Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Annual Report 2012 - Inwido

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL STATEMENTS<br />

exceeds this value is immediately taken up as income. The<br />

portion that does not exceed the fair value of the acquired<br />

identifiable non-monetary assets is systematically taken up<br />

as income over a period that is calculated as the remaining<br />

weighted average useful life for the acquired identifiable<br />

assets that are amortized. In the consolidated accounts,<br />

bargain purchases are reported directly in profit/loss.<br />

Untaxed reserves<br />

Untaxed reserves including deferred tax liability are recognized<br />

in the Parent Company. In the consolidated accounts<br />

however, untaxed reserves are divided into deferred tax<br />

and shareholders’ equity.<br />

Group contributions<br />

Group contributions received by the Parent Company from<br />

its subsidiaries are reported in the Parent Company according<br />

to the same principles as normal dividends from subsidiaries,<br />

in other words, as a financial income item in the<br />

income statement. Group contributions paid by the Parent<br />

Company to its subsidiaries are recognized as an appropriation<br />

in the income statement.<br />

Note 2 Financial risks and policies<br />

Through its operations, the group is exposed<br />

to various kinds of financial risks<br />

Financial risks are those involving fluctuations in the Group’s<br />

earnings and cash flow as a consequence of changes in exchange<br />

rates, interest rate levels, and refinancing and credit<br />

risks. The Group’s financial policy for the management of<br />

financial risks has been designed by the Board of Directors<br />

and provides a framework of guidelines and regulations in<br />

the shape of risk mandates and limits for financing activities.<br />

To read more about the Company’s financial risks, please see<br />

the Financial Risks section in the Directors’ <strong>Report</strong>.<br />

Responsibility for the Group’s financial transactions and<br />

risks is managed centrally by the Parent Company’s finance<br />

department. The overarching objective for risk management efforts<br />

is to provide cost effective financing and to minimize the<br />

negative effects of market fluctuations on the Group’s earnings.<br />

Liquidity risks<br />

Liquidity risk (or financing risk) refers to the risk that it will<br />

not be possible to secure financing or that it will only be possible<br />

to do so at considerably increased expense. Consequently,<br />

it is the Group’s objective that there always be sufficient<br />

cash and equivalents, as well as guaranteed lines of credit to<br />

cover the next six months. Furthermore loan maturities have<br />

been spread out over time to limit the liquidity risk.<br />

To ensure that the Group always has access to external<br />

financing, the finance department shall make sure that<br />

commitments to grant credit, both short and long-term,<br />

are available. Efforts shall be made to maintain the highest<br />

level of cost efficiency possible within the set framework.<br />

At the end of the year, the Group’s financial liabilities<br />

amounted to SEK 1,922.0 million with the maturity structure<br />

indicated in the table below.<br />

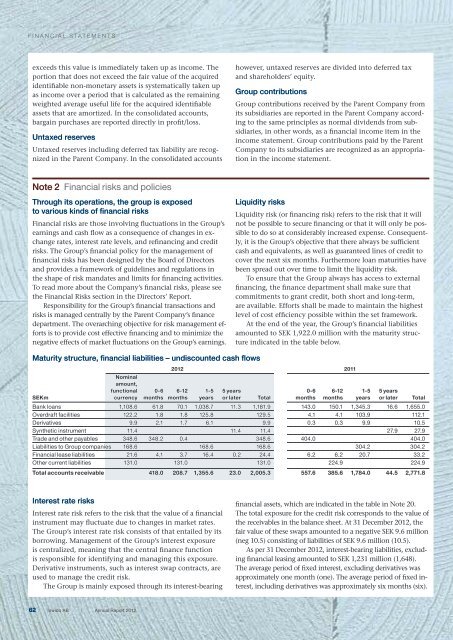

Maturity structure, financial liabilities – undiscounted cash flows<br />

<strong>2012</strong> 2011<br />

Nominal<br />

amount,<br />

functional 0-6 6-12 1-5 5 years 0-6 6-12 1-5 5 years<br />

SEKm currency months months years or later Total months months years or later Total<br />

Bank loans 1,108.6 61.8 70.1 1,038.7 11.3 1,181.9 143.0 150.1 1,345.3 16.6 1,655.0<br />

Overdraft facilities 122.2 1.8 1.8 125.8 129.5 4.1 4.1 103.9 112.1<br />

Derivatives 9.9 2.1 1.7 6.1 9.9 0.3 0.3 9.9 10.5<br />

Synthetic instrument 11.4 11.4 11.4 27.9 27.9<br />

Trade and other payables 348.6 348.2 0.4 348.6 404.0 404.0<br />

Liabilities to Group companies 168.6 168.6 168.6 304.2 304.2<br />

Financial lease liabilities 21.6 4.1 3.7 16.4 0.2 24.4 6.2 6.2 20.7 33.2<br />

Other current liabilities 131.0 131.0 131.0 224.9 224.9<br />

Total accounts receivable 418.0 208.7 1,355.6 23.0 2,005.3 557.6 385.6 1,784.0 44.5 2,771.8<br />

Interest rate risks<br />

Interest rate risk refers to the risk that the value of a financial<br />

instrument may fluctuate due to changes in market rates.<br />

The Group’s interest rate risk consists of that entailed by its<br />

borrowing. Management of the Group’s interest exposure<br />

is centralized, meaning that the central finance function<br />

is responsible for identifying and managing this exposure.<br />

Derivative instruments, such as interest swap contracts, are<br />

used to manage the credit risk.<br />

The Group is mainly exposed through its interest-bearing<br />

financial assets, which are indicated in the table in Note 20.<br />

The total exposure for the credit risk corresponds to the value of<br />

the receivables in the balance sheet. At 31 December <strong>2012</strong>, the<br />

fair value of these swaps amounted to a negative SEK 9.6 million<br />

(neg 10.5) consisting of liabilities of SEK 9.6 million (10.5).<br />

As per 31 December <strong>2012</strong>, interest-bearing liabilities, excluding<br />

financial leasing amounted to SEK 1,231 million (1,648).<br />

The average period of fixed interest, excluding derivatives was<br />

approximately one month (one). The average period of fixed interest,<br />

including derivatives was approximately six months (six).<br />

62<br />

<strong>Inwido</strong> AB | <strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>