FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

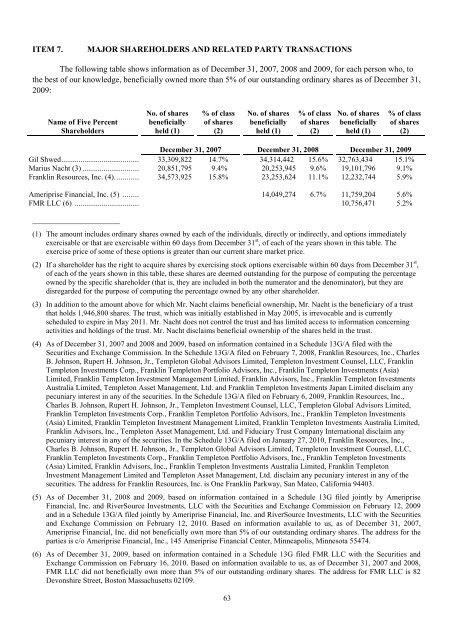

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS<br />

The following table shows information as of December 31, <strong>20</strong>07, <strong>20</strong>08 and <strong>20</strong>09, for each person who, to<br />

the best of our knowledge, beneficially owned more than 5% of our outstanding ordinary shares as of December 31,<br />

<strong>20</strong>09:<br />

Name of Five Percent<br />

Shareholders<br />

Gil Shwed .........................................<br />

Marius Nacht (3) ..............................<br />

Franklin Resources, Inc. (4). ............<br />

No. of shares<br />

beneficially<br />

held (1)<br />

% of class<br />

of shares<br />

(2)<br />

63<br />

No. of shares<br />

beneficially<br />

held (1)<br />

% of class<br />

of shares<br />

(2)<br />

No. of shares<br />

beneficially<br />

held (1)<br />

% of class<br />

of shares<br />

(2)<br />

December 31, <strong>20</strong>07 December 31, <strong>20</strong>08 December 31, <strong>20</strong>09<br />

33,309,822 14.7% 34,314,442 15.6% 32,763,434 15.1%<br />

<strong>20</strong>,851,795 9.4% <strong>20</strong>,253,945 9.6% 19,101,796 9.1%<br />

34,573,925 15.8% 23,253,624 11.1% 12,232,744 5.9%<br />

Ameriprise Financial, Inc. (5) ......... 14,049,274 6.7% 11,759,<strong>20</strong>4 5.6%<br />

FMR LLC (6) .................................. 10,756,471 5.2%<br />

_______________________<br />

(1) The amount includes ordinary shares owned by each of the individuals, directly or indirectly, and options immediately<br />

exercisable or that are exercisable within 60 days from December 31 st , of each of the years shown in this table. The<br />

exercise price of some of these options is greater than our current share market price.<br />

(2) If a shareholder has the right to acquire shares by exercising stock options exercisable within 60 days from December 31 st ,<br />

of each of the years shown in this table, these shares are deemed outstanding for the purpose of computing the percentage<br />

owned by the specific shareholder (that is, they are included in both the numerator and the denominator), but they are<br />

disregarded for the purpose of computing the percentage owned by any other shareholder.<br />

(3) In addition to the amount above for which Mr. Nacht claims beneficial ownership, Mr. Nacht is the beneficiary of a trust<br />

that holds 1,946,800 shares. The trust, which was initially established in May <strong>20</strong>05, is irrevocable and is currently<br />

scheduled to expire in May <strong>20</strong>11. Mr. Nacht does not control the trust and has limited access to information concerning<br />

activities and holdings of the trust. Mr. Nacht disclaims beneficial ownership of the shares held in the trust.<br />

(4) As of December 31, <strong>20</strong>07 and <strong>20</strong>08 and <strong>20</strong>09, based on information contained in a Schedule 13G/A filed with the<br />

Securities and Exchange Commission. In the Schedule 13G/A filed on February 7, <strong>20</strong>08, Franklin Resources, Inc., Charles<br />

B. Johnson, Rupert H. Johnson, Jr., Templeton Global Advisors Limited, Templeton Investment Counsel, LLC, Franklin<br />

Templeton Investments Corp., Franklin Templeton Portfolio Advisors, Inc., Franklin Templeton Investments (Asia)<br />

Limited, Franklin Templeton Investment Management Limited, Franklin Advisors, Inc., Franklin Templeton Investments<br />

Australia Limited, Templeton Asset Management, Ltd. and Franklin Templeton Investments Japan Limited disclaim any<br />

pecuniary interest in any of the securities. In the Schedule 13G/A filed on February 6, <strong>20</strong>09, Franklin Resources, Inc.,<br />

Charles B. Johnson, Rupert H. Johnson, Jr., Templeton Investment Counsel, LLC, Templeton Global Advisors Limited,<br />

Franklin Templeton Investments Corp., Franklin Templeton Portfolio Advisors, Inc., Franklin Templeton Investments<br />

(Asia) Limited, Franklin Templeton Investment Management Limited, Franklin Templeton Investments Australia Limited,<br />

Franklin Advisors, Inc., Templeton Asset Management, Ltd. and Fiduciary Trust Company International disclaim any<br />

pecuniary interest in any of the securities. In the Schedule 13G/A filed on January 27, <strong>20</strong>10, Franklin Resources, Inc.,<br />

Charles B. Johnson, Rupert H. Johnson, Jr., Templeton Global Advisors Limited, Templeton Investment Counsel, LLC,<br />

Franklin Templeton Investments Corp., Franklin Templeton Portfolio Advisors, Inc., Franklin Templeton Investments<br />

(Asia) Limited, Franklin Advisors, Inc., Franklin Templeton Investments Australia Limited, Franklin Templeton<br />

Investment Management Limited and Templeton Asset Management, Ltd. disclaim any pecuniary interest in any of the<br />

securities. The address for Franklin Resources, Inc. is One Franklin Parkway, San Mateo, California 94403.<br />

(5) As of December 31, <strong>20</strong>08 and <strong>20</strong>09, based on information contained in a Schedule 13G filed jointly by Ameriprise<br />

Financial, Inc. and RiverSource Investments, LLC with the Securities and Exchange Commission on February 12, <strong>20</strong>09<br />

and in a Schedule 13G/A filed jointly by Ameriprise Financial, Inc. and RiverSource Investments, LLC with the Securities<br />

and Exchange Commission on February 12, <strong>20</strong>10. Based on information available to us, as of December 31, <strong>20</strong>07,<br />

Ameriprise Financial, Inc. did not beneficially own more than 5% of our outstanding ordinary shares. The address for the<br />

parties is c/o Ameriprise Financial, Inc., 145 Ameriprise Financial Center, Minneapolis, Minnesota 55474.<br />

(6) As of December 31, <strong>20</strong>09, based on information contained in a Schedule 13G filed FMR LLC with the Securities and<br />

Exchange Commission on February 16, <strong>20</strong>10. Based on information available to us, as of December 31, <strong>20</strong>07 and <strong>20</strong>08,<br />

FMR LLC did not beneficially own more than 5% of our outstanding ordinary shares. The address for FMR LLC is 82<br />

Devonshire Street, Boston Massachusetts 02109.