Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

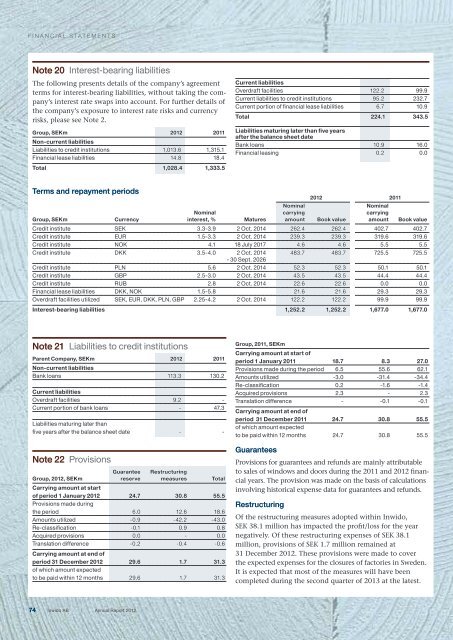

FINANCIAL STATEMENTS<br />

Note 20 Interest-bearing liabilities<br />

The following presents details of the company’s agreement<br />

terms for interest-bearing liabilities, without taking the company’s<br />

interest rate swaps into account. For further details of<br />

the company’s exposure to interest rate risks and currency<br />

risks, please see Note 2.<br />

Group, SEKm <strong>2012</strong> 2011<br />

Non-current liabilities<br />

Liabilities to credit institutions 1,013.6 1,315.1<br />

Financial lease liabilities 14.8 18.4<br />

Total 1,028.4 1,333.5<br />

Current liabilities<br />

Overdraft facilities 122.2 99.9<br />

Current liabilities to credit institutions 95.2 232.7<br />

Current portion of financial lease liabilities 6.7 10.9<br />

Total 224.1 343.5<br />

Liabilities maturing later than five years<br />

after the balance sheet date<br />

Bank loans 10.9 16.0<br />

Financial leasing 0.2 0.0<br />

Terms and repayment periods<br />

<strong>2012</strong> 2011<br />

Nominal<br />

Nominal<br />

Nominal carrying carrying<br />

Group, SEKm Currency interest, % Matures amount Book value amount Book value<br />

Credit institute SEK 3.3-3.9 2 Oct. 2014 262.4 262.4 402.7 402.7<br />

Credit institute EUR 1.5-3.3 2 Oct. 2014 239.3 239.3 319.6 319.6<br />

Credit institute NOK 4.1 18 July 2017 4.6 4.6 5.5 5.5<br />

Credit institute DKK 3.5-4.0 2 Oct. 2014 483.7 483.7 725.5 725.5<br />

- 30 Sept. 2026<br />

Credit institute PLN 5.6 2 Oct. 2014 52.3 52.3 50.1 50.1<br />

Credit institute GBP 2.5-3.0 2 Oct. 2014 43.5 43.5 44.4 44.4<br />

Credit institute RUB 2.8 2 Oct. 2014 22.6 22.6 0.0 0.0<br />

Financial lease liabilities DKK, NOK 1.5-5.8 21.6 21.6 29.3 29.3<br />

Overdraft facilities utilized SEK, EUR, DKK, PLN, GBP 2.25-4.2 2 Oct. 2014 122.2 122.2 99.9 99.9<br />

Interest-bearing liabilities 1,252.2 1,252.2 1,677.0 1,677.0<br />

Note 21 Liabilities to credit institutions<br />

Parent Company, SEKm <strong>2012</strong> 2011<br />

Non-current liabilities<br />

Bank loans 113.3 130.2<br />

Current liabilities<br />

Overdraft facilities 9.2 -<br />

Current portion of bank loans - 47.3<br />

Liabilities maturing later than<br />

five years after the balance sheet date - -<br />

Note 22 Provisions<br />

Guarantee Restructuring<br />

Group, <strong>2012</strong>, SEKm reserve measures Total<br />

Carrying amount at start<br />

of period 1 January <strong>2012</strong> 24.7 30.8 55.5<br />

Provisions made during<br />

the period 6.0 12.6 18.6<br />

Amounts utilized -0.9 -42.2 -43.0<br />

Re-classification -0.1 0.9 0.8<br />

Acquired provisions 0.0 - 0.0<br />

Translation difference -0.2 -0.4 -0.6<br />

Carrying amount at end of<br />

period 31 December <strong>2012</strong> 29.6 1.7 31.3<br />

of which amount expected<br />

to be paid within 12 months 29.6 1.7 31.3<br />

Group, 2011, SEKm<br />

Carrying amount at start of<br />

period 1 January 2011 18.7 8.3 27.0<br />

Provisions made during the period 6.5 55.6 62.1<br />

Amounts utilized -3.0 -31.4 -34.4<br />

Re-classification 0.2 -1.6 -1.4<br />

Acquired provisions 2.3 - 2.3<br />

Translation difference - -0.1 -0.1<br />

Carrying amount at end of<br />

period 31 December 2011 24.7 30.8 55.5<br />

of which amount expected<br />

to be paid within 12 months 24.7 30.8 55.5<br />

Guarantees<br />

Provisions for guarantees and refunds are mainly attributable<br />

to sales of windows and doors during the 2011 and <strong>2012</strong> financial<br />

years. The provision was made on the basis of calculations<br />

involving historical expense data for guarantees and refunds.<br />

Restructuring<br />

Of the restructuring measures adopted within <strong>Inwido</strong>,<br />

SEK 38.1 million has impacted the profit/loss for the year<br />

negatively. Of these restructuring expenses of SEK 38.1<br />

million, provisions of SEK 1.7 million remained at<br />

31 December <strong>2012</strong>. These provisions were made to cover<br />

the expected expenses for the closures of factories in Sweden.<br />

It is expected that most of the measures will have been<br />

completed during the second quarter of 2013 at the latest.<br />

74<br />

<strong>Inwido</strong> AB | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>