FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Our board of directors has determined that Messrs. Yoav Chelouche and Irwin Federman are “audit<br />

committee financial experts” and that they are independent under the applicable Securities and Exchange<br />

Commission and NASDAQ Global Select Market rules.<br />

ITEM 16B. CODE OF ETHICS<br />

In March <strong>20</strong>04, our board of directors adopted a Code of Ethics that applies to all of our employees,<br />

directors and officers, including the Chief Executive Officer, Chief Financial Officer, principal accounting officer<br />

or controller and other individuals who perform similar functions. The Code of Ethics is updated from time to time.<br />

You can obtain a copy of our Code of Ethics without charge, by sending a written request to our investor relations<br />

department at <strong>Check</strong> <strong>Point</strong> Software Technologies Inc., Attn: Investor Relations, 800 Bridge Parkway, Redwood<br />

City, California 94065 U.S.A; Tel: 650-628-<strong>20</strong>00; Email: ir@us.checkpoint.com.<br />

ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES<br />

Fees and Services<br />

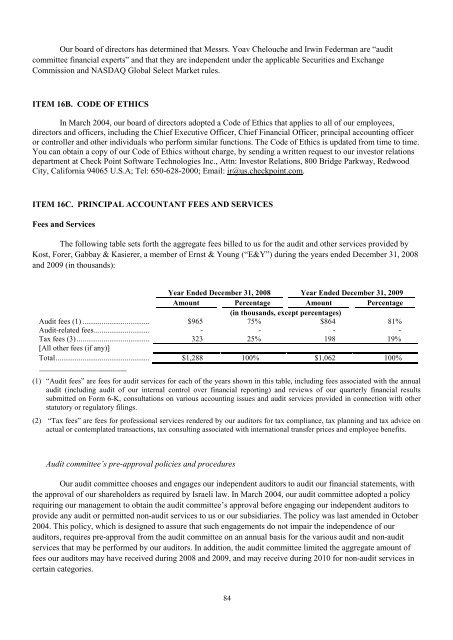

The following table sets forth the aggregate fees billed to us for the audit and other services provided by<br />

Kost, Forer, Gabbay & Kasierer, a member of Ernst & Young (“E&Y”) during the years ended December 31, <strong>20</strong>08<br />

and <strong>20</strong>09 (in thousands):<br />

Year Ended December 31, <strong>20</strong>08 Year Ended December 31, <strong>20</strong>09<br />

Amount Percentage Amount Percentage<br />

(in thousands, except percentages)<br />

Audit fees (1) ................................... $965 75% $864 81%<br />

Audit-related fees ............................. - - - -<br />

Tax fees (3) ...................................... 323 25% 198 19%<br />

[All other fees (if any)]<br />

Total ................................................. $1,288 100% $1,062 100%<br />

_______________________<br />

(1) “Audit fees” are fees for audit services for each of the years shown in this table, including fees associated with the annual<br />

audit (including audit of our internal control over financial reporting) and reviews of our quarterly financial results<br />

submitted on Form 6-K, consultations on various accounting issues and audit services provided in connection with other<br />

statutory or regulatory filings.<br />

(2) “Tax fees” are fees for professional services rendered by our auditors for tax compliance, tax planning and tax advice on<br />

actual or contemplated transactions, tax consulting associated with international transfer prices and employee benefits.<br />

Audit committee’s pre-approval policies and procedures<br />

Our audit committee chooses and engages our independent auditors to audit our financial statements, with<br />

the approval of our shareholders as required by Israeli law. In March <strong>20</strong>04, our audit committee adopted a policy<br />

requiring our management to obtain the audit committee’s approval before engaging our independent auditors to<br />

provide any audit or permitted non-audit services to us or our subsidiaries. The policy was last amended in October<br />

<strong>20</strong>04. This policy, which is designed to assure that such engagements do not impair the independence of our<br />

auditors, requires pre-approval from the audit committee on an annual basis for the various audit and non-audit<br />

services that may be performed by our auditors. In addition, the audit committee limited the aggregate amount of<br />

fees our auditors may have received during <strong>20</strong>08 and <strong>20</strong>09, and may receive during <strong>20</strong>10 for non-audit services in<br />

certain categories.<br />

84