FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

NOTE 12:- SHAREHOLDERS’ EQUITY (Cont.)<br />

NOTE 13:- EARNINGS PER SHARE<br />

The repurchase programs have no time limit and may be suspended from time to time or<br />

discontinued. Under the above programs, the Company repurchased during <strong>20</strong>07, <strong>20</strong>08 and<br />

<strong>20</strong>09 approximately 9.02, 10.9 and 7.81 million shares, respectively, at a total cost of<br />

$ <strong>20</strong>9,757, $ 239,542 and $ <strong>20</strong>2,285, respectively. The average purchase price per share<br />

during <strong>20</strong>07, <strong>20</strong>08 and <strong>20</strong>09 was $ 23.26, $ 21.95 and $ 25.89, respectively. Such<br />

purchases of Ordinary shares are accounted for as treasury stock and result in a reduction<br />

of shareholders’ equity. As of December 31, <strong>20</strong>09, there is approximately $ 31,411<br />

remaining out of the $400,000 authorized under the share repurchase program in <strong>20</strong>08. On<br />

January 27, <strong>20</strong>10, a sixth program was announced, and authorized the repurchase of up to<br />

$250,000 of Ordinary shares.<br />

Through December 31, <strong>20</strong>09, the Company reissued 21,555,289 of its repurchased<br />

Ordinary shares in consideration for the exercise of stock options and restricted shares by<br />

employees and for shares issued under the ESPP.<br />

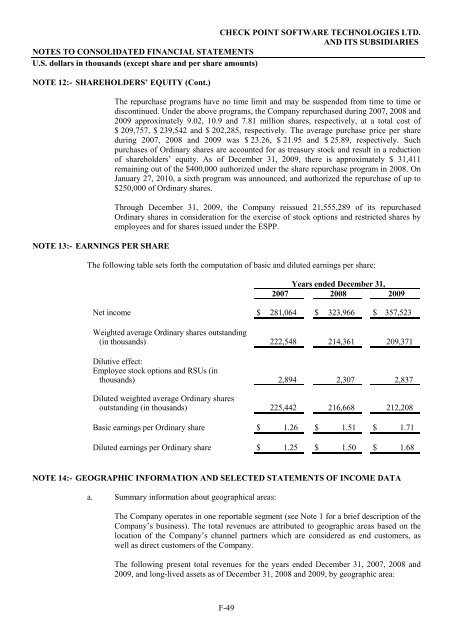

The following table sets forth the computation of basic and diluted earnings per share:<br />

F-49<br />

Years ended December 31,<br />

<strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09<br />

Net income $ 281,064 $ 323,966 $ 357,523<br />

Weighted average Ordinary shares outstanding<br />

(in thousands) 222,548 214,361 <strong>20</strong>9,371<br />

Dilutive effect:<br />

Employee stock options and RSUs (in<br />

thousands) 2,894 2,307 2,837<br />

Diluted weighted average Ordinary shares<br />

outstanding (in thousands) 225,442 216,668 212,<strong>20</strong>8<br />

Basic earnings per Ordinary share $ 1.26 $ 1.51 $ 1.71<br />

Diluted earnings per Ordinary share $ 1.25 $ 1.50 $ 1.68<br />

NOTE 14:- GEOGRAPHIC IN<strong>FORM</strong>ATION AND SELECTED STATEMENTS OF INCOME DATA<br />

a. Summary information about geographical areas:<br />

The Company operates in one reportable segment (see Note 1 for a brief description of the<br />

Company’s business). The total revenues are attributed to geographic areas based on the<br />

location of the Company’s channel partners which are considered as end customers, as<br />

well as direct customers of the Company.<br />

The following present total revenues for the years ended December 31, <strong>20</strong>07, <strong>20</strong>08 and<br />

<strong>20</strong>09, and long-lived assets as of December 31, <strong>20</strong>08 and <strong>20</strong>09, by geographic area: