FORM 20-F - Check Point

FORM 20-F - Check Point

FORM 20-F - Check Point

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS<br />

U.S. dollars in thousands (except share and per share amounts)<br />

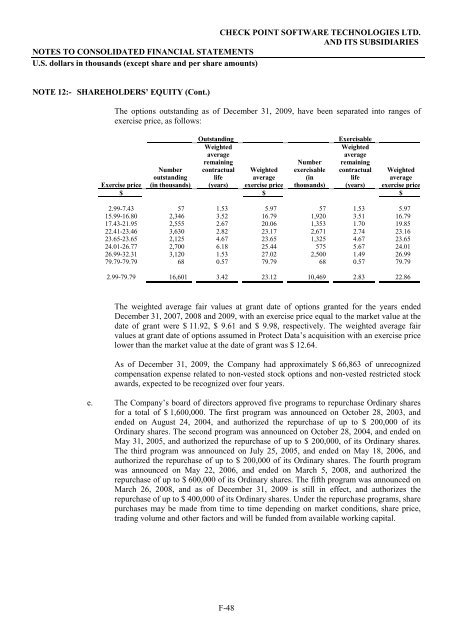

NOTE 12:- SHAREHOLDERS’ EQUITY (Cont.)<br />

The options outstanding as of December 31, <strong>20</strong>09, have been separated into ranges of<br />

exercise price, as follows:<br />

Outstanding Exercisable<br />

Weighted<br />

Weighted<br />

average<br />

average<br />

remaining<br />

Number remaining<br />

Number contractual Weighted exercisable contractual Weighted<br />

outstanding life average (in<br />

life average<br />

Exercise price (in thousands) (years) exercise price thousands) (years) exercise price<br />

$ $ $<br />

2.99-7.43 57 1.53 5.97 57 1.53 5.97<br />

15.99-16.80 2,346 3.52 16.79 1,9<strong>20</strong> 3.51 16.79<br />

17.43-21.95 2,555 2.67 <strong>20</strong>.06 1,353 1.70 19.85<br />

22.41-23.46 3,630 2.82 23.17 2,671 2.74 23.16<br />

23.65-23.65 2,125 4.67 23.65 1,325 4.67 23.65<br />

24.01-26.77 2,700 6.18 25.44 575 5.67 24.01<br />

26.99-32.31 3,1<strong>20</strong> 1.53 27.02 2,500 1.49 26.99<br />

79.79-79.79 68 0.57 79.79 68 0.57 79.79<br />

2.99-79.79 16,601 3.42 23.12 10,469 2.83 22.86<br />

The weighted average fair values at grant date of options granted for the years ended<br />

December 31, <strong>20</strong>07, <strong>20</strong>08 and <strong>20</strong>09, with an exercise price equal to the market value at the<br />

date of grant were $ 11.92, $ 9.61 and $ 9.98, respectively. The weighted average fair<br />

values at grant date of options assumed in Protect Data’s acquisition with an exercise price<br />

lower than the market value at the date of grant was $ 12.64.<br />

As of December 31, <strong>20</strong>09, the Company had approximately $ 66,863 of unrecognized<br />

compensation expense related to non-vested stock options and non-vested restricted stock<br />

awards, expected to be recognized over four years.<br />

e. The Company’s board of directors approved five programs to repurchase Ordinary shares<br />

for a total of $ 1,600,000. The first program was announced on October 28, <strong>20</strong>03, and<br />

ended on August 24, <strong>20</strong>04, and authorized the repurchase of up to $ <strong>20</strong>0,000 of its<br />

Ordinary shares. The second program was announced on October 28, <strong>20</strong>04, and ended on<br />

May 31, <strong>20</strong>05, and authorized the repurchase of up to $ <strong>20</strong>0,000, of its Ordinary shares.<br />

The third program was announced on July 25, <strong>20</strong>05, and ended on May 18, <strong>20</strong>06, and<br />

authorized the repurchase of up to $ <strong>20</strong>0,000 of its Ordinary shares. The fourth program<br />

was announced on May 22, <strong>20</strong>06, and ended on March 5, <strong>20</strong>08, and authorized the<br />

repurchase of up to $ 600,000 of its Ordinary shares. The fifth program was announced on<br />

March 26, <strong>20</strong>08, and as of December 31, <strong>20</strong>09 is still in effect, and authorizes the<br />

repurchase of up to $ 400,000 of its Ordinary shares. Under the repurchase programs, share<br />

purchases may be made from time to time depending on market conditions, share price,<br />

trading volume and other factors and will be funded from available working capital.<br />

F-48