FAMBB

FAMBB

FAMBB

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

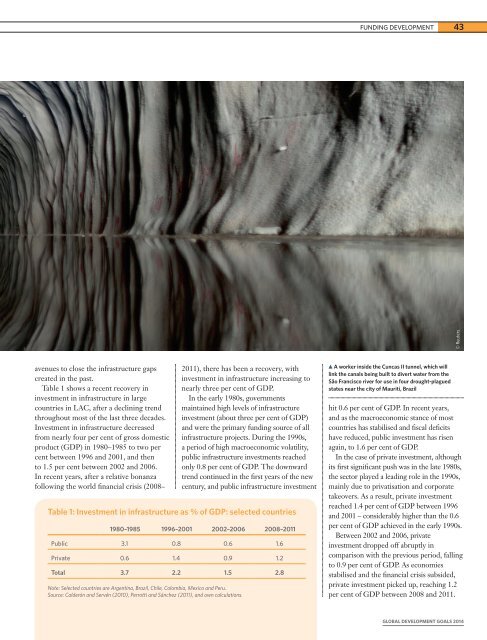

FUNDING DEVELOPMENT43© Reutersavenues to close the infrastructure gapscreated in the past.Table 1 shows a recent recovery ininvestment in infrastructure in largecountries in LAC, after a declining trendthroughout most of the last three decades.Investment in infrastructure decreasedfrom nearly four per cent of gross domesticproduct (GDP) in 1980–1985 to two percent between 1996 and 2001, and thento 1.5 per cent between 2002 and 2006.In recent years, after a relative bonanzafollowing the world financial crisis (2008–Table 1: Investment in infrastructure as % of GDP: selected countries1980–1985 1996–2001 2002–2006 2008–2011Public 3.1 0.8 0.6 1.6Private 0.6 1.4 0.9 1.2Total 3.7 2.2 1.5 2.8Note: Selected countries are Argentina, Brazil, Chile, Colombia, Mexico and Peru.Source: Calderón and Servén (2010), Perrotti and Sánchez (2011), and own calculations.2011), there has been a recovery, withinvestment in infrastructure increasing tonearly three per cent of GDP.In the early 1980s, governmentsmaintained high levels of infrastructureinvestment (about three per cent of GDP)and were the primary funding source of allinfrastructure projects. During the 1990s,a period of high macroeconomic volatility,public infrastructure investments reachedonly 0.8 per cent of GDP. The downwardtrend continued in the first years of the newcentury, and public infrastructure investmentA worker inside the Cuncas II tunnel, which willlink the canals being built to divert water from theSão Francisco river for use in four drought-plaguedstates near the city of Mauriti, Brazilhit 0.6 per cent of GDP. In recent years,and as the macroeconomic stance of mostcountries has stabilised and fiscal deficitshave reduced, public investment has risenagain, to 1.6 per cent of GDP.In the case of private investment, althoughits first significant push was in the late 1980s,the sector played a leading role in the 1990s,mainly due to privatisation and corporatetakeovers. As a result, private investmentreached 1.4 per cent of GDP between 1996and 2001 – considerably higher than the 0.6per cent of GDP achieved in the early 1990s.Between 2002 and 2006, privateinvestment dropped off abruptly incomparison with the previous period, fallingto 0.9 per cent of GDP. As economiesstabilised and the financial crisis subsided,private investment picked up, reaching 1.2per cent of GDP between 2008 and 2011.GLOBAL DEVELOPMENT GOALS 2014