FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

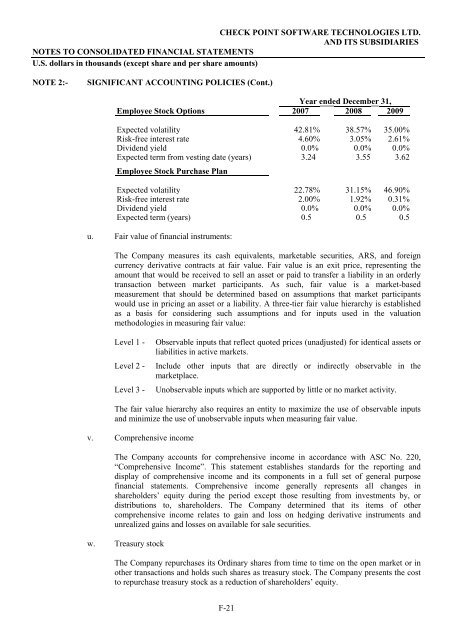

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)<br />

Year ended December 31,<br />

Employee Stock Options <strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09<br />

Expected volatility 42.81% 38.57% 35.00%<br />

Risk-free interest rate 4.60% 3.05% 2.61%<br />

Dividend yield 0.0% 0.0% 0.0%<br />

Expected term from vesting date (years) 3.24 3.55 3.62<br />

Employee Stock Purchase Plan<br />

Expected volatility 22.78% 31.15% 46.90%<br />

Risk-free interest rate 2.00% 1.92% 0.31%<br />

Dividend yield 0.0% 0.0% 0.0%<br />

Expected term (years) 0.5 0.5 0.5<br />

u. Fair value of financial instruments:<br />

The Company measures its cash equivalents, marketable securities, ARS, and foreign<br />

currency derivative contracts at fair value. Fair value is an exit price, representing the<br />

amount that would be received to sell an asset or paid to transfer a liability in an orderly<br />

transaction between market participants. As such, fair value is a market-based<br />

measurement that should be determined based on assumptions that market participants<br />

would use in pricing an asset or a liability. A three-tier fair value hierarchy is established<br />

as a basis for considering such assumptions and for inputs used in the valuation<br />

methodologies in measuring fair value:<br />

Level 1 - Observable inputs that reflect quoted prices (unadjusted) for identical assets or<br />

liabilities in active markets.<br />

Level 2 - Include other inputs that are directly or indirectly observable in the<br />

marketplace.<br />

Level 3 - Unobservable inputs which are supported by little or no market activity.<br />

The fair value hierarchy also requires an entity to maximize the use of observable inputs<br />

and minimize the use of unobservable inputs when measuring fair value.<br />

v. Comprehensive income<br />

The Company accounts for comprehensive income in accordance with ASC No. 2<strong>20</strong>,<br />

“Comprehensive Income”. This statement establishes standards for the reporting and<br />

display of comprehensive income and its components in a full set of general purpose<br />

financial statements. Comprehensive income generally represents all changes in<br />

shareholders’ equity during the period except those resulting from investments by, or<br />

distributions to, shareholders. The Company determined that its items of other<br />

comprehensive income relates to gain and loss on hedging derivative instruments and<br />

unrealized gains and losses on available for sale securities.<br />

w. Treasury stock<br />

The Company repurchases its Ordinary shares from time to time on the open market or in<br />

other transactions and holds such shares as treasury stock. The Company presents the cost<br />

to repurchase treasury stock as a reduction of shareholders’ equity.<br />

F-21