Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

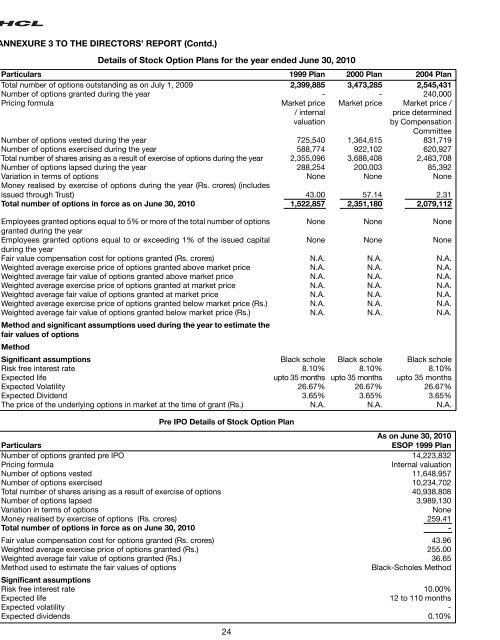

ANNEXURE 3 TO THE DIRECTORS’ REPORT (Contd.)Details of Stock Option Plans for the year ended June 30, 2010Particulars 1999 Plan 2000 Plan 2004 PlanTotal number of options outstanding as on July 1, 2009 2,399,885 3,473,285 2,545,431Number of options granted during the year - - 240,000Pricing formula Market price/ internalvaluation24Market price Market price /price determinedby CompensationCommitteeNumber of options vested during the year 725,540 1,364,615 831,719Number of options exercised during the year 588,774 922,102 620,927Total number of shares arising as a result of exercise of options during the year 2,355,096 3,688,408 2,483,708Number of options lapsed during the year 288,254 200,003 85,392Variation in terms of options None None NoneMoney realised by exercise of options during the year (Rs. crores) (includesissued through Trust) 43.00 57.14 2.31Total number of options in force as on June 30, 2010 1,522,857 2,351,180 2,079,112Employees granted options equal to 5% or more of the total number of options None None Nonegranted during the yearEmployees granted options equal to or exceeding 1% of the issued capital None None Noneduring the yearFair value compensation cost for options granted (Rs. crores) N.A. N.A. N.A.Weighted average exercise price of options granted above market price N.A. N.A. N.A.Weighted average fair value of options granted above market price N.A. N.A. N.A.Weighted average exercise price of options granted at market price N.A. N.A. N.A.Weighted average fair value of options granted at market price N.A. N.A. N.A.Weighted average exercise price of options granted below market price (Rs.) N.A. N.A. N.A.Weighted average fair value of options granted below market price (Rs.) N.A. N.A. N.A.Method and signicant assumptions used during the year to estimate thefair values of optionsMethodSignicant assumptions Black schole Black schole Black scholeRisk free interest rate 8.10% 8.10% 8.10%Expected life upto 35 months upto 35 months upto 35 monthsExpected Volatility 26.67% 26.67% 26.67%Expected Dividend 3.65% 3.65% 3.65%The price of the underlying options in market at the time of grant (Rs.) N.A. N.A. N.A.Pre IPO Details of Stock Option PlanAs on June 30, 2010ParticularsESOP 1999 PlanNumber of options granted pre IPO 14,223,832Pricing formula Internal valuationNumber of options vested 11,648,957Number of options exercised 10,234,702Total number of shares arising as a result of exercise of options 40,938,808Number of options lapsed 3,989,130Variation in terms of options NoneMoney realised by exercise of options (Rs. crores) 259.41Total number of options in force as on June 30, 2010 -Fair value compensation cost for options granted (Rs. crores) 43.96Weighted average exercise price of options granted (Rs.) 255.00Weighted average fair value of options granted (Rs.) 36.65Method used to estimate the fair values of options Black-Scholes MethodSignicant assumptionsRisk free interest rate 10.00%Expected life12 to 110 monthsExpected volatility -Expected dividends 0.10%