />

deals with new disclosure requirements regarding the<br />

offsetting of financial assets and liabilities.<br />

• IFRS 10 Consolidated Financial Statements<br />

• IFRS 11 Joint Arrangements<br />

• IFRS 12 Disclosure of Interest in Other Entities<br />

• Amended IAS 27 Consolidated and Separate Financial<br />

Statements<br />

• Amended IAS 28 Investments in Associates and Joint Ventures<br />

• IFRS 13 Fair Value Measurement<br />

• IFRIC 20 Stripping Costs in the Production Phase<br />

of a Surface Mine<br />

• <strong>Annual</strong> Improvements to IFRSs (2009-2011)<br />

• UFR 9 Recognition of Tax on Returns<br />

Operating segment reporting<br />

Operating segment reporting in accordance with IFRS 8 is<br />

only obligatory for listed companies. Consequently, the<br />

<strong>Inwido</strong> Group provides no segment reporting.<br />

54<br />

<strong>Inwido</strong> AB | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>