Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

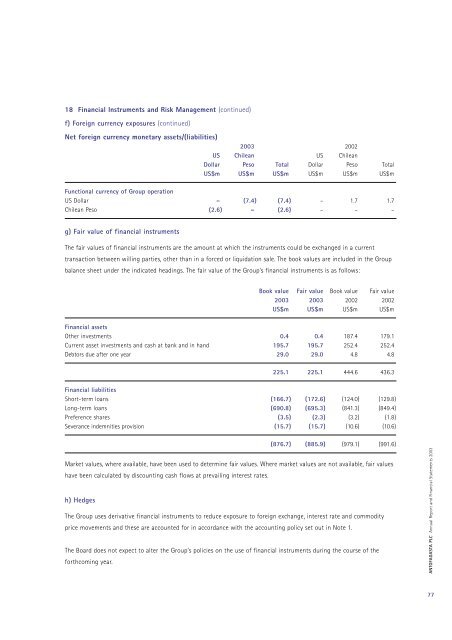

18 Financial Instruments and Risk Management (continued)f) Foreign currency exposures (continued)Net foreign currency monetary assets/(liabilities)<strong>2003</strong> 2002US Chilean US ChileanDollar Peso Total Dollar Peso TotalUS$m US$m US$m US$m US$m US$mFunctional currency of Group operationUS Dollar – (7.4) (7.4) – 1.7 1.7Chilean Peso (2.6) – (2.6) – – –g) Fair value of financial instrumentsThe fair values of financial instruments are the amount at which the instruments could be exchanged in a currenttransaction between willing parties, other than in a forced or liquidation sale. The book values are included in the Groupbalance sheet under the indicated headings. The fair value of the Group’s financial instruments is as follows:Book value Fair value Book value Fair value<strong>2003</strong> <strong>2003</strong> 2002 2002US$m US$m US$m US$mFinancial assetsOther investments 0.4 0.4 187.4 179.1Current asset investments and cash at bank and in hand 195.7 195.7 252.4 252.4Debtors due after one year 29.0 29.0 4.8 4.8225.1 225.1 444.6 436.3Financial liabilitiesShort-term loans (166.7) (172.6) (124.0) (129.8)Long-term loans (690.8) (695.3) (841.3) (849.4)Preference shares (3.5) (2.3) (3.2) (1.8)Severance indemnities provision (15.7) (15.7) (10.6) (10.6)(876.7) (885.9) (979.1) (991.6)Market values, where available, have been used to determine fair values. Where market values are not available, fair valueshave been calculated by discounting cash flows at prevailing interest rates.h) HedgesThe Group uses derivative financial instruments to reduce exposure to foreign exchange, interest rate and commodityprice movements and these are accounted for in accordance with the accounting policy set out in Note 1.The Board does not expect to alter the Group’s policies on the use of financial instruments during the course of theforthcoming year.ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>77