ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

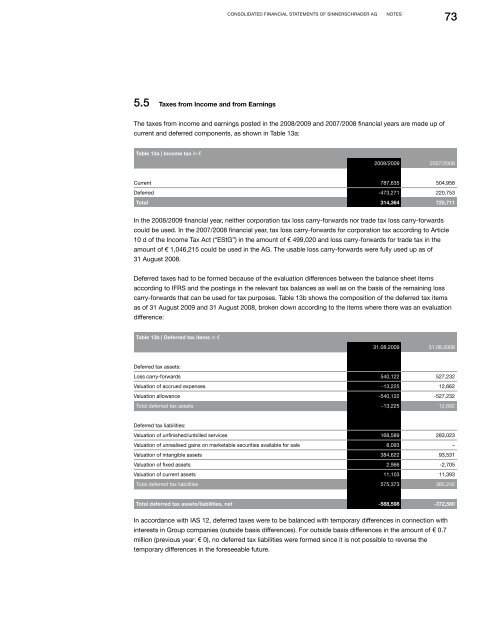

Consolidated Financial Statements of <strong>SinnerSchrader</strong> <strong>AG</strong>Notes735.5 Taxes from Income and from EarningsThe taxes from income and earnings posted in the <strong>2008</strong>/<strong>2009</strong> and 2007/<strong>2008</strong> financial years are made up ofcurrent and deferred components, as shown in Table 13a:Table 13a | Income tax in €<strong>2008</strong>/<strong>2009</strong> 2007/<strong>2008</strong>Current 787,635 504,958Deferred -473,271 220,753Total 314,364 725,711In the <strong>2008</strong>/<strong>2009</strong> financial year, neither corporation tax loss carry-forwards nor trade tax loss carry-forwardscould be used. In the 2007/<strong>2008</strong> financial year, tax loss carry-forwards for corporation tax according to Article10 d of the Income Tax Act (“EStG”) in the amount of € 499,020 and loss carry-forwards for trade tax in theamount of € 1,046,215 could be used in the <strong>AG</strong>. The usable loss carry-forwards were fully used up as of31 August <strong>2008</strong>.Deferred taxes had to be formed because of the evaluation differences between the balance sheet itemsaccording to IFRS and the postings in the relevant tax balances as well as on the basis of the remaining losscarry-forwards that can be used for tax purposes. Table 13b shows the composition of the deferred tax itemsas of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>, broken down according to the items where there was an evaluationdifference:Table 13b | Deferred tax items in €31.08.<strong>2009</strong> 31.08.<strong>2008</strong>Deferred tax assets:Loss carry-forwards 540,122 527,232Valuation of accrued expenses -13,225 12,662Valuation allowance -540,122 -527,232Total deferred tax assets -13,225 12,662Deferred tax liabilities:Valuation of unfinished/unbilled services 168,589 283,023Valuation of unrealised gains on marketable securities available for sale 8,093 –Valuation of intangible assets 384,622 93,531Valuation of fixed assets 2,966 -2,705Valuation of current assets 11,103 11,393Total deferred tax liabilities 575,373 385,242Total deferred tax assets/liabilities, net -588,598 -372,580In accordance with IAS 12, deferred taxes were to be balanced with temporary differences in connection withinterests in Group companies (outside basis differences). For outside basis differences in the amount of € 0.7million (previous year: € 0), no deferred tax liabilities were formed since it is not possible to reverse thetemporary differences in the foreseeable future.