FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

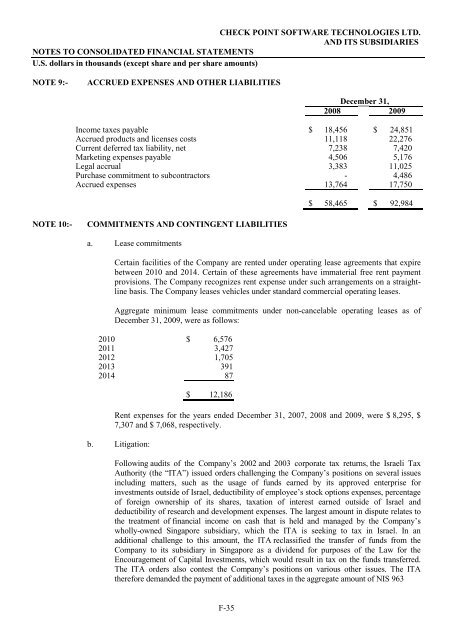

NOTE 9:- ACCRUED EXPENSES AND OTHER LIABILITIES<br />

F-35<br />

December 31,<br />

<strong>20</strong>08 <strong>20</strong>09<br />

Income taxes payable $ 18,456 $ 24,851<br />

Accrued products and licenses costs 11,118 22,276<br />

Current deferred tax liability, net 7,238 7,4<strong>20</strong><br />

Marketing expenses payable 4,506 5,176<br />

Legal accrual 3,383 11,025<br />

Purchase commitment to subcontractors - 4,486<br />

Accrued expenses 13,764 17,750<br />

NOTE 10:- COMMITMENTS AND CONTINGENT LIABILITIES<br />

a. Lease commitments<br />

$ 58,465 $ 92,984<br />

Certain facilities of the Company are rented under operating lease agreements that expire<br />

between <strong>20</strong>10 and <strong>20</strong>14. Certain of these agreements have immaterial free rent payment<br />

provisions. The Company recognizes rent expense under such arrangements on a straightline<br />

basis. The Company leases vehicles under standard commercial operating leases.<br />

Aggregate minimum lease commitments under non-cancelable operating leases as of<br />

December 31, <strong>20</strong>09, were as follows:<br />

<strong>20</strong>10 $ 6,576<br />

<strong>20</strong>11 3,427<br />

<strong>20</strong>12 1,705<br />

<strong>20</strong>13 391<br />

<strong>20</strong>14 87<br />

$ 12,186<br />

Rent expenses for the years ended December 31, <strong>20</strong>07, <strong>20</strong>08 and <strong>20</strong>09, were $ 8,295, $<br />

7,307 and $ 7,068, respectively.<br />

b. Litigation:<br />

Following audits of the Company’s <strong>20</strong>02 and <strong>20</strong>03 corporate tax returns, the Israeli Tax<br />

Authority (the “ITA”) issued orders challenging the Company’s positions on several issues<br />

including matters, such as the usage of funds earned by its approved enterprise for<br />

investments outside of Israel, deductibility of employee’s stock options expenses, percentage<br />

of foreign ownership of its shares, taxation of interest earned outside of Israel and<br />

deductibility of research and development expenses. The largest amount in dispute relates to<br />

the treatment of financial income on cash that is held and managed by the Company’s<br />

wholly-owned Singapore subsidiary, which the ITA is seeking to tax in Israel. In an<br />

additional challenge to this amount, the ITA reclassified the transfer of funds from the<br />

Company to its subsidiary in Singapore as a dividend for purposes of the Law for the<br />

Encouragement of Capital Investments, which would result in tax on the funds transferred.<br />

The ITA orders also contest the Company’s positions on various other issues. The ITA<br />

therefore demanded the payment of additional taxes in the aggregate amount of NIS 963