Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

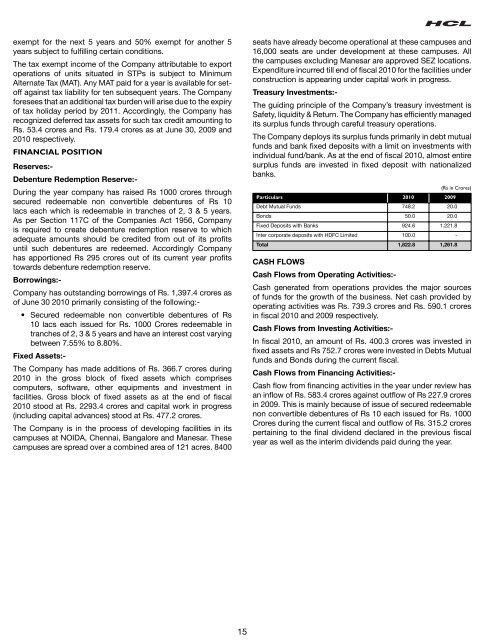

exempt for the next 5 years and 50% exempt for another 5years subject to fullling certain conditions.The tax exempt income of the Company attributable to exportoperations of units situated in STPs is subject to MinimumAlternate Tax (MAT). Any MAT paid for a year is available for setoffagainst tax liability for ten subsequent years. The Companyforesees that an additional tax burden will arise due to the expiryof tax holiday period by 2011. Accordingly, the Company hasrecognized deferred tax assets for such tax credit amounting toRs. 53.4 crores and Rs. 179.4 crores as at June 30, 2009 and2010 respectively.FINANCIAL POSITIONReserves:-Debenture Redemption Reserve:-During the year company has raised Rs 1000 crores throughsecured redeemable non convertible debentures of Rs 10lacs each which is redeemable in tranches of 2, 3 & 5 years.As per Section 117C of the Companies Act 1956, Companyis required to create debenture redemption reserve to whichadequate amounts should be credited from out of its protsuntil such debentures are redeemed. Accordingly Companyhas apportioned Rs 295 crores out of its current year protstowards debenture redemption reserve.Borrowings:-Company has outstanding borrowings of Rs. 1,397.4 crores asof June 30 2010 primarily consisting of the following:-• Secured redeemable non convertible debentures of Rs10 lacs each issued for Rs. 1000 Crores redeemable intranches of 2, 3 & 5 years and have an interest cost varyingbetween 7.55% to 8.80%.Fixed Assets:-The Company has made additions of Rs. 366.7 crores during2010 in the gross block of xed assets which comprisescomputers, software, other equipments and investment infacilities. Gross block of xed assets as at the end of scal2010 stood at Rs. 2293.4 crores and capital work in progress(including capital advances) stood at Rs. 477.2 crores.The Company is in the process of developing facilities in itscampuses at NOIDA, Chennai, Bangalore and Manesar. Thesecampuses are spread over a combined area of 121 acres. 8400seats have already become operational at these campuses and16,000 seats are under development at these campuses. Allthe campuses excluding Manesar are approved SEZ locations.Expenditure incurred till end of scal 2010 for the facilities underconstruction is appearing under capital work in progress.Treasury Investments:-The guiding principle of the Company’s treasury investment isSafety, liquidity & Return. The Company has efciently managedits surplus funds through careful treasury operations.The Company deploys its surplus funds primarily in debt mutualfunds and bank xed deposits with a limit on investments withindividual fund/bank. As at the end of scal 2010, almost entiresurplus funds are invested in xed deposit with nationalizedbanks.(Rs in Crores)Particulars 2010 2009Debt Mutual Funds 748.2 20.0Bonds 50.0 20.0Fixed Deposits with Banks 924.6 1.221.8Inter corporate deposits with HDFC Limited 100.0 -Total 1,822.8 1,261.8CASH FLOWSCash Flows from Operating Activities:-Cash generated from operations provides the major sourcesof funds for the growth of the business. Net cash provided byoperating activities was Rs. 739.3 crores and Rs. 590.1 croresin scal 2010 and 2009 respectively.Cash Flows from Investing Activities:-In scal 2010, an amount of Rs. 400.3 crores was invested inxed assets and Rs 752.7 crores were invested in Debts Mutualfunds and Bonds during the current scal.Cash Flows from Financing Activities:-Cash ow from nancing activities in the year under review hasan inow of Rs. 583.4 crores against outow of Rs 227.9 croresin 2009. This is mainly because of issue of secured redeemablenon convertible debentures of Rs 10 each issued for Rs. 1000Crores during the current scal and outow of Rs. 315.2 crorespertaining to the nal dividend declared in the previous scalyear as well as the interim dividends paid during the year.15