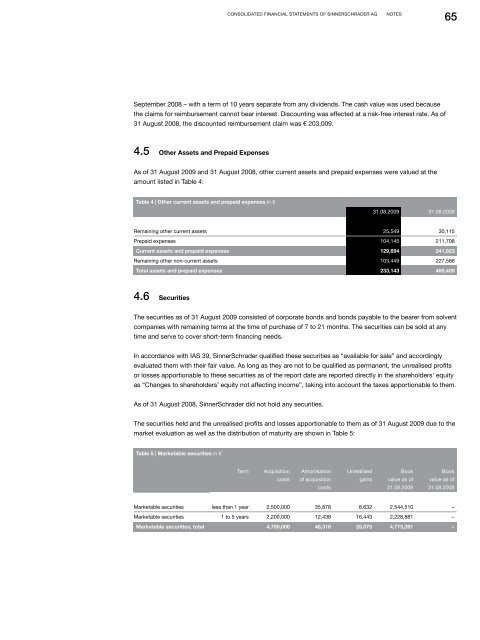

Consolidated Financial Statements of <strong>SinnerSchrader</strong> <strong>AG</strong>Notes65September <strong>2008</strong> – with a term of 10 years separate from any dividends. The cash value was used becausethe claims for reimbursement cannot bear interest. Discounting was effected at a risk-free interest rate. As of31 August <strong>2008</strong>, the discounted reimbursement claim was € 203,009.4.5 Other Assets and Prepaid ExpensesAs of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>, other current assets and prepaid expenses were valued at theamount listed in Table 4:Table 4 | Other current assets and prepaid expenses in €31.08.<strong>2009</strong> 31.08.<strong>2008</strong>Remaining other current assets 25,549 30,115Prepaid expenses 104,145 211,708Current assets and prepaid expenses 129,694 241,823Remaining other non-current assets 103,449 227,586Total assets and prepaid expenses 233,143 469,4094.6 SecuritiesThe securities as of 31 August <strong>2009</strong> consisted of corporate bonds and bonds payable to the bearer from solventcompanies with remaining terms at the time of purchase of 7 to 21 months. The securities can be sold at anytime and serve to cover short-term financing needs.In accordance with IAS 39, <strong>SinnerSchrader</strong> qualified these securities as “available for sale” and accordinglyevaluated them with their fair value. As long as they are not to be qualified as permanent, the unrealised profitsor losses apportionable to these securities as of the report date are reported directly in the shareholders’ equityas “Changes to shareholders’ equity not affecting income”, taking into account the taxes apportionable to them.As of 31 August <strong>2008</strong>, <strong>SinnerSchrader</strong> did not hold any securities.The securities held and the unrealised profits and losses apportionable to them as of 31 August <strong>2009</strong> due to themarket evaluation as well as the distribution of maturity are shown in Table 5:Table 5 | Marketable securities in €TermAcquisitioncostsAmortisationof acquisitioncostsUnrealisedgainsBookvalue as of31.08.<strong>2009</strong>Bookvalue as of31.08.<strong>2008</strong>Marketable securities less than 1 year 2,500,000 35,878 8,632 2,544,510 –Marketable securities 1 to 5 years 2,200,000 12,438 16,443 2,228,881 –Marketable securities, total 4,700,000 48,316 25,075 4,773,391 –

66NotesConsolidated Financial Statements of <strong>SinnerSchrader</strong> <strong>AG</strong>4.7 Liquid FundsCash flows and bank balances resulted in liquid funds of € 3.2 million as of 31 August <strong>2009</strong>. As of 31 Augustof the previous year, the liquid funds also included fixed-term deposit investments with a term of less than onemonth and amounted to € 9.1 million. As of 31 August <strong>2009</strong>, liquid funds in the amount of € 0.6 million wereused as cash deposits for bank guarantees (see Section 4.13).4.8 Shareholders’ Equity• Share CapitalAs of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>, the share capital of <strong>SinnerSchrader</strong> <strong>AG</strong> was € 11,542,764 and wasdivided into 11,542,764 no-par-value share certificates in the names of the bearers, each with a calculated valueof € 1 per share.On 31 August <strong>2009</strong> and 31 August <strong>2008</strong>, 11,272,108 and 11,497,579 shares, respectively, of all issued outstandingshares were in circulation. The remaining 270,656 and 45,185 shares, respectively, were held as<strong>SinnerSchrader</strong> <strong>AG</strong> treasury stock.• Authorised CapitalThe Annual General Meeting of 18 December <strong>2008</strong> authorised the Management Board to increase the share capitalonce or repeatedly by up to a total of € 5,770,000 until 15 January 2013 with the approval of the SupervisoryBoard by issuing no-par-value share certificates issued in the name of the owner in return for a contribution incash or a contribution in kind, excluding the shareholders’ subscription right (“Authorised Capital <strong>2008</strong>”). Thisbecame legally effective upon entry of the decision in the Commercial Register on 16 February <strong>2009</strong>. In the<strong>2008</strong>/<strong>2009</strong> and 2007/<strong>2008</strong> financial years, no capital increases were carried out using the authorised capital.• Conditional CapitalAs of 31 August <strong>2009</strong>, <strong>SinnerSchrader</strong> <strong>AG</strong> had conditional capital in the amount of € 896,538, which wascreated in 1999 (“Conditional Capital I”), 2000 (“Conditional Capital II”), and 2007 (“Conditional Capital III”) forthe issue of share options to employees. With the Annual General Meeting resolution of 23 January 2007,Conditional Capital I and Conditional Capital II were cancelled to the extent that they were no longer neededto service subscription rights and were correspondingly reduced by € 375,000 to € 127,909 and € 168,629,respectively. Until 31 December 2011, options can be issued to employees from Conditional Capital III in theamount of € 600,000, newly created by the Annual General Meeting resolution of 23 January 2007. In the<strong>2008</strong>/<strong>2009</strong> financial year, no options were allocated. Details on the option programmes and outstandingoptions are in section 6.• Capital Reserve, Accumulated DeficitAs of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>, the capital reserve reached a value of € 3,599,444 and € 3,601,770,respectively. As of 31 August 2007, the capital reserve was offset against the accumulated deficit in such a waythat the capital reserve of the parent company in the amount of € 3,612,775 is reflected in the ConsolidatedBalance Sheet pursuant to IFRS. The changes to the capital reserve which have since come into effect arosein connection with the use of treasury stock for the acquisition of subsidiaries.• Reserve for Stock-based CompensationThe reserve comprises the accumulated costs from issuing stock-based compensation. As of 31 August <strong>2009</strong>and 31 August <strong>2008</strong>, they reached a value of € 102,037 and € 70,778, respectively.