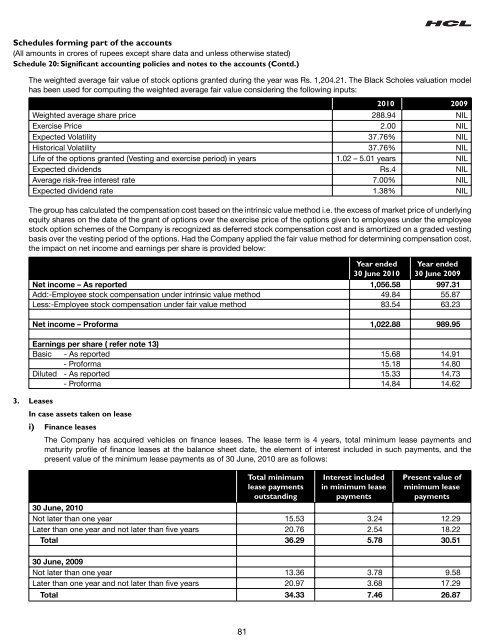

Schedules forming part of the accounts(All amounts in crores of rupees except share data and unless otherwise stated)Schedule 20: Significant accounting policies and notes to the accounts (Contd.)The weighted average fair value of stock options granted during the year was Rs. 1,204.21. The Black Scholes valuation modelhas been used for computing the weighted average fair value considering the following inputs:2010 2009Weighted average share price 288.94 NILExercise Price 2.00 NILExpected Volatility 37.76% NILHistorical Volatility 37.76% NILLife of the options granted (Vesting and exercise period) in years 1.02 – 5.01 years NILExpected dividends Rs.4 NILAverage risk-free interest rate 7.00% NILExpected dividend rate 1.38% NILThe group has calculated the compensation cost based on the intrinsic value method i.e. the excess of market price of underlyingequity shares on the date of the grant of options over the exercise price of the options given to employees under the employeestock option schemes of the Company is recognized as deferred stock compensation cost and is amortized on a graded vestingbasis over the vesting period of the options. Had the Company applied the fair value method for determining compensation cost,the impact on net income and earnings per share is provided below:Year ended30 June 2010Year ended30 June 2009Net income – As reported 1,056.58 997.31Add:-Employee stock compensation under intrinsic value method 49.84 55.87Less:-Employee stock compensation under fair value method 83.54 63.23Net income – Proforma 1,022.88 989.95Earnings per share ( refer note 13)Basic - As reported 15.68 14.91- Proforma 15.18 14.80Diluted - As reported 15.33 14.73- Proforma 14.84 14.623. LeasesIn case assets taken on leasei) Finance leasesThe Company has acquired vehicles on nance leases. The lease term is 4 years, total minimum lease payments andmaturity prole of nance leases at the balance sheet date, the element of interest included in such payments, and thepresent value of the minimum lease payments as of 30 June, 2010 are as follows:Total minimumlease paymentsoutstandingInterest includedin minimum leasepaymentsPresent value ofminimum leasepayments30 June, 2010Not later than one year 15.53 3.24 12.29Later than one year and not later than ve years 20.76 2.54 18.22Total 36.29 5.78 30.5130 June, 2009Not later than one year 13.36 3.78 9.58Later than one year and not later than ve years 20.97 3.68 17.29Total 34.33 7.46 26.8781

Schedules forming part of the accounts(All amounts in crores of rupees except share data and unless otherwise stated)Schedule 20: Significant accounting policies and notes to the accounts (Contd.)ii)Operating LeasesThe Company leases ofce spaces and accommodation for its employees under operating lease agreements. The leaserental expense recognised in the prot and loss account for the year is Rs. 151.69 crores (previous year Rs. 149.58 crores).The escalation amount for non-cancellable operating lease payable in future years and accounted for by the company is Rs.50.24 crores. Future minimum lease payments and payment prole of non-cancellable operating leases are as follows:82Year ended 30 June2010 2009Not later than one year 139.58 126.92Later than one year but not later than ve years 346.57 350.29Later than ve years 302.06 328.84788.21 806.054. Segment reportingIdentification of SegmentsThe Company’s operating businesses are organized and managed separately according to the nature of products and servicesprovided, with each segment representing a strategic business unit that offers different products and serves different markets.The analysis of geographical segments is based on the areas in which major operating divisions of the Company operate.i) Business SegmentsThe operations of the Company and its subsidiaries predominately relate to providing Software services, infrastructureservices including sale of networking equipment and business processing outsourcing services, which are in the natureof customer contact centers and technical help desks. The Chairman of the Company, who is the Chief Strategy Ofcer,evaluates the Company’s performance and allocates resources based on an analysis of various performance indicators bytypes of service provided by the Company and geographic segmentation of customers.Accordingly, revenue from service segments comprises the primary basis of segmental information set out in these nancialstatements. Secondary segmental reporting is performed on the basis of the geographical location of customers.Revenue in relation to service segments is categorised based on items that are individually identiable to that segment, whileexpenditure is categorised in relation to the associated turnover of the segment. Assets and liabilities are also identied toservice segments.ii) Geographic SegmentsGeographic segmentation is based on the location of the respective client. The principal geographical segments have beenclassied as America, Europe and others. Europe comprises business operations conducted by the Company in the UnitedKingdom, Sweden, Germany, Italy, Belgium, Netherlands, Finland, Switzerland, Ireland and Poland. Since services providedby the Company within these European entities are subject to similar risks and returns, their operating results have beenreported as one segment, namely Europe. All other customers, mainly in Japan, Australia, New Zealand, Singapore, Malaysia,Israel, South Korea, India, China, Hong Kong, Czech Republic, Macau, UAE, Portugal and Russia are included in others.iii) Segment accounting policiesThe accounting principles consistently used in the preparation of the nancial statements and consistently applied to recordrevenue and expenditure in individual segments are as set out in Note 1 to this schedule on signicant accounting policies.The accounting policies in relation to segment accounting are as under:a) Segment assets and liabilitiesAll segment assets and liabilities have been allocated to the various segments on the basis of specic identication.Segment assets consist principally of xed assets, sundry debtors, loans and advances, cash and bank balances andunbilled receivables. Segment assets do not include unallocated corporate and treasury assets, net deferred tax assetsand advance taxes.Segment liabilities include sundry creditors and other liabilities. Segment liabilities do not include share capital, reserves,secured loans, unsecured loan and provision for taxes.b) Segment revenue and expensesSegment revenue is directly attributable to the segment and segment expenses have been allocated to various segments on thebasis of specic identication. However, segment revenue does not include miscellaneous income, income from investments and