Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

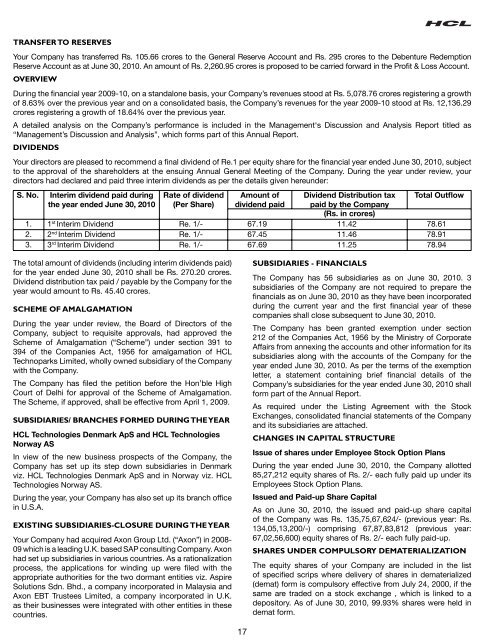

TRANSFER TO RESERVESYour Company has transferred Rs. 105.66 crores to the General Reserve Account and Rs. 295 crores to the Debenture RedemptionReserve Account as at June 30, 2010. An amount of Rs. 2,260.95 crores is proposed to be carried forward in the Prot & Loss Account.OVERVIEWDuring the nancial year 2009-10, on a standalone basis, your Company’s revenues stood at Rs. 5,078.76 crores registering a growthof 8.63% over the previous year and on a consolidated basis, the Company’s revenues for the year 2009-10 stood at Rs. 12,136.29crores registering a growth of 18.64% over the previous year.A detailed analysis on the Company’s performance is included in the Management‘s Discussion and Analysis Report titled as“Management’s Discussion and Analysis”, which forms part of this Annual Report.DIVIDENDSYour directors are pleased to recommend a nal dividend of Re.1 per equity share for the nancial year ended June 30, 2010, subjectto the approval of the shareholders at the ensuing Annual General Meeting of the Company. During the year under review, yourdirectors had declared and paid three interim dividends as per the details given hereunder:S. No. Interim dividend paid during Rate of dividend Amount of Dividend Distribution tax Total Outowthe year ended June 30, 2010 (Per Share) dividend paid paid by the Company(Rs. in crores)1. 1 st Interim Dividend Re. 1/- 67.19 11.42 78.612. 2 nd Interim Dividend Re. 1/- 67.45 11.46 78.913. 3 rd Interim Dividend Re. 1/- 67.69 11.25 78.94The total amount of dividends (including interim dividends paid)for the year ended June 30, 2010 shall be Rs. 270.20 crores.Dividend distribution tax paid / payable by the Company for theyear would amount to Rs. 45.40 crores.SCHEME OF AMALGAMATIONDuring the year under review, the Board of Directors of theCompany, subject to requisite approvals, had approved theScheme of Amalgamation (“Scheme”) under section 391 to394 of the Companies Act, 1956 for amalgamation of HCLTechnoparks Limited, wholly owned subsidiary of the Companywith the Company.The Company has led the petition before the Hon’ble HighCourt of Delhi for approval of the Scheme of Amalgamation.The Scheme, if approved, shall be effective from April 1, 2009.SUBSIDIARIES/ BRANCHES FORMED DURING THE YEARHCL Technologies Denmark ApS and HCL TechnologiesNorway ASIn view of the new business prospects of the Company, theCompany has set up its step down subsidiaries in Denmarkviz. HCL Technologies Denmark ApS and in Norway viz. HCLTechnologies Norway AS.During the year, your Company has also set up its branch ofcein U.S.A.EXISTING SUBSIDIARIES-CLOSURE DURING THE YEARYour Company had acquired Axon Group Ltd. (“Axon”) in 2008-09 which is a leading U.K. based SAP consulting Company. Axonhad set up subsidiaries in various countries. As a rationalizationprocess, the applications for winding up were led with theappropriate authorities for the two dormant entities viz. AspireSolutions Sdn. Bhd., a company incorporated in Malaysia andAxon EBT Trustees Limited, a company incorporated in U.K.as their businesses were integrated with other entities in thesecountries.SUBSIDIARIES - FINANCIALSThe Company has 56 subsidiaries as on June 30, 2010. 3subsidiaries of the Company are not required to prepare thenancials as on June 30, 2010 as they have been incorporatedduring the current year and the rst nancial year of thesecompanies shall close subsequent to June 30, 2010.The Company has been granted exemption under section212 of the Companies Act, 1956 by the Ministry of CorporateAffairs from annexing the accounts and other information for itssubsidiaries along with the accounts of the Company for theyear ended June 30, 2010. As per the terms of the exemptionletter, a statement containing brief nancial details of theCompany’s subsidiaries for the year ended June 30, 2010 shallform part of the Annual Report.As required under the Listing Agreement with the StockExchanges, consolidated nancial statements of the Companyand its subsidiaries are attached.CHANGES IN CAPITAL STRUCTUREIssue of shares under Employee Stock Option PlansDuring the year ended June 30, 2010, the Company allotted85,27,212 equity shares of Rs. 2/- each fully paid up under itsEmployees Stock Option Plans.Issued and Paid-up Share CapitalAs on June 30, 2010, the issued and paid-up share capitalof the Company was Rs. 135,75,67,624/- (previous year: Rs.134,05,13,200/-) comprising 67,87,83,812 (previous year:67,02,56,600) equity shares of Rs. 2/- each fully paid-up.SHARES UNDER COMPULSORY DEMATERIALIZATIONThe equity shares of your Company are included in the listof specied scrips where delivery of shares in dematerialized(demat) form is compulsory effective from July 24, 2000, if thesame are traded on a stock exchange , which is linked to adepository. As of June 30, 2010, 99.93% shares were held indemat form.17