Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

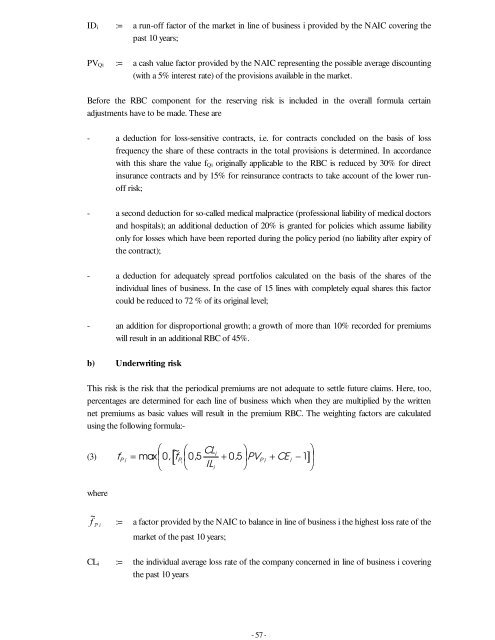

- 57 -ID i := a run-<strong>of</strong>f factor <strong>of</strong> the market in line <strong>of</strong> business i provided by the NAIC covering thepast 10 years;PV Qi := a cash value factor provided by the NAIC representing the possible average discounting(with a 5% interest rate) <strong>of</strong> the provisions available in the market.Before the RBC component for the reserving risk is included in the overall formula certainadjustments have to be made. These are- a deduction for loss-sensitive contracts, i.e. for contracts concluded on the basis <strong>of</strong> lossfrequency the share <strong>of</strong> these contracts in the total provisions is determined. In accordancewith this share the value f Qi originally applicable to the RBC is reduced by 30% for directinsurance contracts and by 15% for reinsurance contracts to take account <strong>of</strong> the lower run<strong>of</strong>frisk;- a second deduction for so-called medical malpractice (pr<strong>of</strong>essional liability <strong>of</strong> medical doctorsand hospitals); an additional deduction <strong>of</strong> 20% is granted for policies which assume liabilityonly for losses which have been reported during the policy period (no liability after expiry <strong>of</strong>the contract);- a deduction for adequately spread portfolios calculated on the basis <strong>of</strong> the shares <strong>of</strong> theindividual lines <strong>of</strong> business. In the case <strong>of</strong> 15 lines with completely equal shares this factorcould be reduced to 72 % <strong>of</strong> its original level;- an addition for disproportional growth; a growth <strong>of</strong> more than 10% recorded for premiumswill result in an additional RBC <strong>of</strong> 45%.b) Underwriting riskThis risk is the risk that the periodical premiums are not adequate to settle future claims. Here, too,percentages are determined for each line <strong>of</strong> business which when they are multiplied by the writtennet premiums as basic values will result in the premium RBC. The weighting factors are calculatedusing the following formula:-CLILi(3) f = max ⎜0, [ ~ fP⎜0, 5 + 0,5⎟ PV + CE i − 1]P i⎛⎝i⎛⎝i⎞⎠P i⎞⎟⎠where~I ¦¨§ := a factor provided by the NAIC to balance in line <strong>of</strong> business i the highest loss rate <strong>of</strong> themarket <strong>of</strong> the past 10 years;CL i := the individual average loss rate <strong>of</strong> the company concerned in line <strong>of</strong> business i coveringthe past 10 years