Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

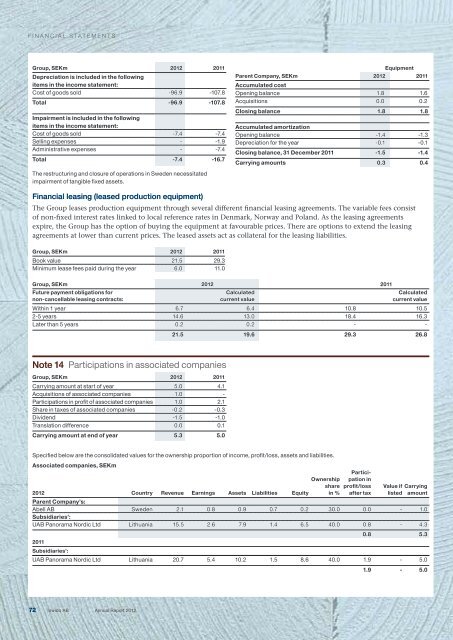

FINANCIAL STATEMENTS<br />

Group, SEKm <strong>2012</strong> 2011<br />

Depreciation is included in the following<br />

items in the income statement:<br />

Cost of goods sold -96.9 -107.8<br />

Total -96.9 -107.8<br />

Impairment is included in the following<br />

items in the income statement:<br />

Cost of goods sold -7.4 -7.4<br />

Selling expenses - -1.9<br />

Administrative expenses - -7.4<br />

Total -7.4 -16.7<br />

The restructuring and closure of operations in Sweden necessitated<br />

impairment of tangible fixed assets.<br />

Equipment<br />

Parent Company, SEKm <strong>2012</strong> 2011<br />

Accumulated cost<br />

Opening balance 1.8 1.6<br />

Acquisitions 0.0 0.2<br />

Closing balance 1.8 1.8<br />

Accumulated amortization<br />

Opening balance -1.4 -1.3<br />

Depreciation for the year -0.1 -0.1<br />

Closing balance, 31 December 2011 -1.5 -1.4<br />

Carrying amounts 0.3 0.4<br />

Financial leasing (leased production equipment)<br />

The Group leases production equipment through several different financial leasing agreements. The variable fees consist<br />

of non-fixed interest rates linked to local reference rates in Denmark, Norway and Poland. As the leasing agreements<br />

expire, the Group has the option of buying the equipment at favourable prices. There are options to extend the leasing<br />

agreements at lower than current prices. The leased assets act as collateral for the leasing liabilities.<br />

Group, SEKm <strong>2012</strong> 2011<br />

Book value 21.5 29.3<br />

Minimum lease fees paid during the year 6.0 11.0<br />

Group, SEKm <strong>2012</strong> 2011<br />

Future payment obligations for Calculated Calculated<br />

non-cancellable leasing contracts: current value current value<br />

Within 1 year 6.7 6.4 10.8 10.5<br />

2-5 years 14.6 13.0 18.4 16.3<br />

Later than 5 years 0.2 0.2 - -<br />

21.5 19.6 29.3 26.8<br />

Note 14 Participations in associated companies<br />

Group, SEKm <strong>2012</strong> 2011<br />

Carrying amount at start of year 5.0 4.1<br />

Acquisitions of associated companies 1.0 -<br />

Participations in profit of associated companies 1.0 2.1<br />

Share in taxes of associated companies -0.2 -0.3<br />

Dividend -1.5 -1.0<br />

Translation difference 0.0 0.1<br />

Carrying amount at end of year 5.3 5.0<br />

Specified below are the consolidated values for the ownership proportion of income, profit/loss, assets and liabilities.<br />

Associated companies, SEKm<br />

Partici-<br />

Ownership pation in<br />

share profit/loss Value if Carrying<br />

<strong>2012</strong> Country Revenue Earnings Assets Liabilities Equity in % after tax listed amount<br />

Parent Company’s:<br />

Abell AB Sweden 2.1 0.8 0.9 0.7 0.2 30.0 0.0 - 1.0<br />

Subsidiaries’:<br />

UAB Panorama Nordic Ltd Lithuania 15.5 2.6 7.9 1.4 6.5 40.0 0.8 - 4.3<br />

0.8 5.3<br />

2011<br />

Subsidiaries’:<br />

UAB Panorama Nordic Ltd Lithuania 20.7 5.4 10.2 1.5 8.6 40.0 1.9 - 5.0<br />

1.9 - 5.0<br />

72<br />

<strong>Inwido</strong> AB | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>