Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

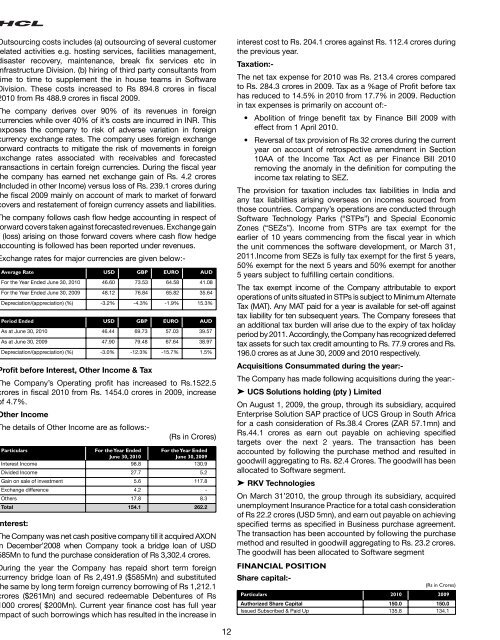

Outsourcing costs includes (a) outsourcing of several customerrelated activities e.g. hosting services, facilities management,disaster recovery, maintenance, break x services etc inInfrastructure Division. (b) hiring of third party consultants fromtime to time to supplement the in house teams in SoftwareDivision. These costs increased to Rs 894.8 crores in scal2010 from Rs 488.9 crores in scal 2009.The company derives over 90% of its revenues in foreigncurrencies while over 40% of it’s costs are incurred in INR. Thisexposes the company to risk of adverse variation in foreigncurrency exchange rates. The company uses foreign exchangeforward contracts to mitigate the risk of movements in foreignexchange rates associated with receivables and forecastedtransactions in certain foreign currencies. During the scal yearthe company has earned net exchange gain of Rs. 4.2 crores(Included in other Income) versus loss of Rs. 239.1 crores duringthe scal 2009 mainly on account of mark to market of forwardcovers and restatement of foreign currency assets and liabilities.The company follows cash ow hedge accounting in respect offorward covers taken against forecasted revenues. Exchange gain/ (loss) arising on those forward covers where cash ow hedgeaccounting is followed has been reported under revenues.Exchange rates for major currencies are given below:-Average Rate USD GBP EURO AUDFor the Year Ended June 30, 2010 46.60 73.53 64.58 41.08For the Year Ended June 30, 2009 48.12 76.84 65.82 35.64Depreciation/(appreciation) (%) -3.2% -4.3% -1.9% 15.3%Period Ended USD GBP EURO AUDAs at June 30, 2010 46.44 69.73 57.03 39.57As at June 30, 2009 47.90 79.48 67.64 38.97Depreciation/(appreciation) (%) -3.0% -12.3% -15.7% 1.5%ParticularsFor the Year EndedJune 30, 2010For the Year EndedJune 30, 2009Interest Income 98.8 130.9Divided Income 27.7 5.2Gain on sale of investment 5.6 117.8Exchange difference 4.2 -Others 17.8 8.3Total 154.1 262.2Interest:The Company was net cash positive company till it acquired AXONin December’2008 when Company took a bridge loan of USD585Mn to fund the purchase consideration of Rs 3,302.4 crores.During the year the Company has repaid short term foreigncurrency bridge loan of Rs 2,491.9 ($585Mn) and substitutedthe same by long term foreign currency borrowing of Rs 1,212.1crores ($261Mn) and secured redeemable Debentures of Rs1000 crores( $200Mn). Current year nance cost has full yearimpact of such borrowings which has resulted in the increase inProt before Interest, Other Income & TaxThe Company’s Operating prot has increased to Rs.1522.5crores in scal 2010 from Rs. 1454.0 crores in 2009, increaseof 4.7%.Other IncomeThe details of Other Income are as follows:-(Rs in Crores)interest cost to Rs. 204.1 crores against Rs. 112.4 crores duringthe previous year.Taxation:-The net tax expense for 2010 was Rs. 213.4 crores comparedto Rs. 284.3 crores in 2009. Tax as a %age of Prot before taxhas reduced to 14.5% in 2010 from 17.7% in 2009. Reductionin tax expenses is primarily on account of:-• Abolition of fringe benet tax by Finance Bill 2009 witheffect from 1 April 2010.• Reversal of tax provision of Rs 32 crores during the currentyear on account of retrospective amendment in Section10AA of the Income Tax Act as per Finance Bill 2010removing the anomaly in the denition for computing theincome tax relating to SEZ.The provision for taxation includes tax liabilities in India andany tax liabilities arising overseas on incomes sourced fromthose countries. Company’s operations are conducted throughSoftware Technology Parks (“STPs”) and Special EconomicZones (“SEZs”). Income from STPs are tax exempt for theearlier of 10 years commencing from the scal year in whichthe unit commences the software development, or March 31,2011.Income from SEZs is fully tax exempt for the rst 5 years,50% exempt for the next 5 years and 50% exempt for another5 years subject to fullling certain conditions.The tax exempt income of the Company attributable to exportoperations of units situated in STPs is subject to Minimum AlternateTax (MAT). Any MAT paid for a year is available for set-off againsttax liability for ten subsequent years. The Company foresees thatan additional tax burden will arise due to the expiry of tax holidayperiod by 2011. Accordingly, the Company has recognized deferredtax assets for such tax credit amounting to Rs. 77.9 crores and Rs.196.0 crores as at June 30, 2009 and 2010 respectively.Acquisitions Consummated during the year:-The Company has made following acquisitions during the year:-➤ UCS Solutions holding (pty ) LimitedOn August 1, 2009, the group, through its subsidiary, acquiredEnterprise Solution SAP practice of UCS Group in South Africafor a cash consideration of Rs.38.4 Crores (ZAR 57.1mn) andRs.44.1 crores as earn out payable on achieving speciedtargets over the next 2 years. The transaction has beenaccounted by following the purchase method and resulted ingoodwill aggregating to Rs. 82.4 Crores. The goodwill has beenallocated to Software segment.➤ RKV TechnologiesOn March 31’2010, the group through its subsidiary, acquiredunemployment Insurance Practice for a total cash considerationof Rs 22.2 crores (USD 5mn), and earn out payable on achievingspecied terms as specied in Business purchase agreement.The transaction has been accounted by following the purchasemethod and resulted in goodwill aggregating to Rs. 23.2 crores.The goodwill has been allocated to Software segmentFINANCIAL POSITIONShare capital:-(Rs in Crores)Particulars 2010 2009Authorized Share Capital 150.0 150.0Issued Subscribed & Paid Up 135.8 134.112