Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

Solvency of Insurance Undertakings (Mueller-Report) - Eiopa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

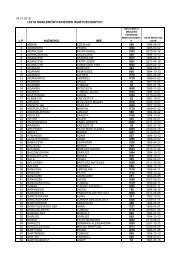

On the other hand the working group recognises that small insurers, especially those having the legalform <strong>of</strong> mutual societies, not only work satisfactorily, but also fulfil an important economic and sociopoliticalfunction. These insurance undertakings shall be granted facilities, with the working groupabsolutely being aware that this may affect competition.Moreover, the working group discussed the question if the member state option to reduce theminimum amount <strong>of</strong> the guarantee fund by one quarter for mutual societies should be abolishedwithout replacing it.In the following, the working group proposes a regulation which should apply in principle, as well aspossible exceptions to it.3.1.2. Basic principleThe working group agrees that non-life insurance undertakings must also in future furnish pro<strong>of</strong> <strong>of</strong>own funds equivalent to a minimum amount depending on the class <strong>of</strong> insurance written alreadywhen applying for authorisation to take up operations.It is generally considered necessary to increase the current minimum amounts at least to an extenttaking account <strong>of</strong> inflation and market development since 1973. The amounts below in million ECUfor the four classes <strong>of</strong> risk in non-life insurance result from applying the consumer price index EUR12/ 15, after adding 10 % to take account <strong>of</strong> inflation until the expected amendment <strong>of</strong> the Directivein 1998 at the earliest, and after rounding up:Class <strong>of</strong> risk 1: 3 (previously 1,4)Class <strong>of</strong> risk 2: 2,5 (previously 0,4)Class <strong>of</strong> risk 3: 2 (previously 0,3)Class <strong>of</strong> risk 4: 1,5 (previously 0,2)In order to address the difficult nature <strong>of</strong> liability insurance better than before, the working group –with the exception <strong>of</strong> three delegations – believes that liability risks should be allocated to the class <strong>of</strong>risk requiring the highest minimum amount and thus placed on one risk level together with creditinsurance. According to the great majority, the previous class <strong>of</strong> risk 2 should be merged with the class<strong>of</strong> risk 1. At the same time, hail, frost and other damage to property included in class <strong>of</strong> risk 4 shouldbe placed on one level with fire and elementary losses, showing the following result:Table 2Class <strong>of</strong> risk1 (types 10 to 15)2 (types 1 to 9, 16 and 18)3 (type 17)Minimum guarantee fundECU 3 millionECU 2 millionECU 1,5 million- 14 -