FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

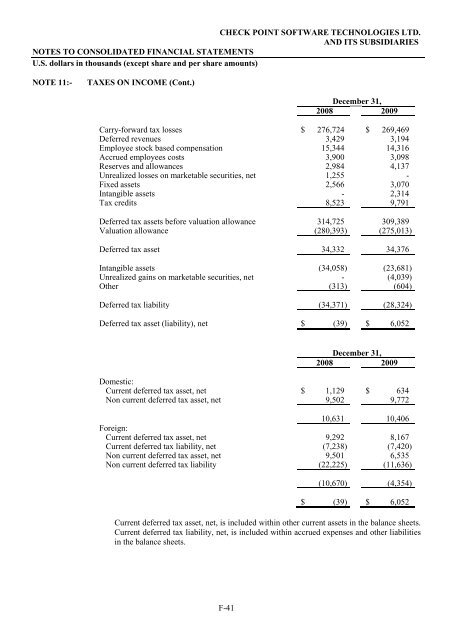

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

NOTE 11:- TAXES ON INCOME (Cont.)<br />

F-41<br />

December 31,<br />

<strong>20</strong>08 <strong>20</strong>09<br />

Carry-forward tax losses $ 276,724 $ 269,469<br />

Deferred revenues 3,429 3,194<br />

Employee stock based compensation 15,344 14,316<br />

Accrued employees costs 3,900 3,098<br />

Reserves and allowances 2,984 4,137<br />

Unrealized losses on marketable securities, net 1,255 -<br />

Fixed assets 2,566 3,070<br />

Intangible assets - 2,314<br />

Tax credits 8,523 9,791<br />

Deferred tax assets before valuation allowance 314,725 309,389<br />

Valuation allowance (280,393) (275,013)<br />

Deferred tax asset 34,332 34,376<br />

Intangible assets (34,058) (23,681)<br />

Unrealized gains on marketable securities, net - (4,039)<br />

Other (313) (604)<br />

Deferred tax liability (34,371) (28,324)<br />

Deferred tax asset (liability), net $ (39) $ 6,052<br />

December 31,<br />

<strong>20</strong>08 <strong>20</strong>09<br />

Domestic:<br />

Current deferred tax asset, net $ 1,129 $ 634<br />

Non current deferred tax asset, net 9,502 9,772<br />

10,631 10,406<br />

Foreign:<br />

Current deferred tax asset, net 9,292 8,167<br />

Current deferred tax liability, net (7,238) (7,4<strong>20</strong>)<br />

Non current deferred tax asset, net 9,501 6,535<br />

Non current deferred tax liability<br />

(22,225) (11,636)<br />

(10,670) (4,354)<br />

$ (39) $ 6,052<br />

Current deferred tax asset, net, is included within other current assets in the balance sheets.<br />

Current deferred tax liability, net, is included within accrued expenses and other liabilities<br />

in the balance sheets.