Estimate <strong>of</strong> an index on the basis <strong>of</strong> risk-weighted investments for non-life insurance in Germany.The weighting factors applied were derived from the respective provisions for the banking sector.The figures used are based on data from the insurance sector for the third quarter <strong>of</strong> 1995.Annex 7 - enclosure 1Items according to article 6 <strong>of</strong> the directive on insurance accounts:Value inC. Investments 1) K DMFactor in%Value x factor <strong>of</strong> which 8 % <strong>of</strong> which 7 % <strong>of</strong> which 6 %I. Land and buildings (6.1%) 8,546,602 100 8,546,602 683,728 598,262 512,796II. Investments in associated undertakings and participating interests (9.8%) 13,688,918 100 13,688,918 1,095,113 958,224 821,335III. 1. Shares and other variable-yield securities and ... (18.8%) 26,168,551 100 26,168,551 2,093,484 1,831,799 1,570,113III. 2. Debt securities and other fixed-income securities 2) (57.8%) 80,391,566 20 16,078,313 1,286,265 1,125,482 964,699III. 3. Participation in investment pools 3)III. 4. Loans guaranteed by mortgages (3.0%) 4,199,696 50 2,099,848 167,988 146,989 125,991III. 5. Other loans (0.3%) 412,547 100 412,547 33,004 28,878 24,753III. 6. Deposits with credit institutions (3.9%) 5,402,543 20 1,080,509 86,441 75,636 64,831III. 7. Other investments (0.2%) 285,928 100 285,928 22,874 20,015 17,156Total (100%) 139,096,351 68,361,216 5,468,897 4,785,285 4,101,674Notes:1) Excluding the item "IV. Deposits with...", since there is no risk here due the possibility to set <strong>of</strong>f.2) Approx. 91 % <strong>of</strong> the total amount would have to be weighted at 0 % or 20 %. For this reason the whole position was weighted at 20%.3) This item does not exist in Germany. The question <strong>of</strong> the weighting factor remains open.16.5.97

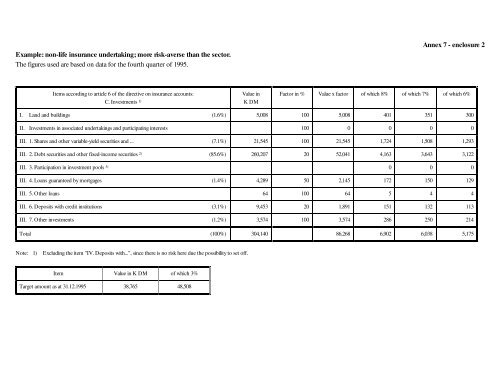

Example: non-life insurance undertaking; more risk-averse than the sector.The figures used are based on data for the fourth quarter <strong>of</strong> 1995.Annex 7 - enclosure 2Items according to article 6 <strong>of</strong> the directive on insurance accounts:Value inC. Investments 1) K DMFactor in % Value x factor <strong>of</strong> which 8% <strong>of</strong> which 7% <strong>of</strong> which 6%I. Land and buildings (1.6%) 5,008 100 5,008 401 351 300II. Investments in associated undertakings and participating interests 100 0 0 0 0III. 1. Shares and other variable-yield securities and ... (7.1%) 21,545 100 21,545 1,724 1,508 1,293III. 2. Debt securities and other fixed-income securities 2) (85.6%) 260,207 20 52,041 4,163 3,643 3,122III. 3. Participation in investment pools 3) 0 0 0III. 4. Loans guaranteed by mortgages (1.4%) 4,289 50 2,145 172 150 129III. 5. Other loans 64 100 64 5 4 4III. 6. Deposits with credit institutions (3.1%) 9,453 20 1,891 151 132 113III. 7. Other investments (1.2%) 3,574 100 3,574 286 250 214Total (100%) 304,140 86,268 6,902 6,038 5,175Note: 1) Excluding the item "IV. Deposits with...", since there is no risk here due the possibility to set <strong>of</strong>f.Item Value in K DM <strong>of</strong> which 3%Target amount as at 31.12.1995 38,765 48,508

- Page 9 and 10:

,QWURGXFWLRQSolvency as referred to

- Page 11 and 12:

At the same time, the economic coll

- Page 13 and 14:

2.1.2 Technical risksa) Current ris

- Page 15 and 16:

Matching riskThe assets of insuranc

- Page 17 and 18:

In life insurance premiums must be

- Page 19 and 20:

Matching riskThe matching risk can

- Page 21 and 22:

However, sufficient experience with

- Page 23 and 24:

With respect to the remaining class

- Page 25 and 26:

However, these undertakings would n

- Page 27 and 28:

first Directive, or in accordance w

- Page 29 and 30:

The parameters A, B and C are to be

- Page 31 and 32:

The majority of delegations admit t

- Page 33 and 34:

Another delegation suggested to all

- Page 35 and 36:

extent taking account of inflation

- Page 37 and 38:

Investment riskTwo alternative yard

- Page 39 and 40: e put into practice. A number of de

- Page 41 and 42: 4.2.2.5 TontinesAt the moment, this

- Page 43 and 44: Moreover, the working group discuss

- Page 45 and 46: 5.2.4 Own funds substitutesOwn fund

- Page 47 and 48: A number of members of the working

- Page 49 and 50: to be at risk. In some member state

- Page 53 and 54: AN N EX 1),1$1&,$/',)),&8/7,(62&&85

- Page 55 and 56: - 47 -- inappropriate capital struc

- Page 57 and 58: - 49 -In terms of frequency of occu

- Page 59: - 51 -Reinsurance riskIn some count

- Page 62 and 63: - 54 -a) Asset risk, C 1:The asset

- Page 64 and 65: - 56 -factors will result in the re

- Page 66 and 67: - 58 -IL i := an average loss rate

- Page 68 and 69: - 60 -First level of intervention (

- Page 71 and 72: - 63 -AN N EX 32:1)81'65(48,5(0(176

- Page 73: - 65 -in the case of balance-sheet

- Page 76 and 77: The value of the liabilities, and p

- Page 78 and 79: - 70 -Enclosure to Annex 4Examples

- Page 81 and 82: - 73 -AN N EX 5$/7(51$7,9(3529,6,21

- Page 83: - 75 -Model calculation CAssumption

- Page 86 and 87: - 78 -Risk of inadequacy of claims

- Page 89: - 81 -ANNEX 7(;$03/(6)257+(&$/&8/$7

- Page 93 and 94: - 85 -AN N EX 8$1$/7(51$7,9(0(7+2',

- Page 95 and 96: AN N EX 9(;7(16,212)7+($'',7,9(0(7+

- Page 97 and 98: - 89 -However, the parameters shoul

- Page 99 and 100: In principle, an insurance undertak

- Page 101: Annex 9 - Enclosure 2Table 2:The ra

- Page 105 and 106: - 97 -ANNEX 11(;$03/(6)257+(&$/&8/$

- Page 107 and 108: Example: life insurance undertaking

- Page 109 and 110: - 101 -AN N EX 123(50$1(17+($/7+,16