ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

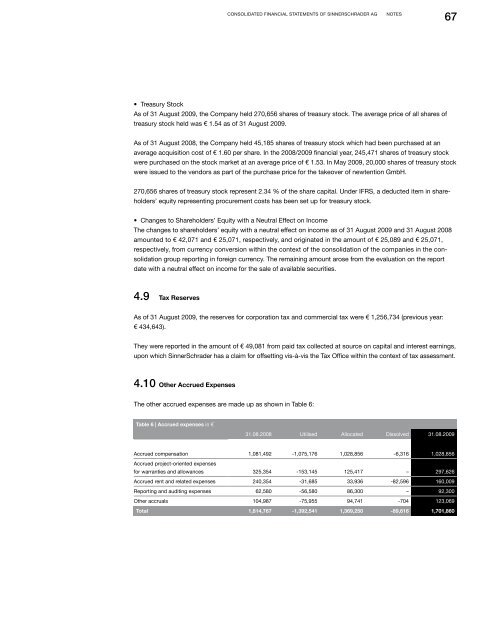

Consolidated Financial Statements of <strong>SinnerSchrader</strong> <strong>AG</strong>Notes67• Treasury StockAs of 31 August <strong>2009</strong>, the Company held 270,656 shares of treasury stock. The average price of all shares oftreasury stock held was € 1.54 as of 31 August <strong>2009</strong>.As of 31 August <strong>2008</strong>, the Company held 45,185 shares of treasury stock which had been purchased at anaverage acquisition cost of € 1.60 per share. In the <strong>2008</strong>/<strong>2009</strong> financial year, 245,471 shares of treasury stockwere purchased on the stock market at an average price of € 1.53. In May <strong>2009</strong>, 20,000 shares of treasury stockwere issued to the vendors as part of the purchase price for the takeover of newtention GmbH.270,656 shares of treasury stock represent 2.34 % of the share capital. Under IFRS, a deducted item in shareholders’equity representing procurement costs has been set up for treasury stock.• Changes to Shareholders’ Equity with a Neutral Effect on IncomeThe changes to shareholders’ equity with a neutral effect on income as of 31 August <strong>2009</strong> and 31 August <strong>2008</strong>amounted to € 42,071 and € 25,071, respectively, and originated in the amount of € 25,089 and € 25,071,respectively, from currency conversion within the context of the consolidation of the companies in the consolidationgroup reporting in foreign currency. The remaining amount arose from the evaluation on the reportdate with a neutral effect on income for the sale of available securities.4.9 Tax ReservesAs of 31 August <strong>2009</strong>, the reserves for corporation tax and commercial tax were € 1,256,734 (previous year:€ 434,643).They were reported in the amount of € 49,081 from paid tax collected at source on capital and interest earnings,upon which <strong>SinnerSchrader</strong> has a claim for offsetting vis-à-vis the Tax Office within the context of tax assessment.4.10 Other Accrued ExpensesThe other accrued expenses are made up as shown in Table 6:Table 6 | Accrued expenses in €31.08.<strong>2008</strong> Utilised Allocated Dissolved 31.08.<strong>2009</strong>Accrued compensation 1,081,492 -1,075,176 1,028,856 -6,316 1,028,856Accrued project-oriented expensesfor warranties and allowances 325,354 -153,145 125,417 – 297,626Accrued rent and related expenses 240,354 -31,685 33,936 -82,596 160,009Reporting and auditing expenses 62,580 -56,580 86,300 – 92,300Other accruals 104,987 -75,955 94,741 -704 123,069Total 1,814,767 -1,392,541 1,369,250 -89,616 1,701,860