Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

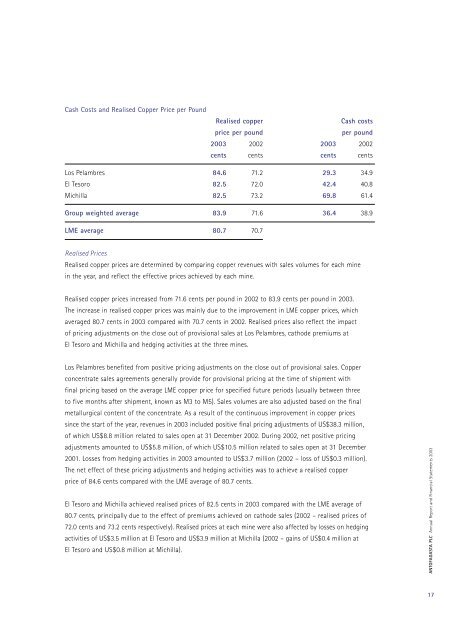

Cash Costs and Realised Copper Price per PoundRealised copperCash costsprice per poundper pound<strong>2003</strong> 2002 <strong>2003</strong> 2002cents cents cents centsLos Pelambres 84.6 71.2 29.3 34.9El Tesoro 82.5 72.0 42.4 40.8Michilla 82.5 73.2 69.8 61.4Group weighted average 83.9 71.6 36.4 38.9LME average 80.7 70.7Realised PricesRealised copper prices are determined by comparing copper revenues with sales volumes for each minein the year, and reflect the effective prices achieved by each mine.Realised copper prices increased from 71.6 cents per pound in 2002 to 83.9 cents per pound in <strong>2003</strong>.The increase in realised copper prices was mainly due to the improvement in LME copper prices, whichaveraged 80.7 cents in <strong>2003</strong> compared with 70.7 cents in 2002. Realised prices also reflect the impactof pricing adjustments on the close out of provisional sales at Los Pelambres, cathode premiums atEl Tesoro and Michilla and hedging activities at the three mines.Los Pelambres benefited from positive pricing adjustments on the close out of provisional sales. Copperconcentrate sales agreements generally provide for provisional pricing at the time of shipment withfinal pricing based on the average LME copper price for specified future periods (usually between threeto five months after shipment, known as M3 to M5). Sales volumes are also adjusted based on the finalmetallurgical content of the concentrate. As a result of the continuous improvement in copper pricessince the start of the year, revenues in <strong>2003</strong> included positive final pricing adjustments of US$38.3 million,of which US$8.8 million related to sales open at 31 December 2002. During 2002, net positive pricingadjustments amounted to US$5.8 million, of which US$10.5 million related to sales open at 31 December2001. Losses from hedging activities in <strong>2003</strong> amounted to US$3.7 million (2002 – loss of US$0.3 million).The net effect of these pricing adjustments and hedging activities was to achieve a realised copperprice of 84.6 cents compared with the LME average of 80.7 cents.El Tesoro and Michilla achieved realised prices of 82.5 cents in <strong>2003</strong> compared with the LME average of80.7 cents, principally due to the effect of premiums achieved on cathode sales (2002 – realised prices of72.0 cents and 73.2 cents respectively). Realised prices at each mine were also affected by losses on hedgingactivities of US$3.5 million at El Tesoro and US$3.9 million at Michilla (2002 – gains of US$0.4 million atEl Tesoro and US$0.8 million at Michilla).ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>17