Schedules forming part of the accounts(All amounts in crores of rupees except share data and unless otherwise stated)Schedule 20: Significant accounting policies and notes to the accountsCompany OverviewHCL Technologies Limited (hereinafter referred to as ‘HCL’ or the ‘Company’) is primarily engaged in providing a range of softwareservices, business process outsourcing and infrastructure services. The Company was incorporated in India in November 1991. TheCompany leverages an extensive offshore infrastructure and its global network of offices in various countries and professionals todeliver solutions across select verticals including Retail, Aerospace and defense, Automotive, Telecom, Financial Services, Government,Hi-tech, Media and Entertainment, Travel, Transportation and Logistics, Energy and utilities, Life Sciences and Healthcare.1. Statement of Significant accounting policiesa)Basis of preparationThe nancial statements have been prepared to comply with the Accounting Standards notied by Companies (AccountingStandards) Rules, 2006, (as amended) and the relevant provisions of the Companies Act, 1956. The nancial statementshave been prepared under the historical cost convention on an accrual basis. The accounting policies have been consistentlyapplied by the Company and are consistent with those used in the previous year.b)Use of estimatesThe preparation of nancial statements in conformity with generally accepted accounting principles requires management tomake estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilitiesat the date of the nancial statements and the results of operations during the reporting period. Although these estimates arebased upon management’s best knowledge of current events and actions, actual results could differ from these estimates.c)Revenue recognitioni)Software ServicesRevenue from Software services comprises income from time and material and xed price contracts. Revenue withrespect to time and material contracts is recognized as related services are performed. Revenue from xed price contractsand xed time frame contracts is recognized in accordance with the percentage completion method under which thesales value of performance, including earnings thereon, is recognized on the basis of cost incurred in respect of eachcontract as a proportion of total cost expected to be incurred. The cumulative impact of any revision in estimates of thepercentage of work completed is reected in the year in which the change becomes known. Provisions for estimatedlosses are made during the year in which a loss becomes probable based on current contract estimates. Revenue fromsale of licenses for the use of software applications is recognised on transfer of title in the user license. Revenue fromannual technical service contracts is recognised on a pro rata basis over the period in which such services are rendered.Income from revenue sharing agreements is recognized when the right to receive is established.ii)Infrastructure ServicesRevenue from infrastructure services is derived from both time based and unit priced contracts. Revenue is recognizedas the related services are performed in accordance with specic terms of the contract. In case of multi-deliverablecontracts where revenue cannot be allocated to various deliverables in a contract, the entire contract is accountedfor as one deliverable and accordingly the revenue is recognized on a proportionate completion method following theperformance pattern of predominant services in the contract or is deferred until the last deliverable is delivered.iii)Business Process Outsourcing servicesRevenue from Business Process Outsourcing services is derived from both time based and unit-price contracts.Revenue is recognized as the related services are performed in accordance with the specic terms of the contracts withthe customer.Cost and earnings in excess of billing are classied as unbilled revenue, while billing in excess of cost and earnings areclassied as unearned revenue. Incremental revenue from existing contracts arising on future sales of the customers’ productswill be recognized when it is earned. Revenue and related direct costs from transition services in outsourcing arrangementsare deferred and recognized over the period of the arrangement. Certain upfront non-recurring costs incurred in the initialphases of outsourcing contracts and contract acquisition costs, are deferred and amortized usually on a straight line basisover the term of the contract. The Company periodically estimates the undiscounted cash ows from the arrangement andcompares it with the unamortized costs. If the unamortized costs exceed the undiscounted cash ow, a loss is recognized.The Company accounts for volume discounts and pricing incentives to customers. The discount terms in the Company’sarrangements with customers generally entitle the customer to discounts, if the customer completes a specied level ofrevenue transactions. In some arrangements, the level of discount varies with increases in the levels of revenue transactions.The Company recognizes discount obligations as a reduction of revenue based on the ratable allocation of the discount toeach of the underlying revenue transactions that result in progress by the customer toward earning the discount.Revenues are shown net of sales tax, value added tax, service tax and applicable discounts and allowances.75

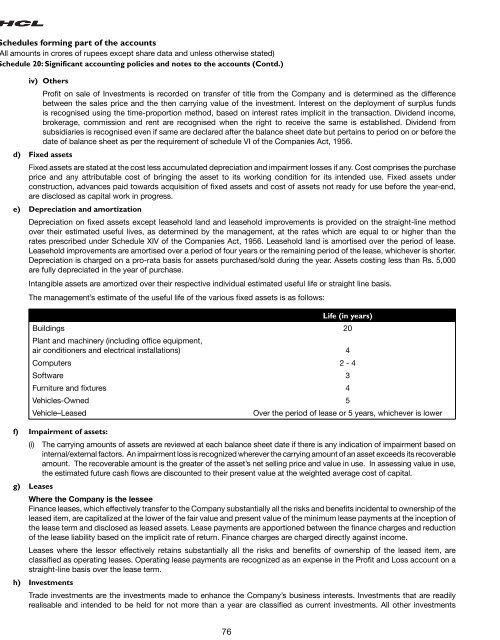

Schedules forming part of the accounts(All amounts in crores of rupees except share data and unless otherwise stated)Schedule 20: Significant accounting policies and notes to the accounts (Contd.)d)e)iv) OthersProt on sale of Investments is recorded on transfer of title from the Company and is determined as the differencebetween the sales price and the then carrying value of the investment. Interest on the deployment of surplus fundsis recognised using the time-proportion method, based on interest rates implicit in the transaction. Dividend income,brokerage, commission and rent are recognised when the right to receive the same is established. Dividend fromsubsidiaries is recognised even if same are declared after the balance sheet date but pertains to period on or before thedate of balance sheet as per the requirement of schedule VI of the Companies Act, 1956.Fixed assetsFixed assets are stated at the cost less accumulated depreciation and impairment losses if any. Cost comprises the purchaseprice and any attributable cost of bringing the asset to its working condition for its intended use. Fixed assets underconstruction, advances paid towards acquisition of xed assets and cost of assets not ready for use before the year-end,are disclosed as capital work in progress.Depreciation and amortizationDepreciation on xed assets except leasehold land and leasehold improvements is provided on the straight-line methodover their estimated useful lives, as determined by the management, at the rates which are equal to or higher than therates prescribed under Schedule XIV of the Companies Act, 1956. Leasehold land is amortised over the period of lease.Leasehold improvements are amortised over a period of four years or the remaining period of the lease, whichever is shorter.Depreciation is charged on a pro-rata basis for assets purchased/sold during the year. Assets costing less than Rs. 5,000are fully depreciated in the year of purchase.Intangible assets are amortized over their respective individual estimated useful life or straight line basis.The management’s estimate of the useful life of the various xed assets is as follows:Life (in years)Buildings 20Plant and machinery (including ofce equipment,air conditioners and electrical installations) 4Computers 2 - 4Software 3Furniture and xtures 4Vehicles-Owned 5Vehicle–LeasedOver the period of lease or 5 years, whichever is lowerf)g)h)Impairment of assets:(i) The carrying amounts of assets are reviewed at each balance sheet date if there is any indication of impairment based oninternal/external factors. An impairment loss is recognized wherever the carrying amount of an asset exceeds its recoverableamount. The recoverable amount is the greater of the asset’s net selling price and value in use. In assessing value in use,the estimated future cash ows are discounted to their present value at the weighted average cost of capital.LeasesWhere the Company is the lesseeFinance leases, which effectively transfer to the Company substantially all the risks and benets incidental to ownership of theleased item, are capitalized at the lower of the fair value and present value of the minimum lease payments at the inception ofthe lease term and disclosed as leased assets. Lease payments are apportioned between the nance charges and reductionof the lease liability based on the implicit rate of return. Finance charges are charged directly against income.Leases where the lessor effectively retains substantially all the risks and benets of ownership of the leased item, areclassied as operating leases. Operating lease payments are recognized as an expense in the Prot and Loss account on astraight-line basis over the lease term.InvestmentsTrade investments are the investments made to enhance the Company’s business interests. Investments that are readilyrealisable and intended to be held for not more than a year are classied as current investments. All other investments76