Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

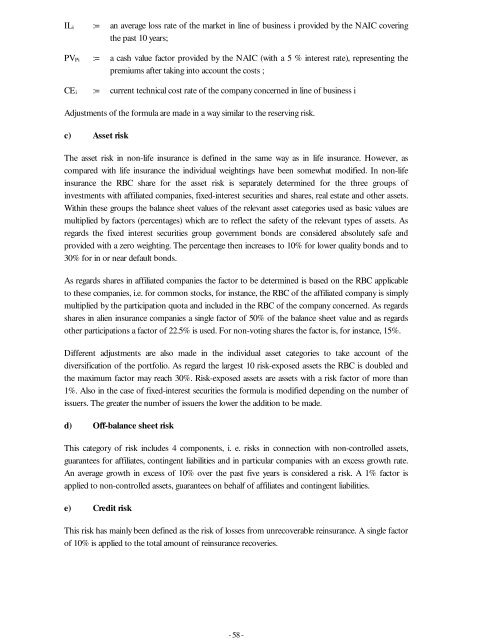

- 58 -IL i := an average loss rate <strong>of</strong> the market in line <strong>of</strong> business i provided by the NAIC coveringthe past 10 years;PV Pi := a cash value factor provided by the NAIC (with a 5 % interest rate), representing thepremiums after taking into account the costs ;CE i := current technical cost rate <strong>of</strong> the company concerned in line <strong>of</strong> business iAdjustments <strong>of</strong> the formula are made in a way similar to the reserving risk.c) Asset riskThe asset risk in non-life insurance is defined in the same way as in life insurance. However, ascompared with life insurance the individual weightings have been somewhat modified. In non-lifeinsurance the RBC share for the asset risk is separately determined for the three groups <strong>of</strong>investments with affiliated companies, fixed-interest securities and shares, real estate and other assets.Within these groups the balance sheet values <strong>of</strong> the relevant asset categories used as basic values aremultiplied by factors (percentages) which are to reflect the safety <strong>of</strong> the relevant types <strong>of</strong> assets. Asregards the fixed interest securities group government bonds are considered absolutely safe andprovided with a zero weighting. The percentage then increases to 10% for lower quality bonds and to30% for in or near default bonds.As regards shares in affiliated companies the factor to be determined is based on the RBC applicableto these companies, i.e. for common stocks, for instance, the RBC <strong>of</strong> the affiliated company is simplymultiplied by the participation quota and included in the RBC <strong>of</strong> the company concerned. As regardsshares in alien insurance companies a single factor <strong>of</strong> 50% <strong>of</strong> the balance sheet value and as regardsother participations a factor <strong>of</strong> 22.5% is used. For non-voting shares the factor is, for instance, 15%.Different adjustments are also made in the individual asset categories to take account <strong>of</strong> thediversification <strong>of</strong> the portfolio. As regard the largest 10 risk-exposed assets the RBC is doubled andthe maximum factor may reach 30%. Risk-exposed assets are assets with a risk factor <strong>of</strong> more than1%. Also in the case <strong>of</strong> fixed-interest securities the formula is modified depending on the number <strong>of</strong>issuers. The greater the number <strong>of</strong> issuers the lower the addition to be made.d) Off-balance sheet riskThis category <strong>of</strong> risk includes 4 components, i. e. risks in connection with non-controlled assets,guarantees for affiliates, contingent liabilities and in particular companies with an excess growth rate.An average growth in excess <strong>of</strong> 10% over the past five years is considered a risk. A 1% factor isapplied to non-controlled assets, guarantees on behalf <strong>of</strong> affiliates and contingent liabilities.e) Credit riskThis risk has mainly been defined as the risk <strong>of</strong> losses from unrecoverable reinsurance. A single factor<strong>of</strong> 10% is applied to the total amount <strong>of</strong> reinsurance recoveries.