FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

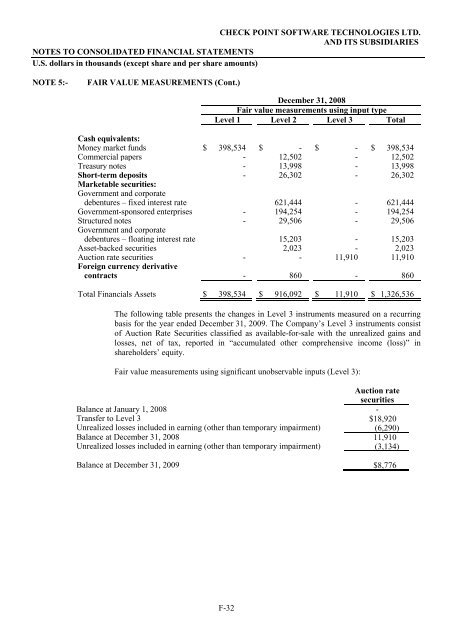

NOTE 5:- FAIR VALUE MEASUREMENTS (Cont.)<br />

December 31, <strong>20</strong>08<br />

Fair value measurements using input type<br />

Level 1 Level 2 Level 3 Total<br />

Cash equivalents:<br />

Money market funds $ 398,534 $ - $ - $ 398,534<br />

Commercial papers - 12,502 - 12,502<br />

Treasury notes - 13,998 - 13,998<br />

Short-term deposits - 26,302 - 26,302<br />

Marketable securities:<br />

Government and corporate<br />

debentures – fixed interest rate 621,444 - 621,444<br />

Government-sponsored enterprises - 194,254 - 194,254<br />

Structured notes - 29,506 - 29,506<br />

Government and corporate<br />

debentures – floating interest rate 15,<strong>20</strong>3 - 15,<strong>20</strong>3<br />

Asset-backed securities 2,023 - 2,023<br />

Auction rate securities - - 11,910 11,910<br />

Foreign currency derivative<br />

contracts - 860 - 860<br />

Total Financials Assets $ 398,534 $ 916,092 $ 11,910 $ 1,326,536<br />

The following table presents the changes in Level 3 instruments measured on a recurring<br />

basis for the year ended December 31, <strong>20</strong>09. The Company’s Level 3 instruments consist<br />

of Auction Rate Securities classified as available-for-sale with the unrealized gains and<br />

losses, net of tax, reported in “accumulated other comprehensive income (loss)” in<br />

shareholders’ equity.<br />

Fair value measurements using significant unobservable inputs (Level 3):<br />

Auction rate<br />

securities<br />

Balance at January 1, <strong>20</strong>08 -<br />

Transfer to Level 3 $18,9<strong>20</strong><br />

Unrealized losses included in earning (other than temporary impairment) (6,290)<br />

Balance at December 31, <strong>20</strong>08 11,910<br />

Unrealized losses included in earning (other than temporary impairment) (3,134)<br />

Balance at December 31, <strong>20</strong>09 $8,776<br />

F-32