Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Vectron</strong> <strong>Systems</strong> <strong>AG</strong><br />

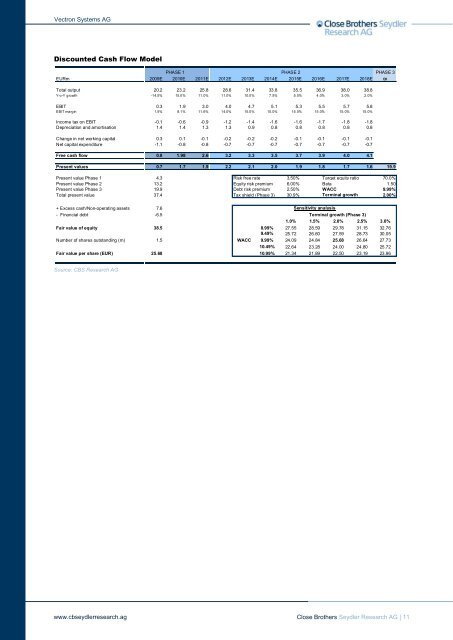

Discounted Cash Flow Model<br />

PHASE 1 PHASE 2 PHASE 3<br />

EURm 2009E 2010E 2011E 2012E 2013E 2014E 2015E 2016E 2017E 2018E<br />

Total output 20.2 23.2 25.8 28.6 31.4 33.8 35.5 36.9 38.0 38.8<br />

Y-o-Y growth -14.5% 15.0% 11.0% 11.0% 10.0% 7.5% 5.0% 4.0% 3.0% 2.0%<br />

EBIT 0.3 1.9 3.0 4.0 4.7 5.1 5.3 5.5 5.7 5.8<br />

EBIT margin 1.5% 8.1% 11.6% 14.0% 15.0% 15.0% 15.0% 15.0% 15.0% 15.0%<br />

Income tax on EBIT -0.1 -0.6 -0.9 -1.2 -1.4 -1.6 -1.6 -1.7 -1.8 -1.8<br />

Depreciation and amortisation 1.4 1.4 1.3 1.3 0.9 0.8 0.8 0.8 0.8 0.8<br />

Change in net working capital 0.3 0.1 -0.1 -0.2 -0.2 -0.2 -0.1 -0.1 -0.1 -0.1<br />

Net capital expenditure -1.1 -0.8 -0.8 -0.7 -0.7 -0.7 -0.7 -0.7 -0.7 -0.7<br />

Free cash flow 0.8 1.98 2.6 3.2 3.3 3.5 3.7 3.9 4.0 4.1<br />

Present values 0.7 1.7 1.9 2.2 2.1 2.0 1.9 1.8 1.7 1.6 19.9<br />

Present value Phase 1 4.3 Risk free rate 3.50% Target equity ratio 70.0%<br />

Present value Phase 2 13.2 Equity risk premium 6.00% Beta 1.50<br />

Present value Phase 3 19.9 Debt risk premium 2.50% WACC 9.99%<br />

Total present value 37.4 Tax shield (Phase 3) 30.9% Terminal growth 2.00%<br />

+ Excess cash/Non-operating assets 7.6<br />

- Financial debt -6.5<br />

Source: CBS Research <strong>AG</strong><br />

www.cbseydlerresearch.ag<br />

Sensitivity analysis<br />

Terminal growth (Phase 3)<br />

1.0% 1.5% 2.0% 2.5% 3.0%<br />

Fair value of equity 38.5 8.99% 27.55 28.59 29.78 31.15 32.76<br />

9.49% 25.72 26.60 27.59 28.73 30.05<br />

Number of shares outstanding (m) 1.5 WACC 9.99% 24.09 24.84 25.68 26.64 27.73<br />

10.49% 22.64 23.28 24.00 24.80 25.72<br />

Fair value per share (EUR) 25.68 10.99% 21.34 21.89 22.50 23.19 23.96<br />

Close Brothers Seydler Research <strong>AG</strong> | 11<br />

8