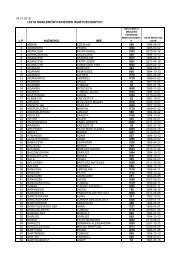

Example: life insurance undertaking; more venturesome than the sector.The figures used are based on data for the fourth quarter <strong>of</strong> 1995.Annex 11 - enclosure 3Items according to article 6 <strong>of</strong> the directive on insurance accounts:Value inC. Investments 1) K DMFactor in%Value x factor <strong>of</strong> which 8% <strong>of</strong> which 7% <strong>of</strong> which 6%I. Land and buildings (7.7%) 271,812 100 271,812 21,745 19,027 16,309II. Investments in associated undertakings and participating interests (2.9%) 100,548 100 100,548 8,044 7,038 6,033III. 1. Shares and other variable-yield securities and ... (30.7%) 1,081,919 100 1,081,919 86,554 75,734 64,915III. 2. Debt securities and other fixed-income securities 2) (36.7%) 1,294,253 20 258,851 20,708 18,120 15,531III. 3. Participation in investment pools 3) 0 0 0 0III. 4. Loans guaranteed by mortgages (19.6%) 692,361 50 346,181 27,694 24,233 20,771III. 5. Other loans (1.4%) 48,445 20 9,689 775 678 581III. 6. Deposits with credit institutions (1.1%) 37,000 20 7,400 592 518 444III. 7. Other investments 100 0 0 0 0Total (100%) 3,526,338 2,076,400 166,112 145,348 124,584Note: 1) Excluding the item "IV. Deposits with...", since there is no risk here due the possibility to set <strong>of</strong>f.Item Value in K DM <strong>of</strong> which 3%Mathematical provision as at 31.12.1995 2,936,909 88,107

- 101 -AN N EX 123(50$1(17+($/7+,1685$1&(In the UK, Class IV business is taken to include contracts <strong>of</strong> the following kinds:a) Contracts providing income benefits when the policyholder is incapable <strong>of</strong> workthrough sickness, infirmity or accident, and where the contracts have an expected duration<strong>of</strong> at least five years (or to retirement if earlier) and cannot be cancelled by the insurer.In practice:- benefits are usually payable until the policyholder has either recovered from therelevant affliction, or has reached retirement age, or dies. Because the purpose <strong>of</strong>the policy is to replace lost income, benefits are usually not payable after normalretirement age.- premiums may be set in advance at a level which is constant throughout the term<strong>of</strong> the contract. However, many contracts are now written (particularly where theterm <strong>of</strong> the contract is fairly long) with provision for review <strong>of</strong> the premium at fiveor ten year intervals.b) Contracts providing lump sum benefits on diagnosis <strong>of</strong> a serious or critical illness(defined in the policy conditions), which are either whole-life contracts or have an expectedduration <strong>of</strong> at least five years, and which cannot be cancelled by the insurer.- In practice premiums may be set in advance at a level which is constantthroughout the term <strong>of</strong> the contract. However, many contracts are now written(particularly where the term <strong>of</strong> the contract is fairly long) with provision for review<strong>of</strong> the premium at five or ten year intervals.- In some insurance contracts a lump sum benefit is payable on diagnosis in place <strong>of</strong>a benefit which would otherwise be payable on death – in other words, there is anacceleration <strong>of</strong> death benefit on diagnosis <strong>of</strong> a critical illness. Such contracts areregarded as falling within Class I rather than Class IV.c) Contracts providing income benefits on infirmity in old age to <strong>of</strong>fset the costs <strong>of</strong>assistance with specified living activities, and which are written as whole-life contracts.- In practice premiums may be set in advance at a level which is constantthroughout the term <strong>of</strong> the contract. However, many contracts are now written(particularly where the term <strong>of</strong> the contract is fairly long) with provision for review<strong>of</strong> the premium at five or ten year intervals.

- Page 9 and 10:

,QWURGXFWLRQSolvency as referred to

- Page 11 and 12:

At the same time, the economic coll

- Page 13 and 14:

2.1.2 Technical risksa) Current ris

- Page 15 and 16:

Matching riskThe assets of insuranc

- Page 17 and 18:

In life insurance premiums must be

- Page 19 and 20:

Matching riskThe matching risk can

- Page 21 and 22:

However, sufficient experience with

- Page 23 and 24:

With respect to the remaining class

- Page 25 and 26:

However, these undertakings would n

- Page 27 and 28:

first Directive, or in accordance w

- Page 29 and 30:

The parameters A, B and C are to be

- Page 31 and 32:

The majority of delegations admit t

- Page 33 and 34:

Another delegation suggested to all

- Page 35 and 36:

extent taking account of inflation

- Page 37 and 38:

Investment riskTwo alternative yard

- Page 39 and 40:

e put into practice. A number of de

- Page 41 and 42:

4.2.2.5 TontinesAt the moment, this

- Page 43 and 44:

Moreover, the working group discuss

- Page 45 and 46:

5.2.4 Own funds substitutesOwn fund

- Page 47 and 48:

A number of members of the working

- Page 49 and 50:

to be at risk. In some member state

- Page 53 and 54:

AN N EX 1),1$1&,$/',)),&8/7,(62&&85

- Page 55 and 56:

- 47 -- inappropriate capital struc

- Page 57 and 58: - 49 -In terms of frequency of occu

- Page 59: - 51 -Reinsurance riskIn some count

- Page 62 and 63: - 54 -a) Asset risk, C 1:The asset

- Page 64 and 65: - 56 -factors will result in the re

- Page 66 and 67: - 58 -IL i := an average loss rate

- Page 68 and 69: - 60 -First level of intervention (

- Page 71 and 72: - 63 -AN N EX 32:1)81'65(48,5(0(176

- Page 73: - 65 -in the case of balance-sheet

- Page 76 and 77: The value of the liabilities, and p

- Page 78 and 79: - 70 -Enclosure to Annex 4Examples

- Page 81 and 82: - 73 -AN N EX 5$/7(51$7,9(3529,6,21

- Page 83: - 75 -Model calculation CAssumption

- Page 86 and 87: - 78 -Risk of inadequacy of claims

- Page 89 and 90: - 81 -ANNEX 7(;$03/(6)257+(&$/&8/$7

- Page 91 and 92: Example: non-life insurance underta

- Page 93 and 94: - 85 -AN N EX 8$1$/7(51$7,9(0(7+2',

- Page 95 and 96: AN N EX 9(;7(16,212)7+($'',7,9(0(7+

- Page 97 and 98: - 89 -However, the parameters shoul

- Page 99 and 100: In principle, an insurance undertak

- Page 101: Annex 9 - Enclosure 2Table 2:The ra

- Page 105 and 106: - 97 -ANNEX 11(;$03/(6)257+(&$/&8/$

- Page 107: Example: life insurance undertaking