ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

ANNUAL REPORT 2008 | 2009 - SinnerSchrader AG

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

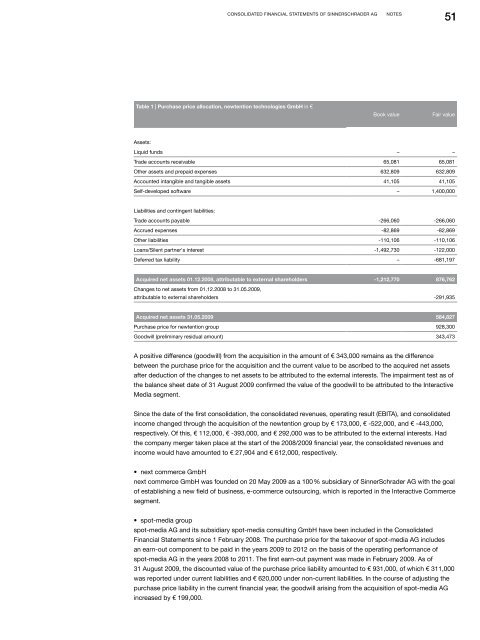

Consolidated Financial Statements of <strong>SinnerSchrader</strong> <strong>AG</strong>Notes51Table 1 | Purchase price allocation, newtention technologies GmbH in €Book valueFair valueAssets:Liquid funds – –Trade accounts receivable 65,081 65,081Other assets and prepaid expenses 632,809 632,809Accounted intangible and tangible assets 41,105 41,105Self-developed software – 1,400,000Liabilities and contingent liabilities:Trade accounts payable -266,060 -266,060Accrued expenses -82,869 -82,869Other liabilities -110,106 -110,106Loans/Silent partner's interest -1,492,730 -122,000Deferred tax liability – -681,197Acquired net assets 01.12.<strong>2008</strong>, attributable to external shareholders -1,212,770 876,762Changes to net assets from 01.12.<strong>2008</strong> to 31.05.<strong>2009</strong>,attributable to external shareholders -291,935Acquired net assets 31.05.<strong>2009</strong> 584,827Purchase price for newtention group 928,300Goodwill (preliminary residual amount) 343,473A positive difference (goodwill) from the acquisition in the amount of € 343,000 remains as the differencebetween the purchase price for the acquisition and the current value to be ascribed to the acquired net assetsafter deduction of the changes to net assets to be attributed to the external interests. The impairment test as ofthe balance sheet date of 31 August <strong>2009</strong> confirmed the value of the goodwill to be attributed to the InteractiveMedia segment.Since the date of the first consolidation, the consolidated revenues, operating result (EBITA), and consolidatedincome changed through the acquisition of the newtention group by € 173,000, € -522,000, and € -443,000,respectively. Of this, € 112,000, € -393,000, and € 292,000 was to be attributed to the external interests. Hadthe company merger taken place at the start of the <strong>2008</strong>/<strong>2009</strong> financial year, the consolidated revenues andincome would have amounted to € 27,904 and € 612,000, respectively.• next commerce GmbHnext commerce GmbH was founded on 20 May <strong>2009</strong> as a 100 % subsidiary of <strong>SinnerSchrader</strong> <strong>AG</strong> with the goalof establishing a new field of business, e-commerce outsourcing, which is reported in the Interactive Commercesegment.• spot-media groupspot-media <strong>AG</strong> and its subsidiary spot-media consulting GmbH have been included in the ConsolidatedFinancial Statements since 1 February <strong>2008</strong>. The purchase price for the takeover of spot-media <strong>AG</strong> includesan earn-out component to be paid in the years <strong>2009</strong> to 2012 on the basis of the operating performance ofspot-media <strong>AG</strong> in the years <strong>2008</strong> to 2011. The first earn-out payment was made in February <strong>2009</strong>. As of31 August <strong>2009</strong>, the discounted value of the purchase price liability amounted to € 931,000, of which € 311,000was reported under current liabilities and € 620,000 under non-current liabilities. In the course of adjusting thepurchase price liability in the current financial year, the goodwill arising from the acquisition of spot-media <strong>AG</strong>increased by € 199,000.