ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

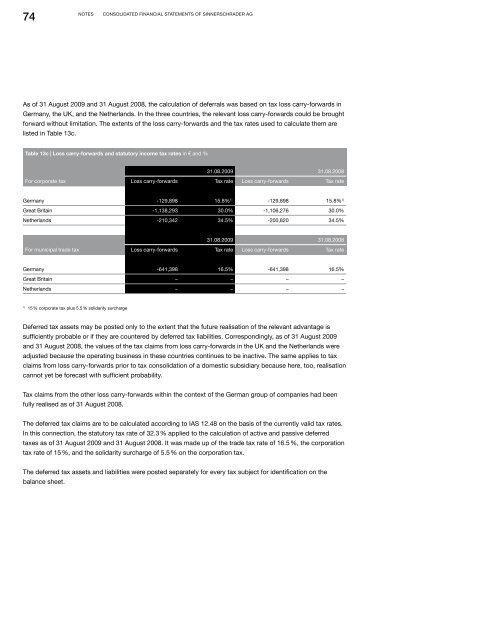

74NotesConsolidated Financial Statements of <strong>SinnerSchrader</strong> <strong>AG</strong>As of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>, the calculation of deferrals was based on tax loss carry-forwards inGermany, the UK, and the Netherlands. In the three countries, the relevant loss carry-forwards could be broughtforward without limitation. The extents of the loss carry-forwards and the tax rates used to calculate them arelisted in Table 13c.Table 13c | Loss carry-forwards and statutory income tax rates in € and %31.08.<strong>2009</strong> 31.08.<strong>2008</strong>For corporate tax Loss carry-forwards Tax rate Loss carry-forwards Tax rateGermany -129,898 15.8% 1)) -129,898 15.8% 1)Great Britain -1,138,293 30.0% -1,106,276 30.0%Netherlands -210,342 34.5% -200,820 34.5%31.08.<strong>2009</strong> 31.08.<strong>2008</strong>For municipal trade tax Loss carry-forwards Tax rate Loss carry-forwards Tax rateGermany -641,398 16.5% -641,398 16.5%Great Britain – – – –Netherlands – – – –1)15 % corporate tax plus 5.5 % solidarity surchargeDeferred tax assets may be posted only to the extent that the future realisation of the relevant advantage issufficiently probable or if they are countered by deferred tax liabilities. Correspondingly, as of 31 August <strong>2009</strong>and 31 August <strong>2008</strong>, the values of the tax claims from loss carry-forwards in the UK and the Netherlands wereadjusted because the operating business in these countries continues to be inactive. The same applies to taxclaims from loss carry-forwards prior to tax consolidation of a domestic subsidiary because here, too, realisationcannot yet be forecast with sufficient probability.Tax claims from the other loss carry-forwards within the context of the German group of companies had beenfully realised as of 31 August <strong>2008</strong>.The deferred tax claims are to be calculated according to IAS 12.48 on the basis of the currently valid tax rates.In this connection, the statutory tax rate of 32.3 % applied to the calculation of active and passive deferredtaxes as of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>. It was made up of the trade tax rate of 16.5 %, the corporationtax rate of 15 %, and the solidarity surcharge of 5.5 % on the corporation tax.The deferred tax assets and liabilities were posted separately for every tax subject for identification on thebalance sheet.