Pittwater Council Annual Report - Pittwater Council - NSW ...

Pittwater Council Annual Report - Pittwater Council - NSW ...

Pittwater Council Annual Report - Pittwater Council - NSW ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

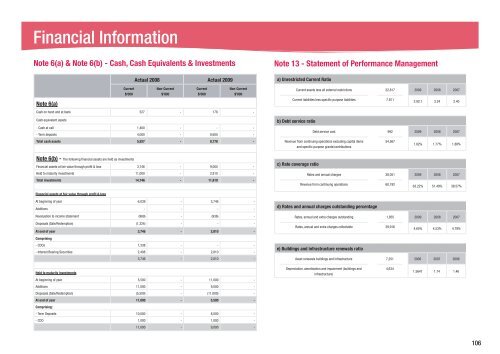

Financial InformationNote 6(a) & Note 6(b) - Cash, Cash Equivalents & InvestmentsNote 13 - Statement of Performance ManagementActual 2008 Actual 2009a) Unrestricted Current RatioCurrent$’000Non-Current$’000Current$’000Non-Current$’000Current assets less all external restrictions 22,817 2009 2008 2007Note 6(a)Current liabilities less specific purpose liabilities 7,8112.92:1 3.24 2.40Cash on hand and at bank 527 - 178 -Cash equivalent assets- Cash at call 1,400 - - -- Term deposits 4,000 - 8,600 -Total cash assets 5,927 - 8,778 -b) Debt service ratioDebt service cost 992 2009 2008 2007Revenue from continuing operations excluding capital items54,567and specific purpose grants/contributions1.82% 1.77% 1.88%Note 6(b) - The following financial assets are held as investmentsFinancial assets at fair value through profit & loss 3,746 - 9,000 -Held to maturity investments 11,000 - 2,810 -Total investments 14,746 - 11,810 -c) Rate coverage ratioRates and annual charges 38,051 2009 2008 2007Revenue from continuing operations 60,19263.22% 51.49% 38.57%Financial assets at fair value through profit & lossAt beginning of year 6,039 - 3,746 -Additions - - - -Revaluation to income statement (969) - (936) -Disposals (Sale/Redemption) (1,324) - - -At end of year 3,746 - 2,810 -d) Rates and annual charges outstanding percentageRates, annual and extra charges outstanding 1,855 2009 2008 2007Rates, annual and extra charges collectable 39,9164.65% 4.53% 4.79%Comprising- CDOs 1,338 - - -- Interest Bearing Securities 2,408 - 2,810 -3,746 - 2,810 -e) Buildings and infrastructure renewals ratioAsset renewals buildings and infrastructure 7,251 2008 2007 2006Held to maturity investmentsDepreciation, amortisation and impairment (buildings andinfrastructure)4,6341.5647 1.74 1.46At beginning of year 5,500 - 11,000 -Additions 11,000 - 9,000 -Disposals (Sale/Redemption) (5,500) - (11,000) -At end of year 11,000 - 5,500 -Comprising:- Term Deposits 10,000 - 8,000 -- CDO 1,000 - 1,000 -11,000 - 9,000 -106