- Page 7:

A HISTORYOFTHE CANADIAN BANKOF COMM

- Page 11 and 12:

A HISTORYOFTHE CANADIAN BANKOF COMM

- Page 13 and 14:

PREFACE[S volume closes at the end

- Page 15:

PrefaceContentsIllustrationsCHAPTER

- Page 18 and 19:

xILLUSTRATIONSPLATENO.FACINGPAGE25

- Page 20 and 21:

XllILLUSTRATIONSNO.63 TCamloops, B.

- Page 24 and 25:

IPLATtIHI Hov \\II.I.I\M M.MASTERFi

- Page 26 and 27:

2 HISTORY OF THE BANKbrought about

- Page 28 and 29:

4 HISTORY OF THE BANKthat, because

- Page 30 and 31:

6 HISTORY OF THE BANKtain the usual

- Page 33 and 34:

THE CHARTER 7the Grand Trunk Railwa

- Page 35 and 36:

THE CHARTER 9proposed bank was to s

- Page 37 and 38:

THE CHARTER 11province or secured b

- Page 39 and 40:

THE CHARTER 13enterprise, perhaps t

- Page 41:

I'I.VTI-: No. |.rilAKLOTTKTCNYN. IV

- Page 44 and 45:

16 HISTORY OF THE BANKpresently be

- Page 46 and 47:

18 HISTORY OF THE BANKMontreal, or

- Page 49 and 50:

THE CHARTER 19financial and commerc

- Page 51 and 52:

THE CHARTER 21of London, 9 who had

- Page 53 and 54:

THE CHARTER 23many of them stand ve

- Page 55 and 56:

THE CHARTER 25drew on the Mancheste

- Page 57 and 58:

THE CHARTER 27Confederation, Mr. Ro

- Page 59 and 60:

THE CHARTER 29Company. It is signif

- Page 61 and 62:

THE CHARTER 31opposition that at ti

- Page 63 and 64:

THE CHARTER 33made its appearance,

- Page 65:

PLATE No. C.EDMONTON, ALTA.

- Page 68 and 69:

36 HISTORY OF THE BANKarrival of Lo

- Page 70 and 71:

38 HISTORY OF THE BANKinto in Novem

- Page 72 and 73:

40 HISTORY OF THE BANKis certain, I

- Page 74 and 75:

42 HISTORY OF THE BANKlater he anno

- Page 76 and 77:

44 HISTORY OF THE BANKCanada banks,

- Page 78 and 79:

46 HISTORY OF THE BANKConservative

- Page 83 and 84:

CHAPTER II.1867 TO 1901.We may now

- Page 85 and 86:

1867 TO 1901 51to open an account w

- Page 87 and 88:

1867 TO 1901 53committee to select

- Page 89:

-3* IX ;-- rii8111'l.ATK No. 7.

- Page 92 and 93:

56 HISTORY OF THE BANKas scrutineer

- Page 94 and 95:

58 HISTORY OF THE BANKtime contribu

- Page 96 and 97:

60 HISTORY OF THE BANKeven terms wi

- Page 98 and 99:

62 HISTORY OF THE BANKwere $32,003,

- Page 101 and 102:

1867 TO 1901 63The opening of the N

- Page 103 and 104:

1867 TO 1901 65and bamboo wares, st

- Page 105:

I'l.VPK No. !).NEW YORK, X.Y.

- Page 108 and 109:

68 HISTORY OF THE BANKwith Great Br

- Page 110 and 111:

70 HISTORY OF THE BANKParkhill. Win

- Page 112 and 113:

72 HISTORY OF THE BANKSaskatchewan

- Page 114 and 115:

74 HISTORY OF THE BANKmoney. The Am

- Page 116 and 117:

76 HISTORY OF THE BANKelected to su

- Page 118 and 119:

78 HISTORY OF THE BANKequalled. Alt

- Page 120 and 121:

80 HISTORY OF THE BANKThe minute bo

- Page 122 and 123:

82 HISTORY OF THE BANKcontaining $1

- Page 125 and 126:

1867 TO 1901 83Dunclas branch, the

- Page 127 and 128:

1867 TO 1901 85sequences; on the ot

- Page 129:

PLATE No. 11.us

- Page 132 and 133:

88 HISTORY OF THE BANKGreat Britain

- Page 134 and 135:

90 HISTORY OF THE BANKof the Provin

- Page 136 and 137:

92 HISTORY OF THE BANKare quoted in

- Page 138 and 139:

94 HISTORY OF THE BANKthe officers

- Page 141 and 142:

1867 TO 1901 95front door of the of

- Page 143 and 144:

1867 TO 1901 97Darling, 1president

- Page 145:

( OUNKR OF KING AND JORDAN STREETS,

- Page 148 and 149:

100 HISTORY OF THE BANKsite was ere

- Page 150 and 151:

102 HISTORY OF THE BANKpublic caree

- Page 153 and 154:

1867 TO 1901 103this examination ha

- Page 155 and 156:

1867 TO 1901 105As a guide for the

- Page 157 and 158:

1867 TO 1901 107chosen to succeed M

- Page 159 and 160:

1867 TO 1901 109January, 1887. Her

- Page 161:

PLATE No. 15.REGINA, SASK.

- Page 164 and 165:

112 HISTORY OF THE BANKIn his actio

- Page 166 and 167:

114 HISTORY OF THE BANKby the death

- Page 169 and 170:

1867 TO 1901 115stood to favour cha

- Page 171 and 172:

1867 TO 1901 117James Stevenson 1of

- Page 173 and 174:

1867 TO 1901 119Bank of Commerce at

- Page 175 and 176:

1867 TO 1901 121shareholders that t

- Page 177 and 178:

1867 TO 1901 123It will be evident

- Page 179 and 180:

in conjunction with Mr. J. O. Bigel

- Page 181 and 182:

1867 TO 1901 127wood, in British Co

- Page 183 and 184:

These figures show the fresh life18

- Page 185:

PLATE No. 17.SAN FRANCISCO, CAL.

- Page 188 and 189:

132 HISTORY OF THE BANKtifii0094- -

- Page 190 and 191:

134 HISTORY OF THE BANKDecember 6,

- Page 193:

and Mr. W. E. H. Massey.11867 TO 19

- Page 197 and 198:

CHAPTER III.THE YUKON ADVENTURE.Som

- Page 199 and 200:

THE YUKON ADVENTURE 139them to hand

- Page 201:

139 138 137* 135 134of Country betw

- Page 204 and 205:

142 HISTORY OF THE BANKexploits of

- Page 207 and 208:

THE YUKON ADVENTURE 143point at tid

- Page 209 and 210:

THE YUKON ADVENTURE 145who had been

- Page 211:

LAKE BENNETT, Y.T.The first Canadia

- Page 214 and 215:

148 HISTORY OF THE BANKportage was

- Page 216 and 217:

150 HISTORY OF THE BANKstrong curre

- Page 219 and 220:

THE YUKON ADVENTURE 151with only an

- Page 221 and 222:

the bank.THE YUKON ADVENTURE 153Whe

- Page 223 and 224:

THE YUKON ADVENTURE 155business, an

- Page 225 and 226:

THE YUKON ADVENTURE 157the whole tr

- Page 227:

PLATE No. 24.

- Page 230 and 231:

160 HISTORY OF THE BANKwould be pas

- Page 232 and 233:

162 HISTORY OF THE BANKsacks of gol

- Page 235 and 236:

THE YUKON ADVENTURE 163business tha

- Page 237 and 238:

THE YUKON ADVENTURE 165which has be

- Page 240 and 241:

iThe firstI)A\YSO\, Y.T.Imilding er

- Page 242 and 243:

168 HISTORY OF THE BANKfrom twelve

- Page 244 and 245:

170 HISTORY OF THE BANKthemselves w

- Page 246 and 247:

172 HISTORY OF THE BANKpayment of w

- Page 248 and 249:

174 HISTORY OF THE BANKof which the

- Page 251 and 252:

THE YUKON ADVENTURE 175ground. It w

- Page 253 and 254:

THE YUKON ADVENTURE 177required, an

- Page 255:

WINTER IN THE YUKON\O.SUMMER IN THE

- Page 258 and 259:

180 HISTORY OF THE BANKby becoming

- Page 260 and 261:

182 HISTORY OF THE BANKferent meals

- Page 263 and 264:

THE YUKON ADVENTURE 183relief,was a

- Page 265 and 266:

THE YUKON ADVENTURE 185had to be ma

- Page 267 and 268:

THE YUKON ADVENTURE 187Early in the

- Page 269 and 270:

THE YUKON ADVENTURE 189from losses

- Page 271:

4PLATE No. 30.

- Page 274 and 275:

192 HISTORY OF THE BANKThe hall was

- Page 276 and 277:

194 HISTORY OF THE BANKthe bank's o

- Page 279 and 280:

THE YUKON ADVENTURE 195"THE SPELL O

- Page 281 and 282:

THE YUKON ADVENTURE 197And it's bet

- Page 285 and 286:

CHAPTER IV.1901 TO 1914.The dawn of

- Page 287 and 288:

1901 TO 1914 201Indian reservation

- Page 289 and 290:

1901 TO 1914 203in the dry areas of

- Page 291 and 292:

1901 TO 1914 205one first-class pas

- Page 293:

C;.MAN.PLATE No. 3*.

- Page 296 and 297:

208 HISTORY OF THE BANKThe rapid st

- Page 298 and 299:

210 HISTORY OF THE BANKyouths in th

- Page 301 and 302:

1901 TO 1914 211valued at $160 per

- Page 303 and 304:

1901 TO 1914 213it had also branche

- Page 305:

WOODSTOCK, ONT.

- Page 308 and 309:

216 HISTORY OF THE BANKreasons for

- Page 310 and 311:

218 HISTORY OF THE BANKrule was pro

- Page 312 and 313:

220 HISTORY OF THE BANKin the devel

- Page 314 and 315:

222 HISTORY OF THE BANKbut that 14,

- Page 317 and 318:

1901 TO 1914 223selected for this p

- Page 319 and 320: 1901 TO 1914 225A few months later

- Page 321: I'LATK NO. :;

- Page 324 and 325: 228 HISTORY OF THE BANKIt may be in

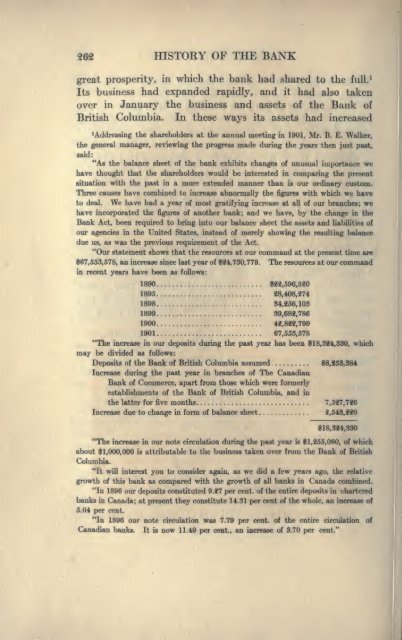

- Page 326 and 327: HISTORY OF THE BANKthe amount was a

- Page 329 and 330: 1901 TO 1914placed a great strain o

- Page 331 and 332: 1901 TO 1914 233It closed its doors

- Page 333 and 334: 1901 TO 1914 35had been filled by t

- Page 335 and 336: 1901 TO 1914 237instructed that the

- Page 337: ;WINNIPEG, MAX., STAFFORD AND GROSV

- Page 340 and 341: 240 HISTORY OF THE BANKaccept notes

- Page 342: 242 HISTORY OF THE BANKyear the pra

- Page 345 and 346: 1901 TO 1914 243were made by the ba

- Page 347 and 348: 1901 TO 1914 245the bank opened rec

- Page 349: IJAIIKr|\1BK.UUKH ii|nin.Man>b ra B

- Page 352 and 353: 248 HISTORY OF THE BANKdoors, or ha

- Page 354 and 355: 250 HISTORY OF THE BANKIndications

- Page 356 and 357: 252 HISTORY OF THE BANKin London fu

- Page 358 and 359: 254 HISTORY OF THE BANKFlumerfelt,

- Page 361 and 362: 1901 TO 1914 255Walker, which had o

- Page 363 and 364: 1901 TO 1914 257meeting to reduce t

- Page 365: PLATE No. 42.PORT ARTHUR, O\T.

- Page 368 and 369: 260 HISTORY OF THE BANKpast in the

- Page 373: 1901 TO 1914 263over fifty per cent

- Page 376 and 377: 266 HISTORY OF THE BANKGetting clea

- Page 378 and 379: 268 HISTORY OF THE BANKsilver, on t

- Page 380 and 381: 270 HISTORY OF THE BANKcash book wo

- Page 383 and 384: THE ROMANCE OF BANKING 271At Langha

- Page 385 and 386: THE ROMANCE OF BANKING 273stood dur

- Page 387: THE BANK'S TEMPORARY OFFICE IX SOUT

- Page 390 and 391: 276 HISTORY OF THE BANKfor him to m

- Page 392 and 393: 278 HISTORY OF THE BANKdistance, or

- Page 395 and 396: THE ROMANCE OF BANKING 279town for

- Page 397 and 398: THE ROMANCE OF BANKING 281ready-mad

- Page 399 and 400: THE ROMANCE OF BANKING 283of a cust

- Page 401 and 402: THE ROMANCE OF BANKING 285in such a

- Page 403: ATLIN. B.C.First office of the hank

- Page 406 and 407: 288 HISTORY OF THE BANKminer at a n

- Page 408 and 409: 290 HISTORY OF THE BANKMr. Kains sa

- Page 411 and 412: THE ROMANCE OF BANKING 291walls fol

- Page 413 and 414: THE ROMANCE OF BANKING 293hatless,

- Page 415: 3ilPLATE No. 49.

- Page 418 and 419: 296 HISTORY OF THE BANKthe fire, th

- Page 420 and 421:

298 HISTORY OF THE BANKa certain ki

- Page 422 and 423:

300 HISTORY OF THE BANKscope. The b

- Page 424 and 425:

302 HISTORY OP THE BANKhouse. Two o

- Page 427 and 428:

THE ROMANCE OF BANKING 303the name

- Page 429:

THE ROMANCE OF BANKING 305temporari

- Page 434 and 435:

308 HISTORY OF THE BANKinsignifican

- Page 436 and 437:

310 HISTORY OF THE BANKupon Russia

- Page 439 and 440:

THE BANK DURING THE WAR 311reach hi

- Page 441 and 442:

THE BANK DURING THE WARSISbranches.

- Page 443 and 444:

THE BANK DURING THE WAR 315was impr

- Page 445 and 446:

THE BANK DURING THE WAR 317given if

- Page 447:

PLATE No. 52.

- Page 450 and 451:

320 HISTORY OF THE BANKthe views of

- Page 452 and 453:

322 HISTORY OF THE BANKto be reinst

- Page 455 and 456:

THE BANK DURING THE WAR 323and gene

- Page 457 and 458:

THE BANK DURING THE WAR 325was poss

- Page 459 and 460:

THE BANK DURING THE WAR 3271914, an

- Page 461 and 462:

THE BANK DURING THE WAR 329soon rea

- Page 463 and 464:

THE BANK DURING THE WAR 331Fund, wh

- Page 465 and 466:

THE BANK DURING THE WAR 333Despite

- Page 467 and 468:

THE BANK DURING THE WAR 335ment to

- Page 469 and 470:

THE BANK DURING THE WAR 337"The dir

- Page 471:

FORT FRANCES, ONT.- - ..._. ...PLAT

- Page 474 and 475:

340 HISTORY OF THE BANKcommon with

- Page 476 and 477:

342 HISTORY OF THE BANKthe concurre

- Page 478 and 479:

844 HISTORY OF THE BANKto New York.

- Page 480 and 481:

346 HISTORY OF THE BANKvalue of the

- Page 482 and 483:

848 HISTORY OF THE BANKDuchess of C

- Page 484 and 485:

350 HISTORY OF THE BANKcheques in H

- Page 486 and 487:

352 HISTORY OF THE BANKtaken up mil

- Page 488 and 489:

354 HISTORY OF THE BANKGovernment.

- Page 491 and 492:

THE BANK DURING THE WAR 355build up

- Page 493 and 494:

THE BANK DURING THE WAR 357Consolid

- Page 495 and 496:

THE BANK DURING THE WAR 359upon app

- Page 497 and 498:

THE BANK DURING THE WAR 361ordered

- Page 499 and 500:

THE BANK DURING THE WAR 363excellen

- Page 501 and 502:

THE BANK DURING THE WAR 365Continen

- Page 503 and 504:

THE BANK DURING THE WAR 367During t

- Page 505 and 506:

THE BANK DURING THE WAR 369large ad

- Page 507:

VANCOUVER. B.C.,KITSILANO BRANCHPLA

- Page 510 and 511:

372 HISTORY OF THE BANKtotalling we

- Page 512 and 513:

374 HISTORY OF THE BANKmovement, wh

- Page 515 and 516:

THE BANK DURING THE WAR 375LL.D., D

- Page 517 and 518:

THE BANK DURING THE WAR 377they ope

- Page 519 and 520:

THE BANK DURING THE WAR 379a list o

- Page 521 and 522:

THE BANK DURING THE WAR 381the ban

- Page 523:

PLATE No. 58.

- Page 526 and 527:

384 HISTORY OF THE BANKAll banks Th

- Page 528 and 529:

386 HISTORY OF THE BANKreference, w

- Page 531 and 532:

THE BANK DURING THE WAR 387ASSETS.G

- Page 533 and 534:

CHAPTER VII.THE LEGISLATIVE DEVELOP

- Page 535 and 536:

DEVELOPMENT OF CANADIAN BANKING 391

- Page 537 and 538:

DEVELOPMENT OF CANADIAN BANKING 393

- Page 539 and 540:

DEVELOPMENT OF CANADIAN BANKING 395

- Page 541 and 542:

DEVELOPMENT OF CANADIAN BANKING 397

- Page 543 and 544:

DEVELOPMENT OF CANADIAN BANKING 399

- Page 545 and 546:

DEVELOPMENT OF CANADIAN BANKING 401

- Page 547:

SMITH'S FALLS, ONT.BLENHEIM, ONT.FO

- Page 550 and 551:

404 HISTORY OF THE BANKThe practica

- Page 552 and 553:

406 HISTORY OF THE BANKAfter a virt

- Page 554 and 555:

408 HISTORY OF THE BANKbe a branch

- Page 556 and 557:

410 HISTORY OF THE BANKand hold suc

- Page 558 and 559:

412 HISTORY OF THE BANKknown as "En

- Page 560 and 561:

414 HISTORY OF THE BANKsecurities b

- Page 562 and 563:

416 HISTORY OF THE BANKthe Quebec B

- Page 564 and 565:

418 HISTORY OF THE BANKchartered ba

- Page 567 and 568:

DEVELOPMENT OF CANADIAN BANKING 419

- Page 569 and 570:

DEVELOPMENT OF CANADIAN BANKING 421

- Page 571 and 572:

DEVELOPMENT OF CANADIAN BANKING 4*3

- Page 573 and 574:

DEVELOPMENT OF CANADIAN BANKING 45w

- Page 575 and 576:

DEVELOPMENT OF CANADIAN BANKING 427

- Page 577 and 578:

DEVELOPMENT OF CANADIAN BANKING 429

- Page 579 and 580:

DEVELOPMENT OF CANADIAN BANKING 431

- Page 581 and 582:

DEVELOPMENT OF CANADIAN BANKING 433

- Page 583:

THETFORD MINES, P.Q.DANVILLE. P.Q.F

- Page 586 and 587:

436 HISTORY OF THE BANKgroups. The

- Page 588 and 589:

438 HISTORY OF THE BANKthe people o

- Page 590 and 591:

440 HISTORY OF THE BANKof the Ameri

- Page 592 and 593:

442 HISTORY OF THE BANKif the Gover

- Page 594 and 595:

444 HISTORY OF THE BANKspecie reser

- Page 596 and 597:

446 HISTORY OF THE BANKand not spec

- Page 598 and 599:

448 HISTORY OF THE BANKconcessions

- Page 600 and 601:

450 HISTORY OF THE BANKwith the ban

- Page 603 and 604:

DEVELOPMENT OF CANADIAN BANKING 451

- Page 605 and 606:

DEVELOPMENT OF CANADIAN BANKING 453

- Page 607 and 608:

DEVELOPMENT OF CANADIAN BANKING 455

- Page 609 and 610:

DEVELOPMENT OF CANADIAN BANKING 457

- Page 611 and 612:

DEVELOPMENT OF CANADIAN BANKING 459

- Page 613 and 614:

DEVELOPMENT OF CANADIAN BANKING 461

- Page 615 and 616:

DEVELOPMENT OF CANADIAN BANKING 463

- Page 617 and 618:

DEVELOPMENT OF CANADIAN BANKING 465

- Page 619:

STRATHROY, ONT.STRATFORD, ONT.ST. T

- Page 622 and 623:

468 HISTORY OF THE BANKquarry were

- Page 624 and 625:

470 HISTORY OF THE BANKof the Minis

- Page 627:

DEVELOPMENT OF CANADIAN BANKING 471

- Page 631 and 632:

APPENDIX I.DAWSON BRANCH.MEMORANDUM

- Page 633 and 634:

DAWSON BRANCH 477C. List of clothin

- Page 635:

S3\\SIO vS 1PLATE No. (JO.

- Page 638 and 639:

APPENDIX III.MARINE INSURANCE DURIN

- Page 640:

482 HISTORY OF THE BANK1. The movem

- Page 643 and 644:

APPENDIX IV.THE BANK PREMISES DEPAR

- Page 645 and 646:

THE BANK PREMISES DEPARTMENT 485whi

- Page 647:

TORONTO, ONT.Bloor and Lippincott B

- Page 650 and 651:

488 HISTORY OF THE BANKon a 4^ per

- Page 652 and 653:

490 HISTORY OF THE BANK

- Page 654 and 655:

492 HISTORY OF THE BANKmatters as t

- Page 656 and 657:

494 HISTORY OF THE BANKMoose Jaw an

- Page 659 and 660:

THE BANK PREMISES DEPARTMENT 495cor

- Page 661 and 662:

THE BANK PREMISES DEPARTMENT 497by

- Page 663:

TORONTO, ONT.Archives Building.PLAT

- Page 666 and 667:

500 HISTORY OFJTHE BANKinto conside

- Page 668 and 669:

502 HISTORY OF THE BANKwhich had to

- Page 671 and 672:

THE ARCHIVES DEPARTMENT 503stories,

- Page 673 and 674:

THE ARCHIVES DEPARTMENT 505heavy pa

- Page 675 and 676:

THE STATIONERY DEPARTMENT 507The op

- Page 677 and 678:

APPENDIX VII.OFFICERS' GUARANTEE FU

- Page 679:

PLATE No. 7.NOTES OF THE CANADIAN B

- Page 682 and 683:

512 HISTORY OF THE BANKto the point

- Page 684 and 685:

514 HISTORY OF THE BANKlosses would

- Page 687 and 688:

OFFICERS' GUARANTEE FUND 515per ann

- Page 689 and 690:

APPENDIX VIII.THE PENSION FUND.It i

- Page 691:

NOTES OF THE CANADIAN BANK OF COMME

- Page 694 and 695:

520 HISTORY OF THE BANKprovision th

- Page 696 and 697:

522 HISTORY OF THE BANKto the Pensi

- Page 698 and 699:

524 HISTORY OF THE BANKwere appoint

- Page 700 and 701:

526 HISTORY OF THE BANKas they migh

- Page 703 and 704:

THE PENSION FUND 527abolished, an i

- Page 705 and 706:

THE PENSION FUND 529quarterly asses

- Page 707:

.^No. 76.NOTES OF THE CANADIAN BANK

- Page 710 and 711:

532 HISTORY OF THE BANKdistinguishi

- Page 712 and 713:

534 HISTORY OF THE BANKthe Canadian

- Page 715 and 716:

THE BRANCH CLEARINGS SYSTEM 535to b

- Page 717 and 718:

THE BRANCH CLEARINGS SYSTEM 537of r

- Page 719 and 720:

THE BRANCH CLEARINGS SYSTEM 539entr

- Page 721 and 722:

THE BRANCH CLEARINGS SYSTEM 541were

- Page 723:

PLATE No. 78.

- Page 726 and 727:

544 HISTORY OF THE BANKIn the follo

- Page 728 and 729:

546 HISTORY OF THE BANKThe Hon. Geo

- Page 731 and 732:

NOTE ISSUES 547On only one occasion

- Page 733 and 734:

NOTE ISSUES 549notes which would be

- Page 735:

PLATE No. 80.

- Page 738 and 739:

552 HISTORY OF THE BANKand other sy

- Page 740 and 741:

554 HISTORY OF THE BANKSept. 19, 18

- Page 742 and 743:

APPENDIX XII.CHRONOLOGICAL LIST OF

- Page 744 and 745:

558 HISTORY OF THE BANKFeb. 15, 189

- Page 747 and 748:

JulyCHRONOLOGICAL LIST OF BRANCHES

- Page 749 and 750:

CHRONOLOGICAL LIST OF BRANCHES 561O

- Page 751:

PLATE No. 82.

- Page 754 and 755:

564 HISTORY OF THE BANKMarch 15. 19

- Page 756 and 757:

566 HISTORY OF THE BANKMarch

- Page 759 and 760:

'CHRONOLOGICAL LIST OF BRANCHES 567

- Page 761 and 762:

March 5, 1912CHRONOLOGICAL LIST OF

- Page 763 and 764:

CHRONOLOGICAL LIST OF BRANCHES 571A

- Page 765 and 766:

APPENDIX XIII.STATISTICS.

- Page 767 and 768:

STATISTICS 575

- Page 769:

PLATE No. 84.

- Page 772 and 773:

TOH*.w t'

- Page 774 and 775:

Tiff* *iTtiMr

- Page 777 and 778:

s000250.GUARANTEEFUND,o.TOTALASSETS

- Page 779 and 780:

PLATE No. 89.

- Page 781 and 782:

TOTAl1868 1870 1875 i860 1885 1890$

- Page 783 and 784:

BANKSMERCKFIERCE

- Page 785 and 786:

Cl1868 1870 1875 1880 1885 1830 189

- Page 788:

.1918234,983 ALL BANKS31,584 COMMER

- Page 792 and 793:

578 HISTORY OF THE BANKBank Act of

- Page 794 and 795:

580 HISTORY OF THE BANKBritish Gove

- Page 796 and 797:

582 HISTORY OF THE BANKCanadian Ban

- Page 798 and 799:

584 HISTORY OF THE BANKDallas, R. J

- Page 800 and 801:

586 HISTORY OF THE BANKFraser, Pitb

- Page 802 and 803:

588 HISTORY OF THE BANKIndian rupee

- Page 804 and 805:

590 HISTORY OF THE BANKMerchants Ba

- Page 806 and 807:

592 HISTORY OF THE BANKProvincial T

- Page 808 and 809:

594 HISTORY OF THE BANKTaylor, John

- Page 817:

BINDINGr ?T."^ 1PLEASE DO NOT REMOV