Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

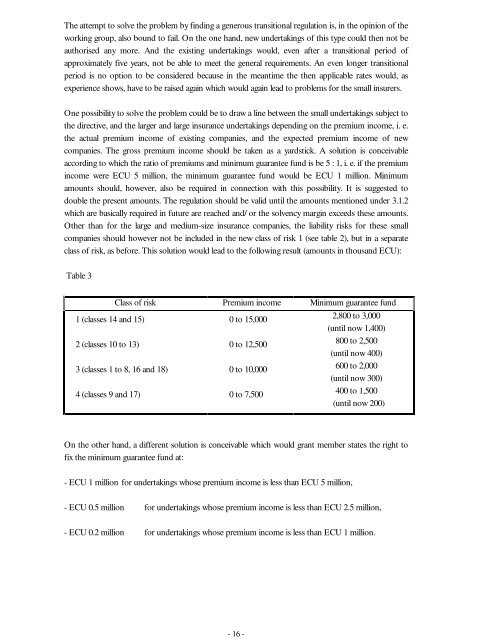

The attempt to solve the problem by finding a generous transitional regulation is, in the opinion <strong>of</strong> theworking group, also bound to fail. On the one hand, new undertakings <strong>of</strong> this type could then not beauthorised any more. And the existing undertakings would, even after a transitional period <strong>of</strong>approximately five years, not be able to meet the general requirements. An even longer transitionalperiod is no option to be considered because in the meantime the then applicable rates would, asexperience shows, have to be raised again which would again lead to problems for the small insurers.One possibility to solve the problem could be to draw a line between the small undertakings subject tothe directive, and the larger and large insurance undertakings depending on the premium income, i. e.the actual premium income <strong>of</strong> existing companies, and the expected premium income <strong>of</strong> newcompanies. The gross premium income should be taken as a yardstick. A solution is conceivableaccording to which the ratio <strong>of</strong> premiums and minimum guarantee fund is be 5 : 1, i. e. if the premiumincome were ECU 5 million, the minimum guarantee fund would be ECU 1 million. Minimumamounts should, however, also be required in connection with this possibility. It is suggested todouble the present amounts. The regulation should be valid until the amounts mentioned under 3.1.2which are basically required in future are reached and/ or the solvency margin exceeds these amounts.Other than for the large and medium-size insurance companies, the liability risks for these smallcompanies should however not be included in the new class <strong>of</strong> risk 1 (see table 2), but in a separateclass <strong>of</strong> risk, as before. This solution would lead to the following result (amounts in thousand ECU):Table 31 (classes 14 and 15)2 (classes 10 to 13)Class <strong>of</strong> risk Premium income Minimum guarantee fund3 (classes 1 to 8, 16 and 18)4 (classes 9 and 17)0 to 15,0000 to 12,5000 to 10,0000 to 7,5002,800 to 3,000(until now 1,400)800 to 2,500(until now 400)600 to 2,000(until now 300)400 to 1,500(until now 200)On the other hand, a different solution is conceivable which would grant member states the right t<strong>of</strong>ix the minimum guarantee fund at:- ECU 1 million for undertakings whose premium income is less than ECU 5 million,- ECU 0.5 million for undertakings whose premium income is less than ECU 2.5 million,- ECU 0.2 million for undertakings whose premium income is less than ECU 1 million.- 16 -