Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

Annual Report 2003 - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

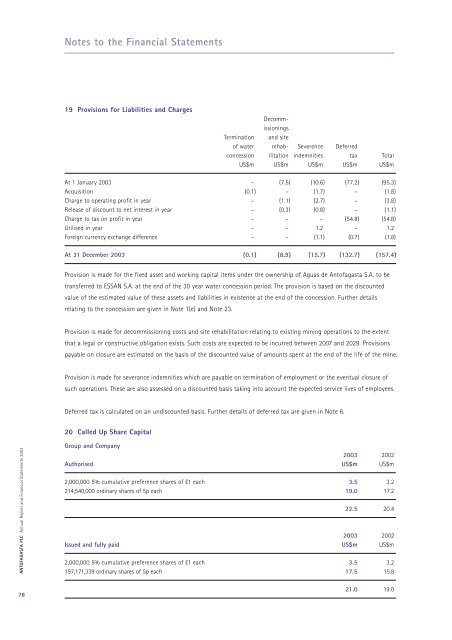

Notes to the Financial Statements19 Provisions for Liabilities and ChargesDecommissioningsTermination and siteof water rehab- Severence Deferredconcession ilitation indemnities tax TotalUS$m US$m US$m US$m US$mAt 1 January <strong>2003</strong> – (7.5) (10.6) (77.2) (95.3)Acquisition (0.1) – (1.7) – (1.8)Charge to operating profit in year – (1.1) (2.7) – (3.8)Release of discount to net interest in year – (0.3) (0.8) – (1.1)Charge to tax on profit in year – – – (54.8) (54.8)Utilised in year – – 1.2 – 1.2Foreign currency exchange difference – – (1.1) (0.7) (1.8)At 31 December <strong>2003</strong> (0.1) (8.9) (15.7) (132.7) (157.4)Provision is made for the fixed asset and working capital items under the ownership of Aguas de <strong>Antofagasta</strong> S.A. to betransferred to ESSAN S.A. at the end of the 30 year water concession period. The provision is based on the discountedvalue of the estimated value of these assets and liabilities in existence at the end of the concession. Further detailsrelating to the concession are given in Note 1(e) and Note 23.Provision is made for decommissioning costs and site rehabilitation relating to existing mining operations to the extentthat a legal or constructive obligation exists. Such costs are expected to be incurred between 2007 and 2029. Provisionspayable on closure are estimated on the basis of the discounted value of amounts spent at the end of the life of the mine.Provision is made for severance indemnities which are payable on termination of employment or the eventual closure ofsuch operations. These are also assessed on a discounted basis taking into account the expected service lives of employees.Deferred tax is calculated on an undiscounted basis. Further details of deferred tax are given in Note 6.20 Called Up Share CapitalANTOFAGASTA PLC <strong>Annual</strong> <strong>Report</strong> and Financial Statements <strong>2003</strong>Group and Company<strong>2003</strong> 2002Authorised US$m US$m2,000,000 5% cumulative preference shares of £1 each 3.5 3.2214,540,000 ordinary shares of 5p each 19.0 17.222.5 20.4<strong>2003</strong> 2002Issued and fully paid US$m US$m2,000,000 5% cumulative preference shares of £1 each 3.5 3.2197,171,339 ordinary shares of 5p each 17.5 15.87821.0 19.0