Untitled - Domain-b

Untitled - Domain-b

Untitled - Domain-b

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

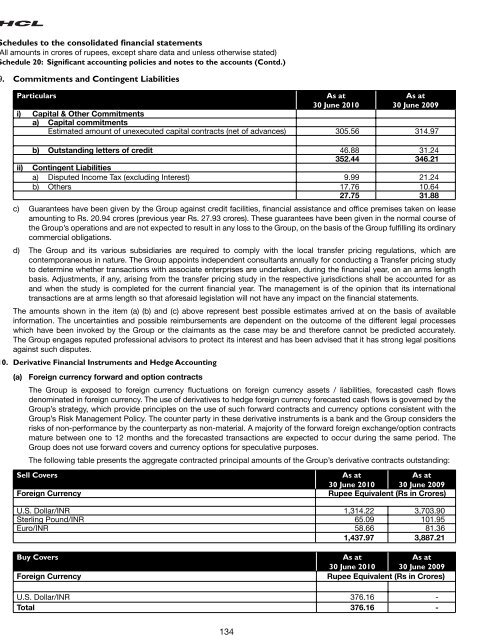

Schedules to the consolidated financial statements(All amounts in crores of rupees, except share data and unless otherwise stated)Schedule 20: Significant accounting policies and notes to the accounts (Contd.)9. Commitments and Contingent LiabilitiesParticularsAs at30 June 2010As at30 June 2009i) Capital & Other Commitmentsa) Capital commitmentsEstimated amount of unexecuted capital contracts (net of advances) 305.56 314.97b) Outstanding letters of credit 46.88 31.24352.44 346.21ii) Contingent Liabilitiesa) Disputed Income Tax (excluding Interest) 9.99 21.24b) Others 17.76 10.6427.75 31.88c) Guarantees have been given by the Group against credit facilities, nancial assistance and ofce premises taken on leaseamounting to Rs. 20.94 crores (previous year Rs. 27.93 crores). These guarantees have been given in the normal course ofthe Group’s operations and are not expected to result in any loss to the Group, on the basis of the Group fullling its ordinarycommercial obligations.d) The Group and its various subsidiaries are required to comply with the local transfer pricing regulations, which arecontemporaneous in nature. The Group appoints independent consultants annually for conducting a Transfer pricing studyto determine whether transactions with associate enterprises are undertaken, during the nancial year, on an arms lengthbasis. Adjustments, if any, arising from the transfer pricing study in the respective jurisdictions shall be accounted for asand when the study is completed for the current nancial year. The management is of the opinion that its internationaltransactions are at arms length so that aforesaid legislation will not have any impact on the nancial statements.The amounts shown in the item (a) (b) and (c) above represent best possible estimates arrived at on the basis of availableinformation. The uncertainties and possible reimbursements are dependent on the outcome of the different legal processeswhich have been invoked by the Group or the claimants as the case may be and therefore cannot be predicted accurately.The Group engages reputed professional advisors to protect its interest and has been advised that it has strong legal positionsagainst such disputes.10. Derivative Financial Instruments and Hedge Accounting(a) Foreign currency forward and option contractsThe Group is exposed to foreign currency uctuations on foreign currency assets / liabilities, forecasted cash owsdenominated in foreign currency. The use of derivatives to hedge foreign currency forecasted cash ows is governed by theGroup’s strategy, which provide principles on the use of such forward contracts and currency options consistent with theGroup’s Risk Management Policy. The counter party in these derivative instruments is a bank and the Group considers therisks of non-performance by the counterparty as non-material. A majority of the forward foreign exchange/option contractsmature between one to 12 months and the forecasted transactions are expected to occur during the same period. TheGroup does not use forward covers and currency options for speculative purposes.The following table presents the aggregate contracted principal amounts of the Group’s derivative contracts outstanding:Sell CoversForeign CurrencyAs atAs at30 June 2010 30 June 2009Rupee Equivalent (Rs in Crores)U.S. Dollar/INR 1,314.22 3,703.90Sterling Pound/INR 65.09 101.95Euro/INR 58.66 81.361,437.97 3,887.21Buy CoversForeign CurrencyAs atAs at30 June 2010 30 June 2009Rupee Equivalent (Rs in Crores)U.S. Dollar/INR 376.16 -Total 376.16 -134