FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

NOTE 3:- ACQUISITIONS (Cont.)<br />

The fair value of the vested option assumed was determined using a Black-Scholes-Merton<br />

valuation model with the following assumptions: expected life of 3 years, risk-free interest<br />

rate of 4.69%, expected volatility of 31% and no dividend yield. The fair value of unvested<br />

Protect Data options related to future service is being amortized on a straight-line basis<br />

over the remaining service period, while the value of vested options is included in total<br />

purchase price.<br />

Acquisition related transaction costs include investment banking fees, legal and accounting<br />

fees and other external costs directly related to the acquisition.<br />

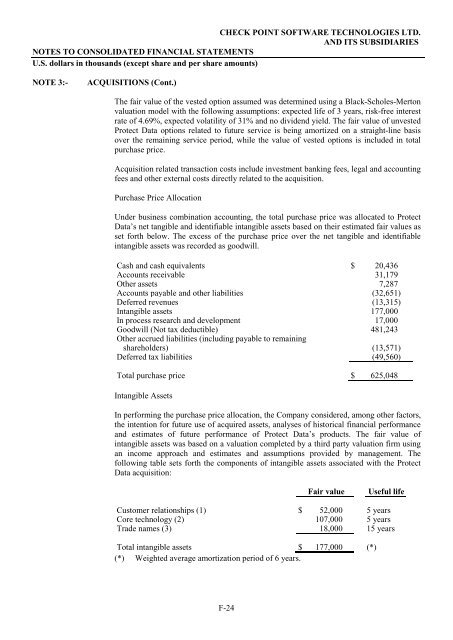

Purchase Price Allocation<br />

Under business combination accounting, the total purchase price was allocated to Protect<br />

Data’s net tangible and identifiable intangible assets based on their estimated fair values as<br />

set forth below. The excess of the purchase price over the net tangible and identifiable<br />

intangible assets was recorded as goodwill.<br />

Cash and cash equivalents $ <strong>20</strong>,436<br />

Accounts receivable 31,179<br />

Other assets 7,287<br />

Accounts payable and other liabilities (32,651)<br />

Deferred revenues (13,315)<br />

Intangible assets 177,000<br />

In process research and development 17,000<br />

Goodwill (Not tax deductible) 481,243<br />

Other accrued liabilities (including payable to remaining<br />

shareholders) (13,571)<br />

Deferred tax liabilities (49,560)<br />

Total purchase price $ 625,048<br />

Intangible Assets<br />

In performing the purchase price allocation, the Company considered, among other factors,<br />

the intention for future use of acquired assets, analyses of historical financial performance<br />

and estimates of future performance of Protect Data’s products. The fair value of<br />

intangible assets was based on a valuation completed by a third party valuation firm using<br />

an income approach and estimates and assumptions provided by management. The<br />

following table sets forth the components of intangible assets associated with the Protect<br />

Data acquisition:<br />

F-24<br />

Fair value Useful life<br />

Customer relationships (1) $ 52,000 5 years<br />

Core technology (2) 107,000 5 years<br />

Trade names (3) 18,000 15 years<br />

Total intangible assets $ 177,000 (*)<br />

(*) Weighted average amortization period of 6 years.