Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

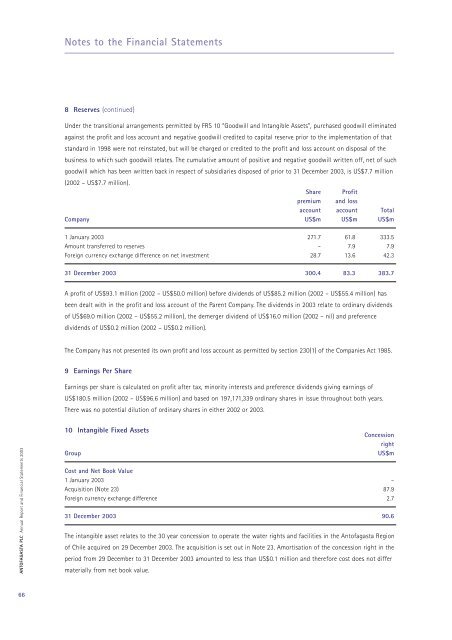

Notes to the Financial Statements8 Reserves (continued)Under the transitional arrangements permitted by FRS 10 “Goodwill and Intangible Assets”, purchased goodwill eliminatedagainst the profit and loss account and negative goodwill credited to capital reserve prior to the implementation of thatstandard in 1998 were not reinstated, but will be charged or credited to the profit and loss account on disposal of thebusiness to which such goodwill relates. The cumulative amount of positive and negative goodwill written off, net of suchgoodwill which has been written back in respect of subsidiaries disposed of prior to 31 December <strong>2003</strong>, is US$7.7 million(2002 – US$7.7 million).Share Profitpremium and lossaccount account TotalCompany US$m US$m US$m1 January <strong>2003</strong> 271.7 61.8 333.5Amount transferred to reserves – 7.9 7.9Foreign currency exchange difference on net investment 28.7 13.6 42.331 December <strong>2003</strong> 300.4 83.3 383.7A profit of US$93.1 million (2002 – US$50.0 million) before dividends of US$85.2 million (2002 – US$55.4 million) hasbeen dealt with in the profit and loss account of the Parent Company. The dividends in <strong>2003</strong> relate to ordinary dividendsof US$69.0 million (2002 – US$55.2 million), the demerger dividend of US$16.0 million (2002 – nil) and preferencedividends of US$0.2 million (2002 – US$0.2 million).The Company has not presented its own profit and loss account as permitted by section 230(1) of the Companies Act 1985.9 Earnings Per ShareEarnings per share is calculated on profit after tax, minority interests and preference dividends giving earnings ofUS$180.5 million (2002 – US$96.6 million) and based on 197,171,339 ordinary shares in issue throughout both years.There was no potential dilution of ordinary shares in either 2002 or <strong>2003</strong>.ANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>10 Intangible Fixed AssetsGroupConcessionrightUS$mCost and Net Book Value1 January <strong>2003</strong> –Acquisition (Note 23) 87.9Foreign currency exchange difference 2.731 December <strong>2003</strong> 90.6The intangible asset relates to the 30 year concession to operate the water rights and facilities in the <strong>Antofagasta</strong> Regionof Chile acquired on 29 December <strong>2003</strong>. The acquisition is set out in Note 23. Amortisation of the concession right in theperiod from 29 December to 31 December <strong>2003</strong> amounted to less than US$0.1 million and therefore cost does not differmaterially from net book value.66