Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

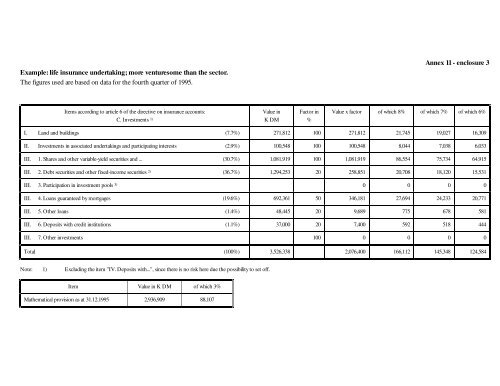

Example: life insurance undertaking; more venturesome than the sector.The figures used are based on data for the fourth quarter <strong>of</strong> 1995.Annex 11 - enclosure 3Items according to article 6 <strong>of</strong> the directive on insurance accounts:Value inC. Investments 1) K DMFactor in%Value x factor <strong>of</strong> which 8% <strong>of</strong> which 7% <strong>of</strong> which 6%I. Land and buildings (7.7%) 271,812 100 271,812 21,745 19,027 16,309II. Investments in associated undertakings and participating interests (2.9%) 100,548 100 100,548 8,044 7,038 6,033III. 1. Shares and other variable-yield securities and ... (30.7%) 1,081,919 100 1,081,919 86,554 75,734 64,915III. 2. Debt securities and other fixed-income securities 2) (36.7%) 1,294,253 20 258,851 20,708 18,120 15,531III. 3. Participation in investment pools 3) 0 0 0 0III. 4. Loans guaranteed by mortgages (19.6%) 692,361 50 346,181 27,694 24,233 20,771III. 5. Other loans (1.4%) 48,445 20 9,689 775 678 581III. 6. Deposits with credit institutions (1.1%) 37,000 20 7,400 592 518 444III. 7. Other investments 100 0 0 0 0Total (100%) 3,526,338 2,076,400 166,112 145,348 124,584Note: 1) Excluding the item "IV. Deposits with...", since there is no risk here due the possibility to set <strong>of</strong>f.Item Value in K DM <strong>of</strong> which 3%Mathematical provision as at 31.12.1995 2,936,909 88,107