FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

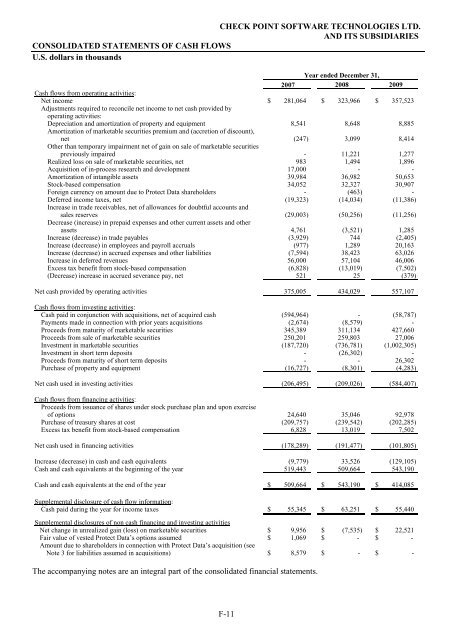

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

U.S. dollars in thousands<br />

Year ended December 31,<br />

<strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09<br />

Cash flows from operating activities :<br />

Net income<br />

Adjustments required to reconcile net income to net cash provided by<br />

operating activities:<br />

$ 281,064 $ 323,966 $ 357,523<br />

Depreciation and amortization of property and equipment<br />

Amortization of marketable securities premium and (accretion of discount),<br />

8,541 8,648 8,885<br />

net<br />

Other than temporary impairment net of gain on sale of marketable securities<br />

(247) 3,099 8,414<br />

previously impaired - 11,221 1,277<br />

Realized loss on sale of marketable securities, net 983 1,494 1,896<br />

Acquisition of in-process research and development 17,000 - -<br />

Amortization of intangible assets 39,984 36,982 50,653<br />

Stock-based compensation 34,052 32,327 30,907<br />

Foreign currency on amount due to Protect Data shareholders - (463) -<br />

Deferred income taxes, net<br />

Increase in trade receivables, net of allowances for doubtful accounts and<br />

(19,323) (14,034) (11,386)<br />

sales reserves<br />

Decrease (increase) in prepaid expenses and other current assets and other<br />

(29,003) (50,256) (11,256)<br />

assets 4,761 (3,521) 1,285<br />

Increase (decrease) in trade payables (3,929) 744 (2,405)<br />

Increase (decrease) in employees and payroll accruals (977) 1,289 <strong>20</strong>,163<br />

Increase (decrease) in accrued expenses and other liabilities (7,594) 38,423 63,026<br />

Increase in deferred revenues 56,000 57,104 46,006<br />

Excess tax benefit from stock-based compensation (6,828) (13,019) (7,502)<br />

(Decrease) increase in accrued severance pay, net 521 25 (379)<br />

Net cash provided by operating activities 375,005 434,029 557,107<br />

Cash flows from investing activities :<br />

Cash paid in conjunction with acquisitions, net of acquired cash (594,964) - (58,787)<br />

Payments made in connection with prior years acquisitions (2,674) (8,579) -<br />

Proceeds from maturity of marketable securities 345,389 311,134 427,660<br />

Proceeds from sale of marketable securities 250,<strong>20</strong>1 259,803 27,006<br />

Investment in marketable securities (187,7<strong>20</strong>) (736,781) (1,002,305)<br />

Investment in short term deposits - (26,302) -<br />

Proceeds from maturity of short term deposits - - 26,302<br />

Purchase of property and equipment (16,727) (8,301) (4,283)<br />

Net cash used in investing activities (<strong>20</strong>6,495) (<strong>20</strong>9,026) (584,407)<br />

Cash flows from financing activities :<br />

Proceeds from issuance of shares under stock purchase plan and upon exercise<br />

of options 24,640 35,046 92,978<br />

Purchase of treasury shares at cost (<strong>20</strong>9,757) (239,542) (<strong>20</strong>2,285)<br />

Excess tax benefit from stock-based compensation 6,828 13,019 7,502<br />

Net cash used in financing activities (178,289) (191,477) (101,805)<br />

Increase (decrease) in cash and cash equivalents (9,779) 33,526 (129,105)<br />

Cash and cash equivalents at the beginning of the year 519,443 509,664 543,190<br />

Cash and cash equivalents at the end of the year $ 509,664 $ 543,190 $ 414,085<br />

Supplemental disclosure of cash flow information :<br />

Cash paid during the year for income taxes $ 55,345 $ 63,251 $ 55,440<br />

Supplemental disclosures of non cash financing and investing activities<br />

Net change in unrealized gain (loss) on marketable securities $ 9,956 $ (7,535) $ 22,521<br />

Fair value of vested Protect Data’s options assumed $ 1,069 $ - $ -<br />

Amount due to shareholders in connection with Protect Data’s acquisition (see<br />

Note 3 for liabilities assumed in acquisitions) $ 8,579 $ - $ -<br />

The accompanying notes are an integral part of the consolidated financial statements.<br />

F-11