Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

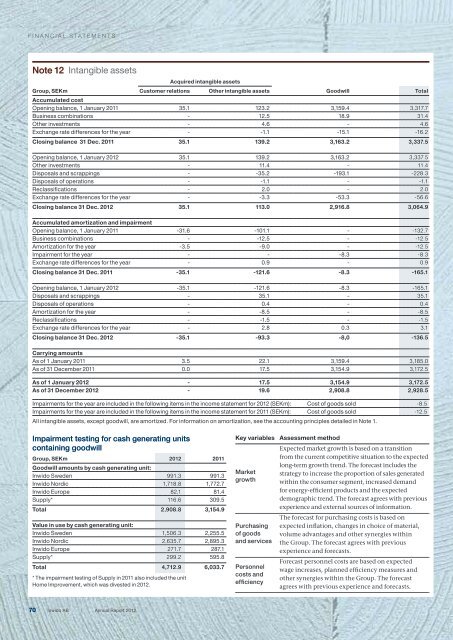

FINANCIAL STATEMENTS<br />

Note 12 Intangible assets<br />

Acquired intangible assets<br />

Group, SEKm Customer relations Other intangible assets Goodwill Total<br />

Accumulated cost<br />

Opening balance, 1 January 2011 35.1 123.2 3,159.4 3,317.7<br />

Business combinations - 12.5 18.9 31.4<br />

Other investments - 4.6 - 4.6<br />

Exchange rate differences for the year - -1.1 -15.1 -16.2<br />

Closing balance 31 Dec. 2011 35.1 139.2 3,163.2 3,337.5<br />

Opening balance, 1 January <strong>2012</strong> 35.1 139.2 3,163.2 3,337.5<br />

Other investments - 11.4 - 11.4<br />

Disposals and scrappings - -35.2 -193.1 -228.3<br />

Disposals of operations - -1.1 - -1.1<br />

Reclassifications - 2.0 - 2.0<br />

Exchange rate differences for the year - -3.3 -53.3 -56.6<br />

Closing balance 31 Dec. <strong>2012</strong> 35.1 113.0 2,916.8 3,064.9<br />

Accumulated amortization and impairment<br />

Opening balance, 1 January 2011 -31.6 -101.1 - -132.7<br />

Business combinations - -12.5 - -12.5<br />

Amortization for the year -3.5 -9.0 - -12.5<br />

Impairment for the year - - -8.3 -8.3<br />

Exchange rate differences for the year - 0.9 - 0.9<br />

Closing balance 31 Dec. 2011 -35.1 -121.6 -8.3 -165.1<br />

Opening balance, 1 January <strong>2012</strong> -35.1 -121.6 -8.3 -165.1<br />

Disposals and scrappings - 35.1 - 35.1<br />

Disposals of operations - 0.4 - 0.4<br />

Amortization for the year - -8.5 - -8.5<br />

Reclassifications - -1.5 - -1.5<br />

Exchange rate differences for the year - 2.8 0.3 3.1<br />

Closing balance 31 Dec. <strong>2012</strong> -35.1 -93.3 -8,0 -136.5<br />

Carrying amounts<br />

As of 1 January 2011 3.5 22.1 3,159.4 3,185.0<br />

As of 31 December 2011 0.0 17.5 3,154.9 3,172.5<br />

As of 1 January <strong>2012</strong> - 17.5 3,154.9 3,172.5<br />

As of 31 December <strong>2012</strong> - 19.6 2,908.8 2,928.5<br />

Impairments for the year are included in the following items in the income statement for <strong>2012</strong> (SEKm): Cost of goods sold -8.5<br />

Impairments for the year are included in the following items in the income statement for 2011 (SEKm): Cost of goods sold -12.5<br />

All intangible assets, except goodwill, are amortized. For information on amortization, see the accounting principles detailed in Note 1.<br />

Impairment testing for cash generating units<br />

containing goodwill<br />

Group, SEKm <strong>2012</strong> 2011<br />

Goodwill amounts by cash generating unit:<br />

<strong>Inwido</strong> Sweden 991.3 991.3<br />

<strong>Inwido</strong> Nordic 1,718.8 1,772.7<br />

<strong>Inwido</strong> Europe 82.1 81.4<br />

Supply* 116.6 309.5<br />

Total 2,908.8 3,154.9<br />

Value in use by cash generating unit:<br />

<strong>Inwido</strong> Sweden 1,506.3 2,255.5<br />

<strong>Inwido</strong> Nordic 2,635.7 2,895.3<br />

<strong>Inwido</strong> Europe 271.7 287.1<br />

Supply* 299.2 595.8<br />

Total 4,712.9 6,033.7<br />

* The impairment testing of Supply in 2011 also included the unit<br />

Home Improvement, which was divested in <strong>2012</strong>.<br />

Key variables Assessment method<br />

Market<br />

growth<br />

Purchasing<br />

of goods<br />

and services<br />

Personnel<br />

costs and<br />

efficiency<br />

Expected market growth is based on a transition<br />

from the current competitive situation to the expected<br />

long-term growth trend. The forecast includes the<br />

strategy to increase the proportion of sales generated<br />

within the consumer segment, increased demand<br />

for energy-efficient products and the expected<br />

demographic trend. The forecast agrees with previous<br />

experience and external sources of information.<br />

The forecast for purchasing costs is based on<br />

expected inflation, changes in choice of material,<br />

volume advantages and other synergies within<br />

the Group. The forecast agrees with previous<br />

experience and forecasts.<br />

Forecast personnel costs are based on expected<br />

wage increases, planned efficiency measures and<br />

other synergies within the Group. The forecast<br />

agrees with previous experience and forecasts.<br />

70<br />

<strong>Inwido</strong> AB | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>