Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Recommendation:<br />

BUY (Initiating Coverage)<br />

Key data<br />

Risk:<br />

HIGH (-)<br />

Fair Value:<br />

EUR 20.71 (-)<br />

Growth company with value characteristics<br />

After challenging FY 2009 <strong>Vectron</strong> will return to its past growth path<br />

▪ <strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>, headquarted in Muenster, is a leading provider of<br />

intelligent POS systems for the networking of branch shops. The company<br />

specializes in the dual platform strategy which allows <strong>Vectron</strong> to deliver<br />

software and hardware from one single source. With its unique business<br />

focus and sophisticated product portfolio, <strong>Vectron</strong> brings almost two<br />

decades of experience to the development of intelligent POS systems.<br />

▪ In a saturated and highly fragmented market, <strong>Vectron</strong> embarked upon a<br />

multi-pronged strategy to expand and diversify its customer basis and to<br />

fully capture emerging market opportunities. Consequently, <strong>Vectron</strong> added<br />

significant sales and R&D resources over the last year to expand its<br />

business activities into new geographic markets and niche segments.<br />

Overall, <strong>Vectron</strong> pursues a pan European expansion strategy and intends to<br />

become a leading European market player in the mid-term.<br />

▪ In its existing markets, <strong>Vectron</strong> as a premium provider with strong<br />

technological expertise and sound financial background will benefit from the<br />

squeeze out of its small regional rivals. Furthermore, the company plans to<br />

monetize on the hidden potentials within its existing installation basis of<br />

more than 100,000 systems by means of revolutionary innovations and<br />

products. Along with higher revenues in its existing markets, <strong>Vectron</strong><br />

expects a significant revenue contribution from its international business.<br />

▪ <strong>Vectron</strong> faces the current recessive market environment with a countercyclical<br />

business expansion strategy by streamlining its product portfolio<br />

and expanding its dealer network. However, we believe that the current<br />

recession will continue to hit company´s revenues in FY 2009, too. Despite<br />

the gloomy short-term growth prospects, we expect <strong>Vectron</strong> to return to its<br />

past growth path by FY 2010E. Overall, we forecast revenues of EUR<br />

20.2m and EUR 23.2m for FY 2009E and FY 2010E, respectively.<br />

▪ Given the mid-term growth prospects and high dividend yield, we consider<br />

<strong>Vectron</strong>´s equity story as attractive. On the basis of a multiple valuation and<br />

a DCF we derived a fair value of EUR 20.71 per share.<br />

▪<br />

Y/E 31.12., EUR m 2007 2008 2009E 2010E 2011E<br />

Sales revenues 25.4 23.6 20.2 23.2 25.8<br />

EBITDA 6.9 5.2 1.7 3.2 4.3<br />

EBIT 5.6 3.8 0.3 1.9 3.0<br />

Net result 3.0 2.6 0.1 1.3 1.9<br />

EPS 6.01 1.71 0.04 0.89 1.30<br />

CPS 8.57 1.26 1.05 1.88 2.09<br />

DPS 1.60 1.40 0.00 0.71 1.04<br />

Gross margin 64.2% 63.2% 62.0% 61.0% 60.3%<br />

EBITDA margin 27.3% 22.0% 8.3% 13.9% 16.7%<br />

EBIT margin 22.0% 16.2% 1.5% 8.1% 11.6%<br />

EV/EBITDA 3.0 4.0 12.4 6.4 4.8<br />

EV/EBIT 3.7 5.5 66.6 11.0 6.9<br />

P/E 2.4 8.6 400.7 16.4 11.3<br />

Source: CBS Research <strong>AG</strong>, <strong>Vectron</strong> <strong>AG</strong><br />

Internet: www. vectron.de<br />

WKN: A0KEXC<br />

Reuters: V3SG.DE<br />

14 April 2009<br />

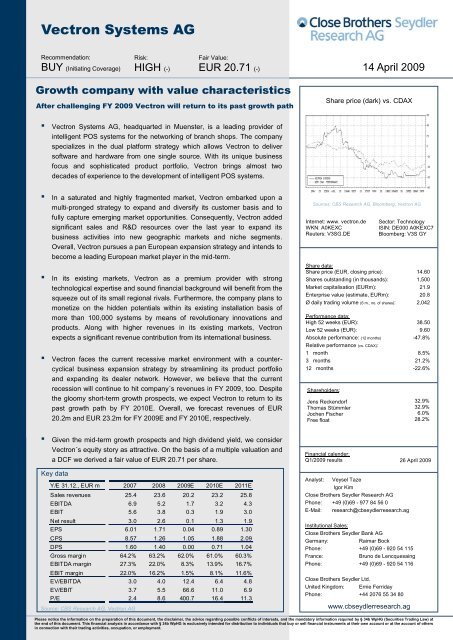

Share price (dark) vs. CDAX<br />

Sources: CBS Research <strong>AG</strong>, Bloomberg, <strong>Vectron</strong> <strong>AG</strong><br />

Share data:<br />

Share price (EUR, closing price):<br />

Shares outstanding (in thousands):<br />

Market capitalisation (EURm):<br />

Enterprise value (estimate, EURm):<br />

Ø daily trading volume (6 m., no. of shares):<br />

Performance data:<br />

High 52 weeks (EUR):<br />

Low 52 weeks (EUR):<br />

Absolute performance: (12 months)<br />

Relative performance (vs. CDAX):<br />

1 month<br />

3 months<br />

12 months<br />

Shareholders:<br />

Jens Reckendorf<br />

Thomas Stümmler<br />

Jochen Fischer<br />

Free float<br />

Financial calender:<br />

Q1/2009 results<br />

Sector: Technology<br />

ISIN: DE000 A0KEXC7<br />

Bloomberg: V3S GY<br />

Analyst: Veysel Taze<br />

Igor Kim<br />

Close Brothers Seydler Research <strong>AG</strong><br />

Phone: +49 (0)69 - 977 84 56 0<br />

E-Mail: research@cbseydlerresearch.ag<br />

www.cbseydlerresearch.ag<br />

Please notice the information on the preparation of this document, the disclaimer, the advice regarding possible conflicts of interests, and the mandatory information required by § 34b WpHG (Securities Trading Law) at<br />

the end of this document. This financial analysis in accordance with § 34b WpHG is exclusively intended for distribution to individuals that buy or sell financial instruments at their own account or at the account of others<br />

in connection with their trading activities, occupation, or employment.<br />

32.9%<br />

32.9%<br />

6.0%<br />

28.2%<br />

26 April 2009<br />

Institutional Sales:<br />

Close Brothers Seydler Bank <strong>AG</strong><br />

Germany: Raimar Bock<br />

Phone: +49 (0)69 - 920 54 115<br />

France: Bruno de Lencquesaing<br />

Phone: +49 (0)69 - 920 54 116<br />

Close Brothers Seydler Ltd.<br />

United Kingdom: Ernie Ferriday<br />

Phone: +44 2076 55 34 80<br />

14.60<br />

1,500<br />

21.9<br />

20.8<br />

2,042<br />

38.50<br />

9.60<br />

-47.8%<br />

8.5%<br />

21.2%<br />

-22.6%

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Table of contents<br />

Investment thesis ...................................................... 3<br />

SWOT analysis ........................................................... 5<br />

www.cbseydlerresearch.ag<br />

Strengths .................................................................................................... 5<br />

Weaknesses............................................................................................... 5<br />

Opportunities .............................................................................................. 6<br />

Threats ....................................................................................................... 6<br />

Valuation.................................................................... 7<br />

Valuation summary .................................................................................... 7<br />

Peer group valuation ..................................................................................... 7<br />

Peers summary – short overview ............................................................... 8<br />

Multiples and derived value ........................................................................ 9<br />

DCF Valuation............................................................................................. 10<br />

Company profile ....................................................... 12<br />

History ...................................................................................................... 12<br />

Shareholders ............................................................................................ 13<br />

Management and founding partners ........................................................ 13<br />

Business model and Products..................................................................... 14<br />

Products ................................................................................................... 14<br />

Sourcing and Manufacturing .................................................................... 16<br />

Customers and Distribution ...................................................................... 16<br />

Strategy ................................................................... 17<br />

Product portfolio enhancement ................................................................ 17<br />

International business expansion ............................................................. 18<br />

Distribution and Marketing ....................................................................... 18<br />

Competition ............................................................. 20<br />

Market environment ................................................ 21<br />

German retail sales in 2009 ..................................................................... 23<br />

Some trends and perspectives of POS systems market .......................... 24<br />

Financials ................................................................ 25<br />

Historical development ............................................................................. 25<br />

Revenue forecasts and gross profits ........................................................ 26<br />

Development of the operating business and profits ................................. 28<br />

Cash flows and financial aspects ............................................................. 28<br />

Close Brothers Seydler Research <strong>AG</strong> | 2

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Investment thesis<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>, headquarted in Muenster, is a leading provider of<br />

intelligent POS systems for the networking of branch shops. The company<br />

specializes in the dual platform strategy which allows <strong>Vectron</strong> to deliver software<br />

and hardware from one single source. Along with intelligent POS <strong>Systems</strong> in<br />

various sizes and product categories, the company´s product range comprises<br />

communication software as well as large variety of peripherals such as printers,<br />

scales and vending machines etc. With an installation basis of more than 100,000<br />

POS systems all over the world, <strong>Vectron</strong> belongs to the "Top 10" of the European<br />

manufacturers and is market leader in the German catering trade and bakery<br />

industry. Overall, <strong>Vectron</strong> is technology leader and brings almost two decades of<br />

experience to the development of intelligent POS systems.<br />

Business model - In our opinion <strong>Vectron</strong> has meanwhile established an<br />

attractive business model which is superior in many respects as it enables to<br />

remain highly innovative while keeping at the same time manufacturing and<br />

distribution expenses on a favourable level.<br />

The focal point in <strong>Vectron</strong>´s business model is its dual platform strategy which<br />

allows the company to pursue a cross-industry and a cross-system strategy instead<br />

of focusing on one industrial segment. Moreover, <strong>Vectron</strong>´s manufacturing process<br />

is based on a “built-to-order” approach which provides the company with the<br />

flexibility to react faster on technological shifts by keeping at the same time<br />

financial resources tied in inventories at a favourable level. Besides, the company<br />

commercialises its products by means of an indirect distribution channel which has<br />

the advantage of providing a broad customer access by keeping at the same time<br />

the costs per customer contact on a relatively low level.<br />

Market positioning – We expect <strong>Vectron</strong> to benefit from the ongoing squeezeout<br />

of the small regional operators in its underlying market.<br />

The market for POS systems is characterized by a high level of fragmentation and<br />

market saturation in developed countries. Apart from few international players, the<br />

underlying market is mainly dominated by a large number of small regional<br />

providers. However, since demand has become more sophisticated many of the<br />

small operators meanwhile face the problem to deliver technologically appropriate<br />

products to address the increasing demand. In absence of major players in its main<br />

customer segment of small-and medium sized enterprises (SMEs), <strong>Vectron</strong> as a<br />

premium manufacturer with sound financial background is in a favourable position<br />

to benefit from the consolidation of its underlying market.<br />

Strategy – Given the market saturation and fragmentation in its underlying<br />

market, we consider <strong>Vectron</strong>´s multi-pronged strategy as promising.<br />

<strong>Vectron</strong> embarked on a multi-pronged strategy to expand and diversify its customer<br />

base and product portfolio, fully capture international business opportunities and<br />

accelerate long-term growth. <strong>Vectron</strong> intends to tap with its product portfolio new<br />

niche segments and price categories which have been neglected by the company<br />

in the past. New innovations as well as technologically improved versions of its<br />

existing products will attract not only new customers, but also create sufficient<br />

incentives for existing customer to replace their “old” systems. The company has<br />

already added mobile and hybrid devices to its products and intends to renew its<br />

entire portfolio of stationary POS systems. Along with higher revenues in its<br />

existing markets, the company expects a significant revenue contribution from its<br />

international business activities. <strong>Vectron</strong> pursues a pan-European expansion<br />

strategy and aims to become a leading European market player in the mid-term.<br />

www.cbseydlerresearch.ag<br />

A leading provider of<br />

intelligent POS<br />

systems<br />

Attractive business<br />

model<br />

<strong>Vectron</strong> is in a favourable<br />

position to benefit<br />

from the squeeze-out<br />

of small players<br />

Promising strategy<br />

Close Brothers Seydler Research <strong>AG</strong> | 3

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Attraction of the equity story – We consider <strong>Vectron</strong>´s equity story as<br />

attractive since it combines the growth prospect of a fast growing company<br />

with the typical characteristics of a value investment (e.g. high dividend<br />

yield).<br />

The key attraction of <strong>Vectron</strong>´s equity story is the expansion of business activities<br />

to new geographic markets, the untapped potentials within its existing markets as<br />

well as company´s sound installation basis and the traditionally high dividend yield<br />

(in the past pay-out ratio of approx. 80%). Although <strong>Vectron</strong>s´s existing markets<br />

has saturated, the company will still generate higher revenues in the future in<br />

course of the squeeze out of small regional operators and the diversified customer<br />

focus. Moreover, given an installation basis of more than 100,000 systems, <strong>Vectron</strong><br />

intends to monetize on this hidden potential within its existing customer basis by<br />

reducing the overall product life cycle by means of new innovations and valueadding<br />

product improvements (e.g. <strong>Vectron</strong> ServiceCall).<br />

Fiscal memory chip – The company´s equity story becomes even more<br />

attractive by considering the tremendous growth prospects related to the<br />

introduction of a mandatory fiscal memory chip (Fiskalspeicher) which shall<br />

enables tamper-proof storage of cash turnover. Such a development represents<br />

great chances for <strong>Vectron</strong> since the company has already collected corresponding<br />

experiences in Turkey and in some Nordic countries. According to the relevant<br />

market participants German authorities consider to introduce this kind of systems<br />

by 2012. However at current stage, we did not account for such a scenario in our<br />

valuation approach.<br />

Risks related to the equity story – We see major risks related to <strong>Vectron</strong>´s<br />

equity story in the ongoing recessive economic environment as well as from<br />

deflating prices as a result of the competitive market environment. <strong>Vectron</strong><br />

operates in a cyclical business in which the company generates its revenues mainly<br />

from the sale of POS systems that has non-recurring characteristics. However, in<br />

the past <strong>Vectron</strong> successfully managed to evade from a margin diluting price<br />

competition.<br />

Financials – We expect <strong>Vectron</strong> to return to its past growth path by 2010E<br />

and benefit from its current counter-cyclical strategy by expanding its<br />

product portfolio and distribution network. Prior to the current ongoing<br />

recession, <strong>Vectron</strong> achieved a top-line growth of C<strong>AG</strong>R 21.9% over the period<br />

2005 to 2007. We expect this trend to slow-down to a C<strong>AG</strong>R of 12.3% until 2012E<br />

as a consequence of the current recessive macroeconomic environment and the<br />

slowing growth pace in its underlying market. After further challenging FY 2009E<br />

with significant decline in the top line as well as bottom line, we expect <strong>Vectron</strong> to<br />

yield the fruits of its counter-cyclical business expansion strategy from 2010E on.<br />

We think that the current investment backlog as result of the ongoing recession will<br />

start to ease from the beginning of FY 2010E and forecast revenues of EUR 23.2m<br />

and EUR 25.8m for 2010E and 2011E, respectively.<br />

Valuation: By combining a multiple valuation and a Discounted Cash Flow<br />

(DCF) model we derived a fair value of EUR 20.71 per share. Although the<br />

challenging market environment will last throughout the entire FY 2009E, we think<br />

<strong>Vectron</strong>´s mid-term growth prospects are still intact. By considering the company´s<br />

attractive business model and the promising growth rate from 2010E on, we think<br />

that the current price level offers an attractive buying opportunity.<br />

www.cbseydlerresearch.ag<br />

Equity story: Growth<br />

company with valueinvestment<br />

characteristics<br />

A possible introduction<br />

of a mandatory fiscal<br />

memory chip indicates<br />

tremendous mid-term<br />

growth<br />

Deflating prices as<br />

major risk<br />

Despite gloomy short-<br />

term growth prospects<br />

mid-term perspective<br />

are still promising<br />

Our fair value amounts<br />

to EUR 20.71<br />

Close Brothers Seydler Research <strong>AG</strong> | 4

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

SWOT analysis<br />

Strengths<br />

� Strong technological expertise: The company´s dual platform strategy<br />

provides the basis to <strong>Vectron</strong>´s innovation power and enables to deliver<br />

software and hardware from one single source<br />

� Sophisticated product portfolio: The company has streamlined its<br />

product portfolio over the last years by introducing new innovations as well<br />

as value adding features (e.g. Hybrid devices, mobile devices or Service<br />

Call). Moreover, <strong>Vectron</strong> utilize the most up-to-date technology in its<br />

products<br />

� Profitable business model with attractive margins: Along with an<br />

attractive market positioning the company generates sound cash flows in<br />

its operating business. Moreover, the company has a strong financial<br />

background with high equity ratio building a sound basis for further<br />

business expansion<br />

� High market entry barriers: New market entrants have to overcome<br />

severe obstacles particularly in establishing appropriate distribution<br />

channels<br />

� Over the last year the product mix has moved towards higher margin<br />

solutions<br />

� Highly experienced management that are at the same time founders<br />

of the company<br />

Weaknesses<br />

� Volatile revenues: <strong>Vectron</strong> operates in a cyclical business where the<br />

company generates its revenues mainly from the sale of POS systems<br />

which has non-recurring characteristics<br />

� Low geographic business diversification: The company still generates<br />

the largest proportion of its revenues in German speaking countries. Due<br />

to the cyclical characteristic of its business <strong>Vectron</strong> is particularly exposed<br />

to the macroeconomic risks of these countries<br />

� Still low number of international distribution partners: In order to<br />

boost its international business, the company still has to achieve a critical<br />

number of distribution partners<br />

� High degree of market penetration and saturation: The company´s<br />

geographical markets show a high level of market saturation and<br />

fragmentation<br />

� High level of depreciation on intangible assets: In course of the<br />

Management Buy Out (MBO) the company had acquired Software-<br />

Sourcecodes which are subject to depreciation over the next years<br />

� The company´s past financial struggle still weighs on <strong>Vectron</strong>´s<br />

reputation within the stock market community<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 5

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Opportunities<br />

� International business expansion: Although the company still has to<br />

establish a more sophisticated international distribution network, the<br />

geographic expansion of its business activities will result in higher<br />

revenues in the future<br />

� Product and customer diversification: With new innovations and value<br />

adding product improvement <strong>Vectron</strong> intends to tap new niche and price<br />

segments. Moreover, the company aims put a stronger emphasis on the<br />

acquisition of key accounts<br />

� The introduction of the “Fiskalspeicher” could result in significant<br />

growth prospects in the mid-term<br />

� Growth prospects arising from market consolidation: Since demand is<br />

Threats<br />

becoming more sophisticated most of the small regional operating<br />

companies face serious problems to deliver appropriate product solutions.<br />

<strong>Vectron</strong> as a technologically and financially strong company could benefit<br />

from the squeeze out of these small market players<br />

� Exposure to macroeconomic environment: The company´s targeted<br />

customers have business models which are sensitive to general economic<br />

conditions. In times of economic downturn most of these customers hold<br />

back their investments<br />

� Risk of deflating prices: In premium and mid-range market segments the<br />

price development has been quite stable over the last years. However,<br />

given the competitive business environment and tough economic<br />

conditions the risk of a margin diluting price competition could become a<br />

realistic scenario<br />

� Risk associated to legal changes as well as product warranties<br />

� Dependency on distribution partners: <strong>Vectron</strong> commercialises its<br />

products via distribution partners a “bad” relationship with distributors<br />

would affect the company´s business activities significantly<br />

www.cbseydlerresearch.ag<br />

Close Brothers Seydler Research <strong>AG</strong> | 6

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Valuation<br />

Valuation summary<br />

We applied a multiple valuation and a Discounted Cash Flow (DCF) model to<br />

derive the company´s fair value. Our multiple valuation on basis of different<br />

multiples for 2009 and 2010 indicates a fair value of EUR 10.77 per share. Due to<br />

the limited comparability of the peer group companies, the result of our multiple<br />

valuation is only weighted with one-third in our overall valuation approach.<br />

Given the long-term growth perspectives, the DCF model is, in our opinion, more<br />

appropriate for assessing the growth prospects in <strong>Vectron</strong>´s equity story. Our DCF<br />

model results in a much higher fair value of EUR 25.68 per share. By combining<br />

both valuation methods we derived a fair value of EUR 20.71.<br />

Consolidation of valuation methods<br />

Source: CBS Research <strong>AG</strong><br />

After a drop in the top line and the bottom line in FY 2008, we think that the<br />

company´s growth prospects for 2009 will remain challenging as a consequence of<br />

the current economic recession. Nevertheless, given the company´s sound market<br />

positioning combined with a sophisticated product and longstanding experience, we<br />

think <strong>Vectron</strong> will return to its past growth path by 2010E. Despite the given market<br />

saturation in its underlying market, we believe <strong>Vectron</strong> will yield the fruits of its<br />

current counter-cyclical growth strategy and will benefit from the squeeze out of its<br />

small competitors. Moreover, we expect significantly higher absolute revenues from<br />

WENN ENDGÜTLIGER FAIR VALUE FESTSTEHT, hier mit<br />

its international business activities in the future.<br />

Inhalte einfügen den Wert in das orangene Feld<br />

einfügen => Zirkelbezug aufgehoben.<br />

Peer group valuation<br />

In a fragmented market, <strong>Vectron</strong> is positioned as a premium provider with main<br />

customer emphasis on SMEs. Apart from the various non-listed competitors,<br />

<strong>Vectron</strong> competes with a limited number of listed large market players which<br />

generate only a certain proportion of their revenues in the market of POS systems.<br />

Consequently, our peer group comparison is mainly dominated by international<br />

players that have a much broader business scope than <strong>Vectron</strong>. In our opinion,<br />

Micros <strong>Systems</strong> is the next comparable peers as it runs a similar business models.<br />

However, the company is much larger than <strong>Vectron</strong> in terms of revenues as well as<br />

market capitalisation. Moreover, it generates revenues in business areas which are<br />

not targeted by <strong>Vectron</strong> at all. We did not consider in our analysis listed competitors<br />

such as NCR, Sharp or Panasonic which generate only a marginal proportion of<br />

their revenues from the distribution of POS systems.<br />

www.cbseydlerresearch.ag<br />

Weighting Fair value<br />

factor per share (EUR)<br />

Peer group valuation 33.3% 10.77<br />

DCF valuation 66.7% 25.68<br />

Fair value per share (EUR) 20.71<br />

Valuation approach<br />

based on DCF and<br />

multiple valuation<br />

Fair value per share is<br />

EUR 20.71<br />

Underlying growth<br />

drivers<br />

Peer group comprises<br />

only international<br />

operators<br />

Close Brothers Seydler Research <strong>AG</strong> | 7

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Peer group company data<br />

Company name Market EV<br />

Source: CBS Research <strong>AG</strong>, Bloomberg<br />

Peers summary – short overview<br />

Our peer group consists of three international companies that operate in similar<br />

business segments and geographic markets as <strong>Vectron</strong>.<br />

MICROS <strong>Systems</strong>, Inc is a leading worldwide designer, manufacturer, marketer<br />

and servicer of enterprise information solutions for the global hospitality and<br />

specialty retail industries. The information solutions consist of application specific<br />

software and hardware systems, supplemented by a wide range of services. Along<br />

with Hotel information systems, the company offers restaurant systems including<br />

full-featured POS applications, hardware, and support services. MICROS has<br />

traditionally strong roots in the hotel and resort industry. Compared to <strong>Vectron</strong> the<br />

company has a much broader business scope and a well-established international<br />

business and targets mainly on hotel and resort as well as retail industries. In FY<br />

2008 ended 30 June 2008, the company achieved sales of USD 954.2m. For the<br />

first half of the ongoing FY, MICROS posted an increase in revenues by 4.7% to<br />

USD 482.0m and achieved a net income after taxes of USD 52.0m.<br />

Radiant <strong>Systems</strong> Inc, headquartered in Atlanta, USA, engages in the<br />

development, installation, and delivery of solutions for managing site operations in<br />

the hospitality and retail industries. The company operates through two segments:<br />

Hospitality and Food Service and Petroleum and Convenience. Radiant pursues an<br />

international business strategy with offices all around the world. In January 4, 2008,<br />

Radiant acquired Quest Retail Technology, a global provider of point of sale and<br />

back office solutions to stadiums, arenas, convention centers, race courses, theme<br />

parks, restaurants, bars and clubs. For the FY 2008, the company reported an<br />

increase in revenues by 19% to USD 301.6m and a net income of USD 11.0m.<br />

Overall, the company generates revenues in business areas which are not directly<br />

related to <strong>Vectron</strong>´s business.<br />

Wincor Nixdorf <strong>AG</strong> is a Germany-based company that provides information<br />

technology (IT) solutions for the retail and banking sectors. The Company's<br />

portfolio of products and services includes hardware, software and consulting<br />

services. The company‟s focus is the production of Automated Teller Machines and<br />

POS-Terminals. The company distributes most of its products through its own sales<br />

organization, although it does also make use of external sales and cooperation<br />

www.cbseydlerresearch.ag<br />

cap. 2009E 2010E 2009E 2010E 2009E 2010E 2009E 2010E<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong> (estimates by CBSR): EUR m 21.9 20.8 0.04 0.89 0.3 1.9 1.7 3.2 20.2 23.2<br />

MICROS SYSTEMS INC USD m 1,671.1 1,345.6 1.27 1.25 146.3 140.0 157.67 149.50 937.78 917.38<br />

RADIANT SYSTEMS INC USD m 188.5 36.0 0.55 0.70 27.6 34.6 36.10 46.60 277.67 307.00<br />

WINCOR NIXDORF <strong>AG</strong> EUR m 1,386.9 185.0 3.80 3.82 183.0 190.8 237.74 241.00 2,247.16 2,254.22<br />

Average 1,082.2 522.2 n/m n/m 119.0 121.8 143.8 145.7 1,154.2 1,159.5<br />

Median 1,386.9 185.0 n/m n/m 146.3 140.0 157.7 149.5 937.8 917.4<br />

Company name<br />

EPS (EUR) EBIT EBITDA<br />

Net margin EBIT margin EBITDA margin Sales growth<br />

2009E 2010E 2009E 2010E 2009E 2010E 2009E 2010E<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong> (estimates by CBSR): 10.8% 0.3% 16.1% 1.5% 22.0% 8.3% -7.2% -14.5%<br />

MICROS SYSTEMS INC 11.0% 10.9% 15.6% 15.3% 16.8% 16.3% -1.7% -2.2%<br />

RADIANT SYSTEMS INC n.a. 7.8% 9.9% 11.3% 13.0% 15.2% -7.9% 10.6%<br />

WINCOR NIXDORF <strong>AG</strong> 5.4% 5.4% 8.1% 8.5% 10.6% 10.7% -3.1% 0.3%<br />

Average 8.2% 8.1% 11.2% 11.7% 13.5% 14.1% -4.2% 2.9%<br />

Median 8.2% 7.8% 9.9% 11.3% 13.0% 15.2% -3.1% 0.3%<br />

Sales<br />

Our peer group consists of:<br />

MICROS <strong>Systems</strong><br />

Radiant <strong>Systems</strong><br />

Wincor Nixdorf<br />

Close Brothers Seydler Research <strong>AG</strong> | 8

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

partners. Wincor Nixdorf possesses a high grade of internationalization, having its<br />

own subsidiaries in 37 countries and a market presence in around 100 countries<br />

around the world. In FY 2007/2008, ended in September 30, the company<br />

generated revenues of EUR 2.3bn and a net income of EUR 127m. Comparability<br />

to <strong>Vectron</strong> is only given in Wincor´s retail business where the company delivers<br />

POS <strong>Systems</strong> to customers with high branch concentration. Overall Wincor<br />

operates in this business segment as a pure manufacturer.<br />

Multiples and derived value<br />

In our peer group analysis, we considered multiples for the fiscal years 2009E and<br />

2010E. We applied different multiples including EV/EBITDA in order to account for<br />

special situation related to <strong>Vectron</strong>´s high depreciation expenses. In the course of<br />

the management-buy-out, <strong>Vectron</strong> had acquired softrwarecodes which the<br />

company has to write-off until 2012E.<br />

Given the current volatility at the stock markets and the fact that <strong>Vectron</strong> is rather a<br />

small player compared to the global operating peers, we decided to weight the peer<br />

group valuation with only 33.3% in our overall valuation approach.<br />

Peer group valuation: Multiples and derived value<br />

Company name<br />

Source: Bloomberg, CBS Research <strong>AG</strong><br />

We applied these multiples to our financial forecasts for <strong>Vectron</strong>. We deducted<br />

<strong>Vectron</strong>s´s net financial debt from the derived enterprise values in order to get the<br />

fair value of equity. From our peer group valuation, we derived a market-oriented<br />

fair value of equity of EUR 16.2 m for the company corresponding to a fair value<br />

per share of EUR 10.77.<br />

www.cbseydlerresearch.ag<br />

2009E 2010E 2009E 2010E 2009E 2010E 2009E 2010E<br />

MICROS SYSTEMS INC 16.4 16.6 9.2 9.6 8.5 9.0 1.4 1.5<br />

RADIANT SYSTEMS INC 10.6 8.3 9.9 7.9 7.6 5.9 1.0 0.9<br />

WINCOR NIXDORF <strong>AG</strong> 11.0 11.0 8.4 8.0 6.5 6.4 0.7 0.7<br />

Average 12.7 12.0 9.2 8.5 7.5 7.1 1.0 1.0<br />

Median 11.0 11.0 9.2 8.0 7.6 6.4 1.0 0.9<br />

Minimum 10.6 8.3 8.4 7.9 6.5 5.9 0.7 0.7<br />

Maximum 16.4 16.6 9.9 9.6 8.5 9.0 1.4 1.5<br />

EUR m<br />

2009E 2010E 2009E 2010E 2009E 2010E 2009E 2010E<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>: Financial estimates by CBSR 0.04 0.89 0.3 1.9 1.7 3.2 20.2 23.2<br />

Applied multiples: Median of the peer group multiples 11.0 11.0 9.2 8.0 7.6 6.4 1.0 0.9<br />

Enterprise value (derived) - - 2.9 15.2 12.6 20.5 19.8 20.6<br />

+ Excess cash and marketable securities 7.6<br />

- Financial debt -6.5<br />

Market capitalization (derived) 0.6 14.7 4.0 16.3 13.8 21.6 20.9 21.7<br />

Average of market capitalizations 16.2<br />

Fair market capitalization 16.2<br />

Number of shares outstanding (m) 1.5<br />

Fair value per share (EUR) 10.77<br />

EPS EBIT EBITDA<br />

We applied multiples<br />

for the FY 2009E and<br />

2010E<br />

P / E EV / EBIT EV / EBITDA EV / Sales<br />

Sales<br />

Our fair value results<br />

in EUR 10.77<br />

Close Brothers Seydler Research <strong>AG</strong> | 9

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

DCF Valuation<br />

Our Discounted Cash Flow (DCF) model is based on the following assumptions:<br />

Weighted average cost of capital (WACC): On basis of the current long-term<br />

yields of German federal bonds, we set the risk-free rate at 3.5%. We assumed an<br />

equity risk premium of 6.0%, and a debt risk premium of 2.50%. Although the<br />

company´s stocks have been listed for a long period, we did not apply <strong>Vectron</strong>´s<br />

historic beta in our WACC calculation. We decided to apply a beta of 1.50 which is<br />

significantly above its historic value as well as the beta of most its peers. The<br />

reason for this adjustment was mainly due to the company´s small size as well as<br />

the cyclical characteristics of its underlying business with non-recurring revenues.<br />

We furthermore assumed a long-term target equity ratio at market values of 70%,<br />

which is rather a conservative assumption. These premises lead to a WACC of<br />

9.99%<br />

Phase 1 (2008-10E): We estimated the free cash flows (FCF) of phase 1 according<br />

to our detailed financial forecasts for this period stated in the financials section. We<br />

assume that 2008 and 2009 will be challenging as company´s revenues will be hit<br />

by the global economic slowdown.<br />

Phase 2 (2012-18E): For Phase 2, we made more general assumptions,<br />

considering the expected industry growth and <strong>Vectron</strong>´s positioning. We believe<br />

that <strong>Vectron</strong> will yield the fruits of its international business expansion once the<br />

current recessive market environment has passed. From the mid-term growth<br />

perspectives, we expect the company to monetise more strongly on hidden<br />

potentials within its existing customer basis and to take advantage of the squeezeout<br />

of small market players. Moreover, we assumed a stronger revenue<br />

contribution from its international business as <strong>Vectron</strong> has sped up its international<br />

expansion in 2008. Overall we allowed annual revenue growth to decrease<br />

successively to 2.0% in 2018E, resulting in a C<strong>AG</strong>R 2012-18E of 5.2%. We<br />

assumed that the company can reach an EBIT margin of 9.0%, a level which the<br />

company originally aimed to achieve at the end of the fiscal year 2010.<br />

Phase 3: For the calculation of the terminal value, we applied a long-term FCF<br />

growth rate of 2.0% which equals the estimated long-term inflation rate. This<br />

assumption theoretically corresponds to a real-term zero growth, since we use a<br />

nominal discount rate (WACC).<br />

Based on these assumptions, we calculated a fair value of the operating business<br />

of EUR 37.4m. By deducting the company´s debt position the resulting fair value of<br />

equity achieved EUR 38.5m. Overall, the fair value per share amounts to EUR<br />

25.68.<br />

www.cbseydlerresearch.ag<br />

Assumptions:<br />

WACC of 9.99%<br />

Phase 1: Detailed<br />

financial forecasts<br />

Phase 2: decreasing<br />

revenue growth<br />

Phase 3: 2% growth for<br />

terminal value<br />

Our DCF yield in a fair<br />

value per share of<br />

25.68<br />

Close Brothers Seydler Research <strong>AG</strong> | 10

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Discounted Cash Flow Model<br />

PHASE 1 PHASE 2 PHASE 3<br />

EURm 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E<br />

Total output 20.2 23.2 25.8 28.6 31.4 33.8 35.5 36.9 38.0 38.8<br />

Y-o-Y growth -14.5% 15.0% 11.0% 11.0% 10.0% 7.5% 5.0% 4.0% 3.0% 2.0%<br />

EBIT 0.3 1.9 3.0 4.0 4.7 5.1 5.3 5.5 5.7 5.8<br />

EBIT margin 1.5% 8.1% 11.6% 14.0% 15.0% 15.0% 15.0% 15.0% 15.0% 15.0%<br />

Income tax on EBIT -0.1 -0.6 -0.9 -1.2 -1.4 -1.6 -1.6 -1.7 -1.8 -1.8<br />

Depreciation and amortisation 1.4 1.4 1.3 1.3 0.9 0.8 0.8 0.8 0.8 0.8<br />

Change in net working capital 0.3 0.1 -0.1 -0.2 -0.2 -0.2 -0.1 -0.1 -0.1 -0.1<br />

Net capital expenditure -1.1 -0.8 -0.8 -0.7 -0.7 -0.7 -0.7 -0.7 -0.7 -0.7<br />

Free cash flow 0.8 1.98 2.6 3.2 3.3 3.5 3.7 3.9 4.0 4.1<br />

Present values 0.7 1.7 1.9 2.2 2.1 2.0 1.9 1.8 1.7 1.6 19.9<br />

Present value Phase 1 4.3 Risk free rate 3.50% Target equity ratio 70.0%<br />

Present value Phase 2 13.2 Equity risk premium 6.00% Beta 1.50<br />

Present value Phase 3 19.9 Debt risk premium 2.50% WACC 9.99%<br />

Total present value 37.4 Tax shield (Phase 3) 30.9% Terminal growth 2.00%<br />

+ Excess cash/Non-operating assets 7.6<br />

- Financial debt -6.5<br />

Source: CBS Research <strong>AG</strong><br />

www.cbseydlerresearch.ag<br />

Sensitivity analysis<br />

Terminal growth (Phase 3)<br />

1.0% 1.5% 2.0% 2.5% 3.0%<br />

Fair value of equity 38.5 8.99% 27.55 28.59 29.78 31.15 32.76<br />

9.49% 25.72 26.60 27.59 28.73 30.05<br />

Number of shares outstanding (m) 1.5 WACC 9.99% 24.09 24.84 25.68 26.64 27.73<br />

10.49% 22.64 23.28 24.00 24.80 25.72<br />

Fair value per share (EUR) 25.68 10.99% 21.34 21.89 22.50 23.19 23.96<br />

Close Brothers Seydler Research <strong>AG</strong> | 11<br />

8

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Company profile<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>, headquarted in Muenster/Germany, is leading provider of<br />

intelligent POS systems and communication software for the networking of branch<br />

shops. <strong>Vectron</strong> manufactures and distributes state-of-the art POS systems in<br />

various sizes and price categories. The company´s software comprises a program<br />

generator enabling industry specific adjustments as well as operating on both PC<br />

based platform and proprietary platform. Furthermore, the company offers<br />

supplementary peripheral devices such as printers or scanners which <strong>Vectron</strong><br />

sources from external partners. Overall, <strong>Vectron</strong> specializes in the dual platform<br />

strategy delivering software and hardware from one single source.<br />

With an installation basis of more than 100,000 POS systems all over the world,<br />

<strong>Vectron</strong> belongs to the "Top 10" of the European manufacturers and is market<br />

leader in the German catering trade and bakery trade. The company is positioned<br />

as a premium provider with business emphasis on small and medium sized<br />

companies (SMEs). <strong>Vectron</strong>‟s products are sold in 25 countries worldwide through<br />

a network of more than 250 retailers and distributors.<br />

<strong>Vectron</strong>´s business approach<br />

Sourcing & Manufactering<br />

� Sourcing of non-core<br />

components from external<br />

partners<br />

� Manufacturing at company s<br />

headquarter<br />

Source: CBS Research <strong>AG</strong><br />

History<br />

The company´s history is closely tied to the vita of three founders Jens Reckendorf,<br />

Thomas Stümmler and Jochen Fischer. The company was founded 1990 with Mr.<br />

Reckendorf and Mr. Stümmler as founding partners. Originally, <strong>Vectron</strong> had its<br />

main business emphasis on the development of communication software enabling<br />

the interaction between third party POS systems. However, with the introduction of<br />

its first own-developed POS System in 1998, the company extended its expertise,<br />

by adding manufacturing excellences to its business activities. A milestone in<br />

company´s history was the successful listing on the Neue Markt of the Frankfurt<br />

stock exchange in 1999.<br />

Over the next years, the company came under heavy financial pressure as result of<br />

its fast business expansion and the long-lasting economic recession on its<br />

domestic market. At the end of 2002, Hansa International <strong>AG</strong> located in Zurich<br />

joined <strong>Vectron</strong> as investor which resulted later in a merger between <strong>Vectron</strong> and its<br />

German daughter Hansa Chemie <strong>AG</strong>. The new company developed under the<br />

name Hansa Group <strong>AG</strong>.<br />

In course of a management-buy-out (asset deal) led by its origin founders, <strong>Vectron</strong><br />

became independent in May 2006. In March 2007, the company went public again<br />

and is listed on the Entry Standard of the Frankfurt stock exchange. After the<br />

successful turnaround <strong>Vectron</strong> strives for a profitable growth in the future.<br />

www.cbseydlerresearch.ag<br />

„Built-to-<br />

Order“<br />

Dual platform<br />

Hardware Software<br />

strategy<br />

Software and hardware from one single source<br />

Indirect<br />

distribution<br />

Leading provider of<br />

intelligent POS<br />

systems with a dual<br />

platform strategy<br />

Customers & Markets<br />

� Pan-European businsss<br />

emphasis<br />

� Main customer focus on<br />

SMEs<br />

Eventful history<br />

Close Brothers Seydler Research <strong>AG</strong> | 12

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Shareholders<br />

The company´s management team who are also the founders jointly hold a stake of<br />

77% in <strong>Vectron</strong> shares. The holding proportion of the management was in the past<br />

relatively stable which underline their loyalty to the company.<br />

Shareholder structure<br />

28.2%<br />

6.0%<br />

Source: <strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>, CBS Research <strong>AG</strong><br />

Management and founding partners<br />

The company´s management board comprises two members.<br />

Thomas Stümmler - Founding partner and member of the Executive Board<br />

During his studies in Law at the University of Munster, Mr. Thomas Stümmler<br />

became a partner and CEO in the <strong>Vectron</strong> <strong>Systems</strong> Datentechnik GmbH - the<br />

predecessor of <strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong> - where he also managed the company„s<br />

sales. Subsequently, he took the position of an Executive Board member in the<br />

newly formed company Hansa Group <strong>AG</strong> after the merger between <strong>Vectron</strong> and<br />

the German daughter Hansa International <strong>AG</strong>, where he stayed until 2006. His next<br />

professional step was to relaunch <strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong> as an independent<br />

company. As member of the executive board, Mr.Stümmler is responsible for the<br />

sales & marketing. Moreover, he manages the human resource department and the<br />

company„s accounting.<br />

Jens Reckendorf: Founding partner and member of the Executive Board<br />

After his studies in Physics at the University of Munster, Mr. Reckendorf worked<br />

from 1990 to 1999 as a Development Executive at <strong>Vectron</strong> <strong>Systems</strong> Datentechnik<br />

GmbH. From 1999 to 2006 he was a member of the Executive Board of <strong>Vectron</strong><br />

<strong>Systems</strong> <strong>AG</strong> (prev.). In 2006, with the relaunch of <strong>Vectron</strong> <strong>Systems</strong>, he became a<br />

founding partner and a member of the Executive Board. His responsibilities at<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong> include Development, Production, Supply and IT.<br />

Jochen Fischer: Founding partner<br />

His educational background is based on study of Law at the Westphalia Wilhelms<br />

University and since 2004 he has been working as an assistant lecturer at the<br />

Munster University of Applied Sciences. In 1982, he founded Fischer & Partner, an<br />

agency which specialized in company communications. Since 1999, Mr. Fischer<br />

consulted the predecessor companies of <strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>. His current<br />

responsibilities as an external consultant at the company are operational marketing,<br />

investor and public relations.<br />

The company´s supervisory board currently consists of three members with<br />

Christian Ehlers as Chairman of the Board<br />

.<br />

www.cbseydlerresearch.ag<br />

32.9%<br />

32.9%<br />

Jens Reckendorf, 32.9%<br />

Thomas Stümmler, 32.9%<br />

Jochen Fischer, 6.0%<br />

Free float, 28.2%<br />

Management board<br />

members are the<br />

founders of the<br />

company<br />

Close Brothers Seydler Research <strong>AG</strong> | 13

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Business model and Products<br />

In a highly fragmented market with lack of major competitors, <strong>Vectron</strong> is technology<br />

leader and delivers hardware and software from one single source.<br />

Business model<br />

Sourcing & Manufacturing Product strategy Distribution<br />

Source: CBS Research <strong>AG</strong><br />

The focal point in <strong>Vectron</strong>´s business model is the dual platform strategy which<br />

allows the company to pursue a cross-industry and cross-system business<br />

approach. The modular software architecture that forms the basis for all <strong>Vectron</strong><br />

POS systems is easy to adjust to the requirements of different industrial segments<br />

and is able to run on both PC-based systems and <strong>Vectron</strong>´s proprietary platform.<br />

Overall, the dual platform strategy allows the company to run one software for<br />

various industries and various devices by offering at the same time following<br />

advantages:<br />

� It enables to pursue a broader business scope since the company can<br />

monetize on growth potential in various industrial segments instead of<br />

focusing on industry<br />

� Reduction of the timeframe for new innovation as well as the integration of<br />

new features in existing systems<br />

� With the dual platform strategy <strong>Vectron</strong> can remain highly innovative and<br />

respond faster to new technological shifts<br />

� It allows customers to keep investment in POS systems at a favourable<br />

level since they only require one software<br />

On the basis of its dual platform strategy, <strong>Vectron</strong> has built up a sophisticated<br />

product portfolio comprising mobile as well as hybrid devices (combination of<br />

mobile and stationary devices) and stationary POS systems in various sizes and<br />

price categories.<br />

Products<br />

„Built-to-order“<br />

approach“<br />

Lean production process<br />

combined with low capital<br />

tied in inventories<br />

Along with intelligent POS <strong>Systems</strong>, the company´s product range comprises<br />

communication software as well as a large variety of peripherals such as printers,<br />

scales, vending machines etc, which <strong>Vectron</strong> exclusively sources from external<br />

partners. The software forms the basis for all <strong>Vectron</strong> POS systems and has not<br />

been designed for any particular industry. By means of an integrated “program<br />

generator” the software can be tailored to individual customer requirements.<br />

www.cbseydlerresearch.ag<br />

Dual platform<br />

Hardware Software<br />

strategy<br />

� High innovation<br />

power<br />

� Sophisticated<br />

product portfolio<br />

� Broad customer and<br />

business scope<br />

Software and hardware<br />

from one single source<br />

Indirect<br />

distribution<br />

Broader customer access<br />

combined with low cost per<br />

customer contact<br />

Dual platform strategy<br />

Product portfolio<br />

comprises hardware,<br />

software and<br />

peripherals<br />

Close Brothers Seydler Research <strong>AG</strong> | 14

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

According to the company, <strong>Vectron</strong> is the sole supplier worldwide offering software<br />

that runs on both the PC platform and the proprietary <strong>Vectron</strong> platform<br />

The company generates the main proportion of its revenues from the distribution of<br />

POS systems. <strong>Vectron</strong>s´s product range comprises mobile as well as hybrid and<br />

stationary devices. While also covering PC-based systems, <strong>Vectron</strong> offers a special<br />

proprietary hardware, which was exclusively designed for POS systems. This<br />

hardware is less expensive and less prone to manipulations while delivering the<br />

same performance as PC-based systems.<br />

<strong>Vectron</strong>´s POS systems are all equipped with the 64-bit technology and can be<br />

used as a network ECR, ensuring that all POS models can be networked. New<br />

interfaces expand the large range of connections to <strong>Vectron</strong>´s POS systems.<br />

Special highlight are the USB-Ports and the extensive options for back office<br />

connections. Currently, <strong>Vectron</strong>´s product portfolio comprises seven different<br />

proprietary models available in various sizes and price categories.<br />

<strong>Vectron</strong>´s POS <strong>Systems</strong><br />

POS Mini POS MobilePro<br />

POS Vario<br />

POS ColorTouch<br />

POS Modular<br />

Source: CBS Research <strong>AG</strong>,<br />

Traditionally <strong>Vectron</strong> has a strong emphasis on the technological side of the<br />

business. In order to remain also highly innovative in the future, <strong>Vectron</strong> added<br />

further resources to its R&D activities by expanding the number of employees to<br />

currently 31.<br />

The company intends to reduce the usual product life cycle (approx. 4-6 years) by<br />

means of revolutionary innovations. Over the last years, <strong>Vectron</strong> has constantly<br />

upgraded its product portfolio with the new generation of POS <strong>Systems</strong> particularly<br />

www.cbseydlerresearch.ag<br />

The POS Mini was designed to the<br />

need of small businesses offering at<br />

the same time the capacity for more<br />

space and branch solutions<br />

POS Vario is the perfect all-rounder<br />

among <strong>Vectron</strong>-POS systems to<br />

cover the mid-range segment. It<br />

offers efficient technology, highest<br />

flexibility and attractive design.<br />

The ColorTouch, designed for the<br />

premium segment is characterised by<br />

excellent performance and innovative<br />

design . The large, splash-proof display<br />

is equipped with an interactive touchscreen<br />

surface, enabling rapid, intuitive<br />

operations.<br />

<strong>Vectron</strong> POS Modular offers extensive<br />

and flexible cash register functions in<br />

an individually configurable housing. Its<br />

range of application reaches from the<br />

single station to a network-integrated<br />

system, it can be used as print and as<br />

data server or even as Kitchen Video<br />

Controller.<br />

POS MobileXL<br />

<strong>Vectron</strong> POS SteelTouch<br />

POS PC<br />

Main revenue<br />

generators are POS<br />

systems<br />

This mobile device is based on the same<br />

powerful processor technology as the<br />

stationary <strong>Vectron</strong> POS systems. The lightweight<br />

but strong magnesium housing and<br />

spill-proof design ensure long life and troublefree<br />

use. Rapid data processing speeds up<br />

the ordering and cashing in processes. It can<br />

be utilized as a stand-alone device or in<br />

connection with a stationary system<br />

A hybrid POS system which combines the<br />

advantages of a mobile devices with that of<br />

stationary devices. In smaller restaurants,<br />

the POS MobileXL can be a complete, lowcost<br />

solution. In larger businesses, one or<br />

more of these units, used in conjunction with<br />

other <strong>Vectron</strong> models, adds mobility and<br />

flexibility to the system.<br />

The stainless steel system <strong>Vectron</strong> POS<br />

SteelTouch offers a 15‟‟ TFT-touch screen,<br />

which is infinitely variable and provides<br />

ample space for clear, simple operations.<br />

Its powerful technology and the flexible<br />

software make <strong>Vectron</strong> POS SteelTouch a<br />

real all-rounder for highest demands<br />

In contrast to all other <strong>Vectron</strong> POS<br />

systems, the POS-PC is not a proprietary<br />

POS system. It is a ECR software for a PC<br />

with Windows-operating system. The POS-<br />

PC offers the possibility to apply officeprograms<br />

like MS-Excel or MS-Word, stock<br />

control systems or E-mail options at the<br />

point of sale<br />

Strong R&D capacities<br />

New innovations in the<br />

area of mobile and<br />

hybrid devices<br />

Close Brothers Seydler Research <strong>AG</strong> | 15

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

in the area of mobile devices and hybrid systems. Leading Innovations over the last<br />

years were the <strong>Vectron</strong> POS MobilePro, <strong>Vectron</strong> POS Mobile XL or <strong>Vectron</strong> POS<br />

SteelTouch as well as <strong>Vectron</strong> Service Call.<br />

Sourcing and Manufacturing<br />

The company´s POS systems are developed and manufactured at the company´s<br />

headquarter in Muenster while the non-core components which do not require any<br />

special expertise (e.g. Keyboards, Screens etc) are sourced from external partners.<br />

The real added-value which the company delivers with its intelligent systems arises<br />

from the equipment of the hardware with <strong>Vectron</strong>´s software. The final assembly of<br />

the products is carried out at <strong>Vectron</strong>'s headquarter where the company´s usually<br />

manufactures 12,000 to 14,000 devices per annum.<br />

The manufacturing process is based on a “Built-to-Order” approach which<br />

means that the company only starts assembling when it receives an order from a<br />

customer. This approach provides the company with the flexibility to react faster on<br />

technological shifts by keeping at the same time production expenses and financial<br />

resources tied in inventories at a low level. However, in order to optimise the<br />

manufacturing process, <strong>Vectron</strong> pre-fabricates those components which are<br />

universally applicable. The configuration and adaption of <strong>Vectron</strong>´s POS to the<br />

customers systems is usually carried out by authorized dealers.<br />

Customers and Distribution<br />

The company is positioned in the premium and mid-range segment with customer<br />

emphasis on small and medium-sized (SME) companies. Although <strong>Vectron</strong> has<br />

traditionally a strong customer focus on the catering trade and bakeries, the<br />

company´s “POS-<strong>Systems</strong>” can be utilized in various industries. The British cinema<br />

chain Odeon Cinemas with more than 100 cinemas, the German hairdresser chain<br />

Klier - with more than 800 branch offices as well as the bakery chains "Ihle",<br />

"Siebrecht", "Heberer" and "Bakers family", a discount-subsidiary of the Kamps <strong>AG</strong><br />

utilizes in their branches <strong>Vectron</strong>'s systems.<br />

As result of its traditional business emphasis on SMEs sized companies, <strong>Vectron</strong><br />

distributes its products exclusively via authorized dealers and resellers which are<br />

spread out across Germany. This indirect distribution approach allows the company<br />

to gain a broad customer access by keeping at the same time the expenses per<br />

customer contact on an economically favourable level. Traditionally, the distribution<br />

partners are responsible for the installation and service of the systems as well as<br />

customer training.<br />

In order to guarantee a fast and professional assistance to its clients the distribution<br />

partners are supported by a service team at the company´s helpdesk in Muenster.<br />

In countries where the company has no sufficient number of authorized dealers<br />

<strong>Vectron</strong>s´s distributes its product by means of resellers. Since distribution partner<br />

are allowed to sale also third-party products, it is crucial to company´s success to<br />

build up good relationships with its distribution partners. Overall the company has<br />

more than 250 authorized dealers and resellers over the world.<br />

www.cbseydlerresearch.ag<br />

Final assembly at<br />

company´s headquarter<br />

Built-to-order approach<br />

Main customer<br />

emphasis is placed on<br />

SMEs<br />

Indirect distribution<br />

via authorized dealers<br />

and resellers<br />

Close Brothers Seydler Research <strong>AG</strong> | 16

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Strategy<br />

With its unique business focus and sophisticated product portfolio, <strong>Vectron</strong> brings<br />

almost two decades of experience to the development of intelligent POS systems.<br />

<strong>Vectron</strong> offers a sophisticated product portfolio and is positioned as premium<br />

provider with special emphasis on SMEs. The company embarked multi-pronged<br />

strategy based on <strong>Vectron</strong>´s dual platform approach.<br />

Strategic elements<br />

Product portfolio<br />

enhancement:<br />

� New product<br />

innovations<br />

� Improved version of<br />

existing products<br />

� Value adding features<br />

and suplementary<br />

innovations<br />

Source: CBS Research <strong>AG</strong><br />

Product portfolio enhancement<br />

The diversification of the product portfolio with new innovations as well as the<br />

introduction of new versions of its existing products is one of the key elements of<br />

<strong>Vectron</strong>´s strategy. In doing so, the company intends to tap new niche segments<br />

and price categories which have been neglected by <strong>Vectron</strong> in the past. With the<br />

expansion of its product portfolio <strong>Vectron</strong> aims to expand and diversify its customer<br />

basis by entering new niche segments.<br />

New innovations and further value adding product improvements shall not only<br />

attract new customer, but also increase the incentives for existing customers to<br />

replace their existing systems. Given an installation basis of more than 100,000<br />

systems, the company aims to monetise on this hidden potential within its existing<br />

customer basis. Therefore, a reduction of the overall product life cycle by means of<br />

revolutionary innovations would result in significant revenue streams in the midterm.<br />

Main innovations are expected to occur predominantly in following fields:<br />

� Internet-based applications: The integration of internet into the POS<br />

<strong>Systems</strong> enabling online reservation or online orders etc.<br />

� New hybrid and mobile devices allowing for a higher flexibility in service<br />

� New supplementary innovations such as <strong>Vectron</strong> Service Call – An<br />

innovation which allows the guests in a restaurant to call for the waitress<br />

by pressing the button on the battery-operated, wireless table transmitters<br />

suffices. Moreover, it is able to improve the communication between the<br />

kitchen and the service staff<br />

� Security and tax related product improvements (e.g. Fiscal memory chip)<br />

www.cbseydlerresearch.ag<br />

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

International business<br />

expansion:<br />

� Pan-European<br />

business expansion<br />

� Mid-term objective:<br />

Leading European<br />

market player<br />

Dual platform strategy: One software for various industries and applications<br />

Distribution and<br />

Marketing:<br />

� Implementation of<br />

an international<br />

disttribution network<br />

� Improved product<br />

awerness<br />

Three-pillar strategy<br />

<strong>Vectron</strong> intends to tap<br />

new product and<br />

customer niches<br />

Revenue potentials<br />

within existing<br />

installation basis<br />

Close Brothers Seydler Research <strong>AG</strong> | 17

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

On the basis of the current R&D and production capacities, <strong>Vectron</strong> intends to<br />

introduce one or two new product innovations per fiscal year. After the introduction<br />

of new mobile and hybrid devices over the last year, <strong>Vectron</strong> aims to streamline its<br />

entire product portfolio of stationary devices until 2010.<br />

Given the high degree of market saturation in its underlying markets, the expansion<br />

of product portfolio into new niche segments and price categories is in our opinion<br />

the right approach to achieve higher revenues in its existing markets. In a highly<br />

fragmented market, <strong>Vectron</strong> will be able to monetize on its leading technological<br />

position and sound financial background by squeezing out the small local<br />

competitors. Overall, <strong>Vectron</strong> is in a favourable position expand its market share<br />

over the next years.<br />

International business expansion<br />

Along with higher revenues in its existing markets, the company´s international<br />

business is expected to become a significant revenue pillar in the future. Currently,<br />

<strong>Vectron</strong> still generates the main proportion of its revenues in German speaking<br />

countries and the Benelux region. However, the company is forcing its<br />

internationalization and pursues a pan-European expansion strategy. As a first step<br />

<strong>Vectron</strong> intends to establish its business model in France, Spain and UK. In doing<br />

so, the company aims to achieve a significant market position in these countries<br />

before tapping new geographic market.<br />

<strong>Vectron</strong> intends to become a leading European market player in the mid-term. In<br />

pursuing this goal the main obstacle, which <strong>Vectron</strong> has to overcome, will be the<br />

implementation of an appropriate distribution network even though the company<br />

has already authorized dealers and resellers in some of its targeted markets.<br />

In order to realize its pan-European business ambitions, <strong>Vectron</strong> aims to expand<br />

the number of its international distribution partners by a large number over the next<br />

years. Therefore, the company has already added sales resources in order to<br />

acquire international distribution partners with strong selling power. Overall,<br />

<strong>Vectron</strong> is in a favourable position to achieve this objective since it can materialise<br />

on its leading technological position as well as on its longstanding experience and<br />

sophisticated products.<br />

Distribution and Marketing<br />

The company´s future success will depend on a high degree on its capability to<br />

materialise on its strong technological expertise by commercializing its<br />

sophisticated products in an economically effective manner. In the past, <strong>Vectron</strong><br />

had a strong emphasis on the technological side of the business, but intends to<br />

improve its distribution and marketing activities in the future. Particularly the<br />

establishment of an appropriate international distribution network is crucial to<br />

<strong>Vectron</strong>´s future business success. Overall, the company aims to achieve better<br />

product awareness with its distribution and marketing activities<br />

As result of its past customer emphasis on SMEs, <strong>Vectron</strong> implemented an indirect<br />

distribution strategy via authorized dealers and resellers. In the future, the<br />

company intends to tighten its relationships to its distribution partners and increase<br />

the number of exclusive dealers distributing only <strong>Vectron</strong>`s POS <strong>Systems</strong>.<br />

www.cbseydlerresearch.ag<br />

Promising strategy in a<br />

saturated market<br />

Monetizing on<br />

potentials in untapped<br />

geographic markets<br />

Mid-term objective:<br />

Leading European player<br />

Expansion of the number<br />

of international<br />

distribution partners<br />

Goal: improved product<br />

awareness via...<br />

...improved relations to<br />

distribution partners,...<br />

Close Brothers Seydler Research <strong>AG</strong> | 18

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

<strong>Vectron</strong>´s distribution and marketing approach<br />

Key account<br />

management<br />

Source: CBS Research <strong>AG</strong><br />

In addition to its traditional customer emphasis, the acquisition of major customers<br />

will be the focus of attention in the future. The company intends to put a stronger<br />

emphasis on the acquisition of key accounts, particularly in its domestic markets<br />

which achieved market saturation. Therefore, the implementation of a key account<br />

management in partnership with its authorized dealers is considered as a further<br />

approach to gain access to large sized companies.<br />

In order to improve the after-sales service and the relationship to its dealers and<br />

authorized partners, <strong>Vectron</strong> has added resources to its sales workforce at<br />

company´s headquarter in Munster. The company has particularly improved the<br />

mentoring of its international distribution partners and intends to add further<br />

resources in this area over the next years.<br />

As a premium provider of intelligent POS <strong>Systems</strong>, <strong>Vectron</strong> aims to increase the<br />

brand awareness for its products. Along with participations on relevant trade fairs,<br />

placing commercials in appropriate magazines and media is a further tool to<br />

increase the popularity of its products. Furthermore, the company has started a<br />

customer incentive program in order to increase customer loyalty<br />

www.cbseydlerresearch.ag<br />

Participation on<br />

relevant trade<br />

fairs<br />

Indirect<br />

distribution<br />

Via authorized<br />

dealers and resellers<br />

Commercials in<br />

appropriate media<br />

Customer<br />

incentive program<br />

...focus on key<br />

accounts,...<br />

... commercials and<br />

trade fairs<br />

Close Brothers Seydler Research <strong>AG</strong> | 19

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

Competition<br />

In a highly fragmented market, <strong>Vectron</strong> is positioned as premium provider with<br />

strong technological expertise. Apart from few international operating providers<br />

which are highly specialised on delivering industry specific solutions, the<br />

competitive landscape is mainly characterized by large number of small national<br />

operators. Compared to most of its competitors, <strong>Vectron</strong> pursues a cross-industry<br />

and cross-device strategy enabling a broader business scope.<br />

With MICROS <strong>Systems</strong>, Wincor Nixdorf, NCR as well as the Japanese companies<br />

Sharp and Casio there are essentially five big international market players<br />

operating within the POS market. These large operators have put their main<br />

business emphasis on those industries which offer a high degree of branch<br />

concentration. Such specialisation can be particularly found in retail sector and the<br />

hotel and resort industry.<br />

As result of their specialisation on large customers, these big market players have<br />

developed competitive advantages in the specific industries which they are<br />

specialized on. Moreover, such a clustering allows them to achieve large<br />

installation numbers once they have developed a customer specific solution. In<br />

order to gain access to customers with extensive branch networks these<br />

multinationals mostly follow a direct distribution approach with key account<br />

management.<br />

Compared to these few international players there are a large number of small<br />

providers operating in their regional markets. Most of these companies have neither<br />

the technological expertise, nor the financial background to expand their business<br />

out of their niche segments. Since the technological requirements for POS systems<br />

are becoming more sophisticated most of the small providers face serious<br />

challenges to deliver competitive product solutions. Therefore, many of the small<br />

players are expected to lose competitive ground over the next years.<br />

<strong>Vectron</strong> with its sound financial background and outstanding technological<br />

expertise is in favourable position to benefit from a possible squeeze out of small<br />

national providers. Moreover, as a premium provider with business emphasis on<br />

small and medium sized companies, <strong>Vectron</strong> benefits from the high level of market<br />

entry barriers in its business segment. New market entrants have to overcome<br />

significant obstacles particularly in the implementation of appropriate distribution<br />

network. Usually, most dealers and resellers avoid switching their manufacturers<br />

since it causes additional expenses e.g. training the sales workforce or portfolio<br />

implementation costs etc.<br />

Overall <strong>Vectron</strong> competitive advantage arises from its unique innovation power<br />

combined with a promising market positioning and longstanding expertise. In<br />

absence of the direct major competitors in its targeted niche segment, <strong>Vectron</strong><br />

should be able to utilize on its competitive advantages to gain significant market<br />

share in the future.<br />

www.cbseydlerresearch.ag<br />

<strong>Vectron</strong> pursues a<br />

cross-industry and<br />

cross-device strategy<br />

4 major market players<br />

with focus on specific<br />

industries<br />

Large number of small<br />

providers with lack of<br />

technological knowhow<br />

and financial<br />

strength<br />