Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

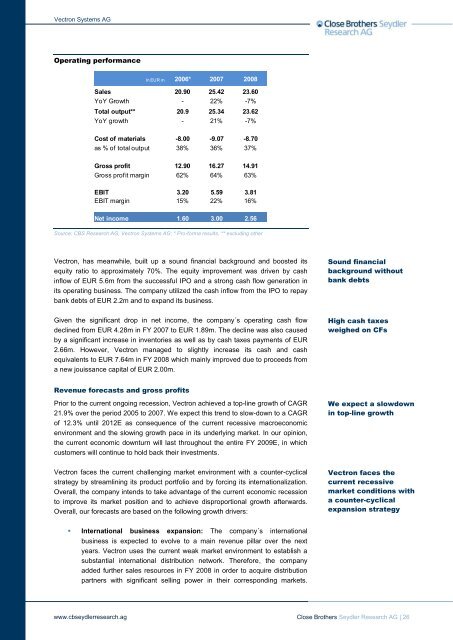

Operating performance<br />

Source: CBS Research <strong>AG</strong>, <strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong>; * Pro-forma results, ** excluding other<br />

<strong>Vectron</strong>, has meanwhile, built up a sound financial background and boosted its<br />

equity ratio to approximately 70%. The equity improvement was driven by cash<br />

inflow of EUR 5.6m from the successful IPO and a strong cash flow generation in<br />

its operating business. The company utilized the cash inflow from the IPO to repay<br />

bank debts of EUR 2.2m and to expand its business.<br />

Given the significant drop in net income, the company´s operating cash flow<br />

declined from EUR 4.28m in FY 2007 to EUR 1.89m. The decline was also caused<br />

by a significant increase in inventories as well as by cash taxes payments of EUR<br />

2.66m. However, <strong>Vectron</strong> managed to slightly increase its cash and cash<br />

equivalents to EUR 7.64m in FY 2008 which mainly improved due to proceeds from<br />

a new jouissance capital of EUR 2.00m.<br />

Revenue forecasts and gross profits<br />

www.cbseydlerresearch.ag<br />

In EUR m 2006* 2007 2008<br />

Sales 20.90 25.42 23.60<br />

YoY Growth - 22% -7%<br />

Total output** 20.9 25.34 23.62<br />

YoY growth - 21% -7%<br />

Cost of materials -8.00 -9.07 -8.70<br />

as % of total output 38% 36% 37%<br />

Gross profit 12.90 16.27 14.91<br />

Gross profit margin 62% 64% 63%<br />

EBIT 3.20 5.59 3.81<br />

EBIT margin 15% 22% 16%<br />

Net income 1.60 3.00 2.56<br />

Prior to the current ongoing recession, <strong>Vectron</strong> achieved a top-line growth of C<strong>AG</strong>R<br />

21.9% over the period 2005 to 2007. We expect this trend to slow-down to a C<strong>AG</strong>R<br />

of 12.3% until 2012E as consequence of the current recessive macroeconomic<br />

environment and the slowing growth pace in its underlying market. In our opinion,<br />

the current economic downturn will last throughout the entire FY 2009E, in which<br />

customers will continue to hold back their investments.<br />

<strong>Vectron</strong> faces the current challenging market environment with a counter-cyclical<br />

strategy by streamlining its product portfolio and by forcing its internationalization.<br />

Overall, the company intends to take advantage of the current economic recession<br />

to improve its market position and to achieve disproportional growth afterwards.<br />

Overall, our forecasts are based on the following growth drivers:<br />

� International business expansion: The company´s international<br />

business is expected to evolve to a main revenue pillar over the next<br />

years. <strong>Vectron</strong> uses the current weak market environment to establish a<br />

substantial international distribution network. Therefore, the company<br />

added further sales resources in FY 2008 in order to acquire distribution<br />

partners with significant selling power in their corresponding markets.<br />

Sound financial<br />

background without<br />

bank debts<br />

High cash taxes<br />

weighed on CFs<br />

We expect a slowdown<br />

in top-line growth<br />

<strong>Vectron</strong> faces the<br />

current recessive<br />

market conditions with<br />

a counter-cyclical<br />

expansion strategy<br />

Close Brothers Seydler Research <strong>AG</strong> | 26