Annual Report 2011 (5.07 MB, PDF-File) - Oerlikon

Annual Report 2011 (5.07 MB, PDF-File) - Oerlikon

Annual Report 2011 (5.07 MB, PDF-File) - Oerlikon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Figures Group Notes OC <strong>Oerlikon</strong> Corporation AG, Pfäffikon<br />

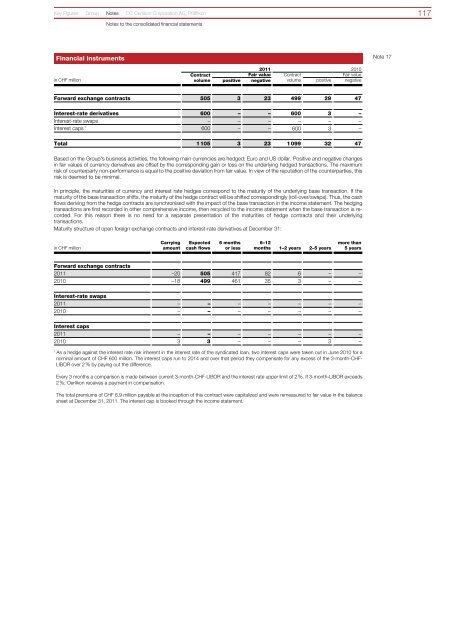

Financial instruments<br />

Notes to the consolidated financial statements<br />

<strong>2011</strong> 2010<br />

Contract<br />

Fair value Contract<br />

Fair value<br />

in CHF million volume positive negative volume positive negative<br />

Forward exchange contracts 505 3 23 499 29 47<br />

Interest-rate derivatives 600 – – 600 3 –<br />

Interest-rate swaps – – – – – –<br />

Interest caps 1 600 – – 600 3 –<br />

Total 1 105 3 23 1 099 32 47<br />

Based on the Group’s business activities, the following main currencies are hedged: Euro and US dollar. Positive and negative changes<br />

in fair values of currency derivatives are offset by the corresponding gain or loss on the underlying hedged transactions. The maximum<br />

risk of counterparty non-performance is equal to the positive deviation from fair value. In view of the reputation of the counterparties, this<br />

risk is deemed to be minimal.<br />

In principle, the maturities of currency and interest rate hedges correspond to the maturity of the underlying base transaction. If the<br />

maturity of the base transaction shifts, the maturity of the hedge contract will be shifted correspondingly (roll-over/swaps). Thus, the cash<br />

flows deriving from the hedge contracts are synchronised with the impact of the base transaction in the income statement. The hedging<br />

transactions are first recorded in other comprehensive income, then recycled to the income statement when the base transaction is recorded.<br />

For this reason there is no need for a separate presentation of the maturities of hedge contracts and their underlying<br />

transactions.<br />

Maturity structure of open foreign exchange contracts and interest-rate derivatives at December 31:<br />

in CHF million<br />

Carrying<br />

amount<br />

Expected<br />

cash flows<br />

6 months<br />

or less<br />

6–12<br />

months 1–2 years 2–5 years<br />

more than<br />

5 years<br />

Forward exchange contracts<br />

<strong>2011</strong> –20 505 417 82 6 – –<br />

2010 –18 499 461 35 3 – –<br />

Interest-rate swaps<br />

<strong>2011</strong> – – – – – – –<br />

2010 – – – – – – –<br />

Interest caps<br />

<strong>2011</strong> – – – – – – –<br />

2010 3 3 – – – 3 –<br />

1 As a hedge against the interest rate risk inherent in the interest rate of the syndicated loan, two interest caps were taken out in June 2010 for a<br />

nominal amount of CHF 600 million. The interest caps run to 2014 and over that period they compensate for any excess of the 3-month-CHF-<br />

LIBOR over 2 % by paying out the difference.<br />

Every 3 months a comparison is made between current 3-month-CHF-LIBOR and the interest rate upper limit of 2 %. If 3-month-LIBOR exceeds<br />

2 %, <strong>Oerlikon</strong> receives a payment in compensation.<br />

The total premiums of CHF 6.9 million payable at the inception of this contract were capitalized and were remeasured to fair value in the balance<br />

sheet at December 31, <strong>2011</strong>. The interest cap is booked through the income statement.<br />

Note 17<br />

117