Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

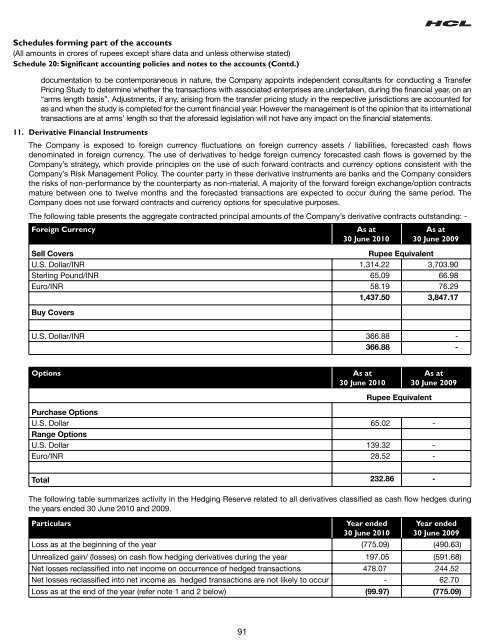

Schedules forming part of the accounts(All amounts in crores of rupees except share data and unless otherwise stated)Schedule 20: Significant accounting policies and notes to the accounts (Contd.)documentation to be contemporaneous in nature, the Company appoints independent consultants for conducting a TransferPricing Study to determine whether the transactions with associated enterprises are undertaken, during the financial year, on an“arms length basis”. Adjustments, if any, arising from the transfer pricing study in the respective jurisdictions are accounted foras and when the study is completed for the current financial year. However the management is of the opinion that its internationaltransactions are at arms’ length so that the aforesaid legislation will not have any impact on the financial statements.11. Derivative Financial InstrumentsThe Company is exposed to foreign currency fluctuations on foreign currency assets / liabilities, forecasted cash flowsdenominated in foreign currency. The use of derivatives to hedge foreign currency forecasted cash flows is governed by theCompany’s strategy, which provide principles on the use of such forward contracts and currency options consistent with theCompany’s Risk Management Policy. The counter party in these derivative instruments are banks and the Company considersthe risks of non-performance by the counterparty as non-material. A majority of the forward foreign exchange/option contractsmature between one to twelve months and the forecasted transactions are expected to occur during the same period. TheCompany does not use forward contracts and currency options for speculative purposes.The following table presents the aggregate contracted principal amounts of the Company’s derivative contracts outstanding: -Foreign CurrencyAs at30 June 2010As at30 June 2009Sell CoversRupee EquivalentU.S. Dollar/INR 1,314.22 3,703.90Sterling Pound/INR 65.09 66.98Euro/INR 58.19 76.291,437.50 3,847.17Buy CoversU.S. Dollar/INR 366.88 -366.88 -OptionsAs at30 June 2010Rupee EquivalentAs at30 June 2009Purchase OptionsU.S. Dollar 65.02 -Range OptionsU.S. Dollar 139.32 -Euro/INR 28.52 -Total 232.86 -The following table summarizes activity in the Hedging Reserve related to all derivatives classified as cash flow hedges duringthe years ended 30 June 2010 and 2009.ParticularsYear ended30 June 2010Year ended30 June 2009Loss as at the beginning of the year (775.09) (490.63)Unrealized gain/ (losses) on cash ow hedging derivatives during the year 197.05 (591.68)Net losses reclassied into net income on occurrence of hedged transactions 478.07 244.52Net losses reclassied into net income as hedged transactions are not likely to occur - 62.70Loss as at the end of the year (refer note 1 and 2 below) (99.97) (775.09)91